Overview Of Code Of Ethics

Ethics has to be inculcated in the habit and temperament of the individual, so that there is an overall culture of ethics being developed; The internal force due to ethics has to be strong enough to withstand any selfish motive or temptation. The members of the Institute, whether in practice or in service, are required to comply with the provisions of Code of Ethics in order to maintain independence in mind as well as in appearance. The “Code of Conduct” serves as a collection of professional ethical standards that govern the interactions of Chartered Accountants with clients, employers, employees, fellow members, and the general public.

International Federation of Accountants (IFAC) has established the International Ethics Standards Board for Accountants (IESBA) to function as an independent standard-setting body, which develops Ethical Standards and Guidance for use by professional accountants. ICAI being member of IFAC has considered the Ethics Standards issued by IESBA while framing Code of Ethics for CAs.

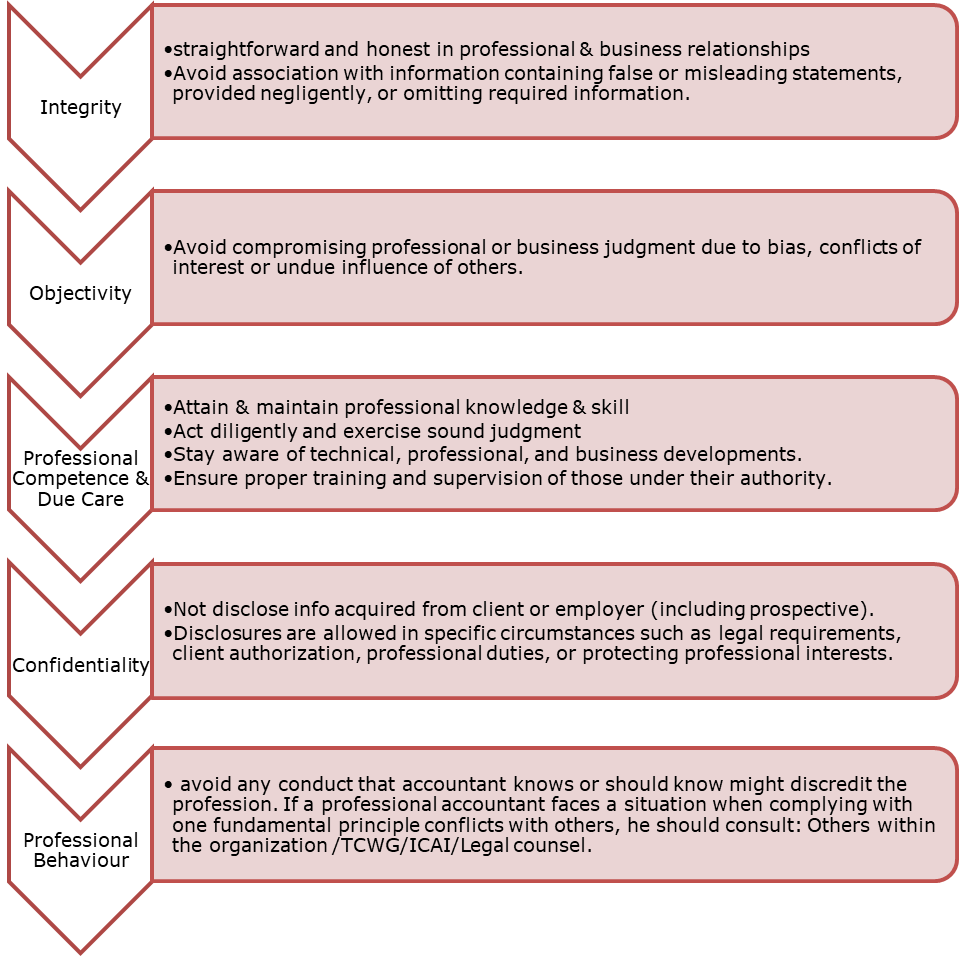

PART 1- FUNDAMENTAL PRINCIPLES

Part 1 establishes conceptual framework for all members to ensure compliance with 5 fundamental principles of professional ethics –

Threats to compliance with the fundamental principles fall into one or more of the following categories:

