One year of Revised Schedule III: Decoded

In the dynamic world of accounting and finance, staying abreast of regulatory changes is pivotal to ensure compliance and uphold the highest professional standards. The Ministry of Corporate Affairs (MCA) has amended Schedule III of Companies Act 2013 (Act) (here in referred to as Schedule III amendment or amendment), on 24 March 2021 with an objective to increase transparency and provide additional disclosures to users of financial statements. These amendments are effective from 1 April 2021.

In this Article, we have tried to highlight what practical challenges were faced while implementing the amendments and illustrative disclosures forming part of Financial statements of Public Companies for selected amendments. Further, it does not attempt to provide an in-depth analysis or conclusive views on the new changes.

By understanding and embracing these changes, professionals can ensure compliance, transparency, and alignment with the latest regulatory framework, safeguarding corporate interests and maintaining stakeholder trust.

Let us discuss these amendments in detailed manner…

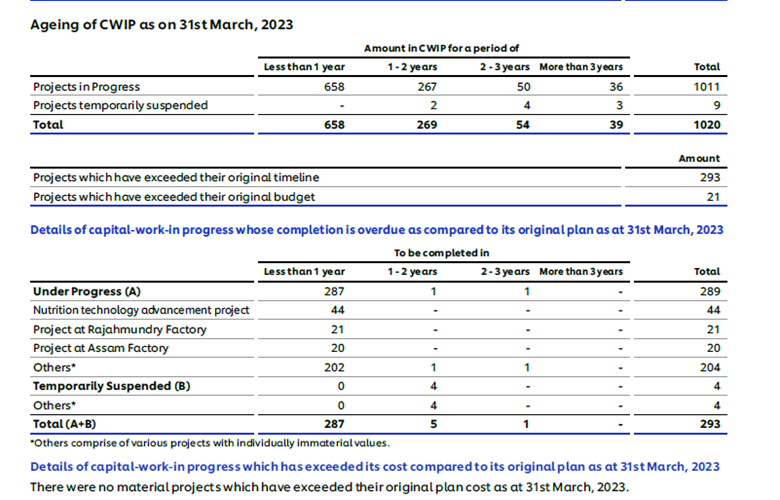

A] CWIP Ageing and Completion Schedule –

New Requirement:

In this disclosure, data must be classified into two categories: ‘Projects in Progress’ and ‘Projects Temporarily Suspended,’ accompanied by an ageing schedule. The classification is evaluated at each reporting date, and the ageing of each item is calculated from its initial recognition date until the balance sheet date.

For Capital Work in Progress (CWIP) that is overdue or has exceeded its cost in comparison to its original plan, the completion schedule for such CWIP shall be provided.

The details of projects where activities have been temporarily suspended shall be disclosed separately.

Implementation Challenges:

In our experience, we have observed that numerous companies struggled to maintain comprehensive documentation concerning planned completion or budgets, particularly in the context of long-term construction contracts. Determining exact timelines for completion and segregating individual contracts to establish accurate amounts in the ageing table posed significant challenges during project implementation and at year-end assessments. Due to such inadequate documentation of CWIP by companies, auditors had to rely on the data provided by the company’s management and perform alternative procedures around the same.

Large-scale projects often undergo modifications during their execution, necessitating careful evaluation and judgment. As per Guidance note issued by ICAI “Management shall apply judgement in determining whether such revisions in the plans are a fresh ‘Original Plan’ or simply an update of estimates and assumptions such that the original plan is revisited and revised. When plans are subsequently revisited and revised, same should not be considered for determining variation when making above disclosures.

Furthermore, challenges also arised concerning the classification of temporary suspensions of projects. As per Guidance note issued by ICAI “When temporary suspension is a necessary part of the process of getting an asset ready for its intended use, the project should not be considered to have been temporarily suspended and the CWIP related to such projects should continue to be presented under Projects in progress.” Herein lies the question of which suspensions should be regarded as temporary, necessitating a judicious assessment in light of the specific circumstances.

Illustrative Disclosure:

Extract of Annual Report of HINDUSTAN UNILEVER LIMITED (HUL) for FY 2022-23