- Self-interest threat –threat that a financial or other interest will inappropriately influence a professional accountant’s judgment or behaviour;

- Self-review threat –threat that a professional accountant will not appropriately evaluate the results of a previous judgment made; or an activity performed by the accountant, or by another individual within the accountant’s firm or employing organization, on which the accountant will rely when forming a judgment as part of performing a current activity;

- Advocacy threat –threat that a professional accountant will promote a client’s or employing organization’s position to the point that the accountant’s objectivity is compromised;

- Familiarity threat –threat that due to a long or close relationship with a client, or employing organization, professional accountant will be too sympathetic to their interests or too accepting of their work;

- Intimidation threat –threat that a professional accountant will be deterred from acting objectively because of actual or perceived pressures, including attempts to exercise undue influence over the accountant.

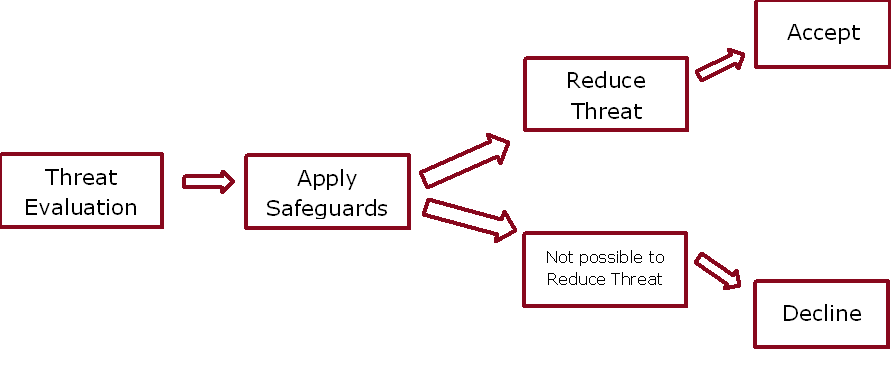

- Evaluating threats: When a professional accountant identifies a threat to compliance with fundamental principles, they must assess if it’s at an acceptable level. Evaluation includes qualitative and quantitative factors, considering the combined impact of multiple threats.

Safeguards are actions, individually or in combination that the professional accountant takes that effectively reduce threats to compliance with the fundamental principles to an acceptable level.

Conditions, policies, and procedures, such as corporate governance requirements, educational criteria, complaint systems, duty to report breaches, and monitoring procedures, also influence threat assessment. This holistic approach ensures comprehensive consideration of factors affecting the accountant’s adherence to ethical standards.

PART 4A- INDEPENDENCE FOR AUDIT AND REVIEW ENGAGEMENTS

Professional accountants in public practice are required to maintain independence during audit and review engagements, as per the Code’s stipulations.

Independence is tied to the principles of objectivity and integrity, encompassing independence of mind and independence in appearance. The maintenance of independence is crucial throughout both the engagement period and the period covered by the financial statements.

The Companies Act 2013 outlines additional independence requirements for statutory auditors, including auditor rotation (Section 139(2)) and eligibility for appointment (Section 141(3)).

- FEES

When the fees earned from auditing a client constitute a significant portion of a firm’s total income, there is a potential self-interest or intimidation threat. The firm’s dependence on this client, coupled with the fear of losing the client, might create a self-interest or intimidation threat.

| Thresholds for Total Fees as a Percentage of Auditing Firm’s Total | ||

| Consecutive Years | Threshold | Action Required |

| 2 years | > 15% | (a) Disclose this fact to those charged with governance of the audit client, except when the fees are below a specified amount or relate to certain entities. (b) Discuss and consider implementing safeguards, such as a pre-issuance or post-issuance review by an external professional accountant or body, to address the threat posed by the significant total fees. If fees significantly exceed 15%, assess if post-issuance review sufficiently reduces threat. If not, conduct a pre-issuance review. |

| 2 years | >20% (For Public Interest Entities) | Disclose to ICAI when fees from audit client and related entities represent more than 20% of total fees for Public Interest entities. |

| 2 years | >40% (For Other Entities) | Disclose to ICAI when fees from audit client and related entities represent more than 40% of total fees for other entities. |

Overdue Fees: When a significant part of fees due from an audit client remains unpaid for a long time, the firm shall determine:

- Whether the overdue fees might be equivalent to a loan to the client; and

- Whether it is appropriate for the firm to be re-appointed or continue the audit engagement.

Contingent Fees: The fees which are based on a percentage of profits or which are contingent upon the findings, or results of such work, is not allowed except in cases which are permitted under Regulation 192 of The Chartered Accountants Regulations, 1988.

Gifts and Hospitality: A firm, network firm or an audit team member shall not accept gifts and hospitality from an audit client, unless the value is trivial and inconsequential. But if the intention is to improperly influence behaviour, irrespective of the value being trivial or inconsequential, it is not allowed.

| Fees of other work > Fees payable for carrying out statutory audit |

As per chapter IX of Council Guidelines, a member of Institute in practice shall not accept appointment as statutory auditor of PSU(s)/ Govt Company(s)/Listed Company(s) and other Public Company(s) having turnover of 50 Cr or more in a year, if:

Other work excludes:

- audit under any other statute.

- certification work required to be done by statutory auditors; and

- any representation before an authority

- FINANCIAL INTERESTS

A financial interest can be direct or indirect, depending on the beneficial owner’s control or influence over an intermediary like a collective investment vehicle or trust.

When an entity controls an audit client, and the client is significant to the entity, the firm, network firm, audit team member, or their immediate family should not have a direct or materially indirect financial interest in that entity, since it could lead to self interest threat. If the audit client is under the Companies Act, 2013, additional restrictions apply, barring the firm, individual practitioner, sole proprietor, partner, or their relatives from holding securities or interests in the holding company.

Financial Interests in Common with the Audit Client:

(a) Prohibits from holding a financial interest in an entity if an audit client also has a financial interest, unless the financial interests are immaterial to all relevant parties or the audit client lacks significant influence over the entity.

(b) Mandates that an individual with a financial interest, as described in (a), must either dispose of the interest or reduce it to a level where it is no longer considered material before becoming an audit team member.

Financial Interests Received Unintentionally: In such cases where a firm acquires direct or material indirect financial interest in an audit client through inheritance, gift, merger, or similar circumstances, it must be promptly disposed of. Alternatively, enough of an indirect financial interest should be disposed of to make the remaining interest immaterial.

- LOANS AND GUARANTEES

The provision or guarantee of a loan to an audit client is restricted for a firm, network firm, audit team member, or any immediate family member. Such loans or guarantees should be immaterial to both the entity providing the loan and the audit client, in accordance with Council guidelines on indebtedness and additional restrictions under the Companies Act, 2013.

As per Section 141 of the Companies Act, 2013, and Rule 10 of Companies (Audit and Auditors) Rules, 2014, a firm, individual practitioner, sole proprietor, or partner (as applicable) and their relatives must not be indebted in excess of Rs 5 lakhs (or a prescribed limit) to the company, its subsidiary, or its holding/associate company. Additionally, providing guarantees or security for third-party indebtedness is restricted to rupees one lakh (or a prescribed limit).

Chapter X of Council General Guidelines- Chapter X Appointment of an auditor when he is indebted to a concern, Member in practice or partner of firm in practice or firm or relative of such member or partner shall not accept appointment as auditor of concern while indebted to concern or given any guarantee or provided any security in connection with indebtedness of any 3rd person to concern, for limits fixed in statute and in other cases for amount exceeding 100,000/-.

Loans and Guarantees with an Audit Client that is a Bank or Similar Institution:

A firm, network firm, audit team member, or any immediate family member should not accept a loan or a guarantee of a loan from an audit client that is a bank or a similar institution unless the loan or guarantee is provided under normal lending procedures, terms, and conditions. Even if such a loan is obtained under normal terms, it may still pose a self-interest threat if it is material to either the audit client or the firm receiving the loan. The above is subject to the Council guidelines on indebtedness, issued from time to time and additional restrictions under the Companies Act, 2013, as amended from time to time, where applicable.

- LONG ASSOCIATION OF PERSONNEL (INCLUDING PARTNER ROTATION) WITH AN AUDIT CLIENT

A self-interest threat and familiarity threat can arise when an individual is concerned about losing a longstanding client or desires to maintain a close personal relationship with a member of senior management or those charged with governance. This threat has the potential to inappropriately influence the individual’s judgment.

| Individual acted as: | Cooling off period |

| Engagement partner for 7 cumulative years | 5 consecutive years |

| Engagement quality control review for 7 cumulative years | 3 consecutive years |

| Key audit partner other than in the capacities set out above for seven cumulative years | 2 consecutive years |

- PROVISION OF NON-ASSURANCE SERVICES TO AN AUDIT CLIENT

Providing non-assurance services to audit clients might create threats to compliance with the fundamental principles and threats to independence. Before a firm or network firm agrees to provide a non-assurance service to an audit client, it must assess whether doing so could create a threat to independence. Moreover, Section 141(3)(i) of the Companies Act, 2013, states that a person providing services mentioned in Section 144 to a company or its holding or subsidiary company is ineligible for appointment as an auditor of that company.

A firm or network firm is prohibited from taking on a management responsibility for an audit client. Additionally, under Section 144 of the Companies Act, 2013, when applicable, this restriction extends to the holding company and subsidiary company of the audit client. Providing advice and recommendations to assist the management of an audit client in discharging its responsibilities is not assuming a management responsibility.

Providing accounting and bookkeeping services, tax services, IT system services, certain litigation support services, legal services, recruiting services, corporate finance services and valuation services to an audit client might create a self-review threat. However, providing tax return preparation services does not usually create a threat.

- ADMINISTRATIVE SERVICES

Providing administrative services to an audit client does not usually create a threat. Administrative services involve assisting clients with their routine or mechanical tasks within the normal course of operations. Such services require little to no professional judgment and are clerical in nature.

- INTERNAL AUDIT SERVICES

Internal audit services involve assisting the audit client in the performance of its internal audit activities. A statutory auditor of an entity cannot be its internal auditor as it will not be possible for him to give an independent and objective opinion. Further, under Companies Act, 2013, where applicable, the restriction also applies to the subsidiary company or holding company of the audit client.

PART 4B- INDEPENDENCE FOR ASSURANCE ENGAGEMENTS OTHER THAN AUDIT AND REVIEW ENGAGEMENTS

This section is about assurance tasks that aren’t audits or reviews but are generally called “assurance engagements.” The aim is to increase confidence in evaluating or measuring something against set standards for users who are interested (except for the party responsible).A firm performing an assurance engagement shall be independent.

Examples of such engagements include:

- An audit of specific elements, accounts or items of a financial statement.

- Performance assurance on a company’s key performance indicators.

- Engagements to issue reports or certificates under the Guidance Note on Reports or Certificates for Special Purposes (Revised 2016) for clients which are not financial statements audit clients.

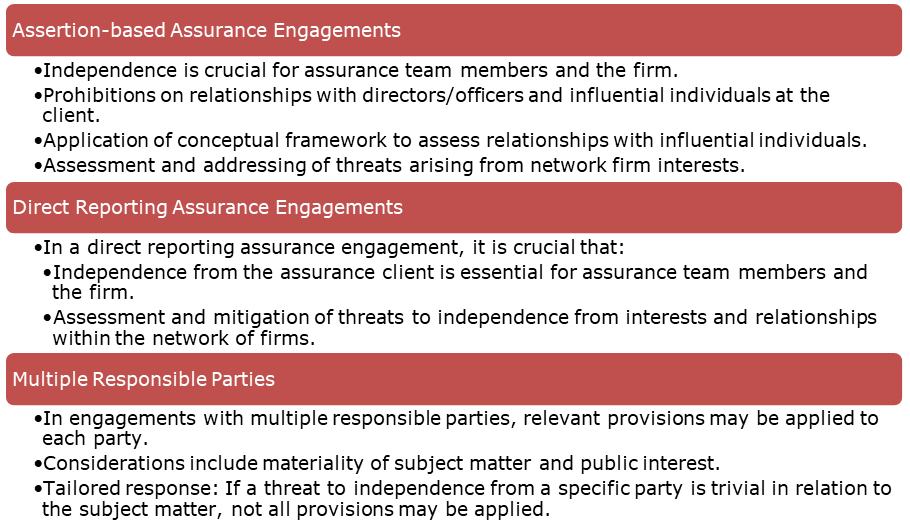

Assurance engagements come in two forms: assertion-based and direct reporting, involving three key parties—the firm, the responsible party, and the intended users.

In an assertion-based assurance engagement, the responsible party conducts the evaluation or measurement of the subject matter. The resulting subject matter information takes the form of an assertion made by the responsible party, which is then shared with the intended users.

In a direct reporting assurance engagement, the firm either directly performs the evaluation or measurement of the subject matter or obtains a representation from the responsible party who conducted the evaluation or measurement. This representation, not disclosed to the intended users, is then presented to them in the assurance report along with the subject matter information

Types of Assurance Engagements:

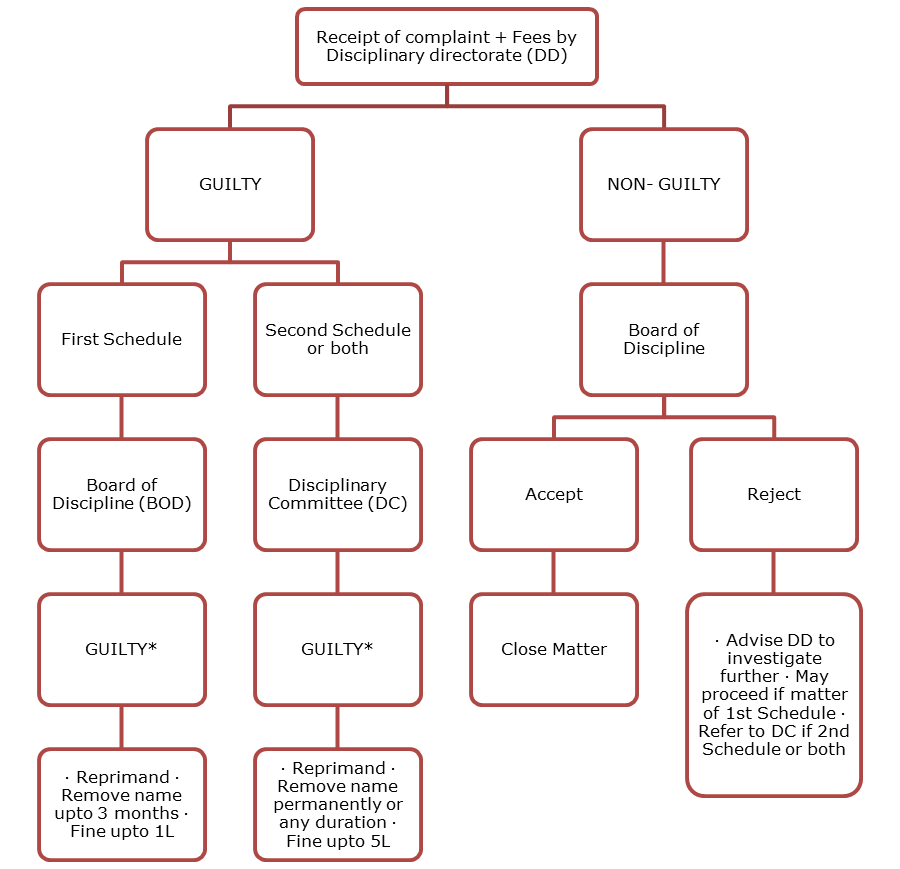

Professional Misconduct

A chartered accountant would be guilty of misconduct if he has violated any of the clauses in either of the Schedules. When held guilty under the first schedule, the case can be presented either before Board of Discipline or Disciplinary Committee. However when held guilty under second schedule, the case is presented before the Disciplinary Committee.

First Schedule- internal to the profession

| Part | Particulars | No. of Clauses |

| I | Professional misconduct in relation to CAs in practice | 12 |

| II | Misconduct in relation to members in service | 2 |

| III | Misconduct in relation to members in general | 3 |

| IV | Other Misconduct’ in relation to all members generally | 2 |

PART I

| Clause No. | A member in practice would be guilty of misconduct if he: |

| (1) | Allows any person to practice in his name except his partner and employee who is also a chartered accountant |

| (2) | Pays any share , commission or brokerage to person other than member of Institute or his partner or retired partner |

| (3) | Accepts profits from a person who is not a member of Institute |

| (4) | Enters into partnership with person who is not member of Institute |

| (5) | Secures work from person who is not his employee or partner. |

| (6) | Solicits work by circular, advertisement, personal interview etc. (except to the extent allowed) |

| (7) | Advertises his professional services (except to the extent allowed) |

| (8) | Accepts audit work without first communicating with the previous auditor in writing |

| (9) | Accepts audit work without first ascertaining that requirements of section 225 of the Companies Act, 1956 (now section 140 of the Companies Act, 2013) are complied with. |

| (10) | Accepts professional assignment where fees are based on percentage of profits or are contingent upon the findings or results. |

| (11) | Engages in any other business or occupation (barring few exceptions) |

| (12) | Allows a person who is not his partner or any other person who is not a member of the Institute to sign on his behalf any balance sheet, profit and loss account, report or financial statements. |

PART II – Members in Service

| Clause No. | A member (other than member in practice) would be guilty of misconduct if he: |

| (1) | Undertakes to share his emoluments of employment |

| (2) | Accepts any party of his fees, profits or gains from any lawyer, CA, broker engaged by the Company, customer as commission or gratification. |

PART III – Members Generally

| Clause No. | A member (whether in practice or not) would be guilty of misconduct if he: |

| (1) | Not being a fellow, acts as a fellow |

| (2) | Does not supply information called for by the Institute, Council, its Committees, Director (Discipline), BOD, DC etc. |

| (3) | Gives information knowing it to be false while inviting professional work, responding to tenders, enquiries or publishing write up. |

PART IV – Other Misconduct

| Clause No. | A member whether in practice or not would be guilty of misconduct if he: |

| (1) | Held guilty by any civil or criminal court for an offence which is punishable with imprisonment for a term not exceeding six months |

| (2) | Brings disrepute to the profession or the Institute as a result of his action |

Second Schedule – outsiders are affected

| Part | Particulars | No. of Clauses |

| I | Professional misconduct in relation to CAs in practice | 10 |

| II | Clauses relating to members generally | 4 |

| III | Residuary clauses of ‘Other Misconduct’ | 1 |

PART I

| Clause No. | A member (whether in practice or not) would be guilty of misconduct if he: |

| (1) | Discloses information acquired in the course of professional engagement to any person other than his client. |

| (2) | Certifies any report of financial statements unless the examination has been done by him or his partner or employee or by any other CA in practice. |

| (3) | Gives an impression that he vouches for the accuracy of the forecast. |

| (4) | Expresses his opinion on financial statements of any business in which he, his firm or partner has substantial interest. |

| (5) | Fails to discloses a material fact which is not disclosed in the financial statement but the disclosure of which is necessary |

| (6) | Fails to report a material misstatement. |

| (7) | Does not exercise due diligence or is grossly negligent. |

| (8) | Fails to obtain sufficient information which is necessary for expression of opinion. |

| (9) | Fails to invite attention to any material departure from generally accepted audit procedures. |

| (10) | Fails to keep moneys of client other than money meant to be expended in a separate bank account. |

PART II

| Clause No. | A member (whether in practice or not) would be guilty of misconduct if he: |

| (1) | Contravenes any provisions of this Act or regulations etc. |

| (2) | Being an employee of company, firm or any other person discloses confidential information. |

| (3) | Includes in any document to be submitted to the Institute Council, its committees etc. any information knowing it to be false. |

| (4) | Defalcates or embezzles money. |

PART III

| A member whether in practice or not would be guilty of misconduct if he is held guilty by any civil or criminal court for an offence which is punishable with imprisonment exceeding six months. |

DISCIPLINARY PROCEEDINGS

*If not found guilty → Matter closed The importance of professional ethics cannot be overstated. It is essential for building trust and credibility with clients, colleagues, and the wider community. It also helps to maintain the integrity and reputation of the profession and ensures that professionals are held to account for their actions. In many instances, post qualification CAs are not updated with the code of ethics issued by the ICAI to maintain the fundamental principles. Due to such ignorance, in the recent times, proceedings have been taken up in multifold against various Chartered accountants by the Board of Discipline and Disciplinary Committee.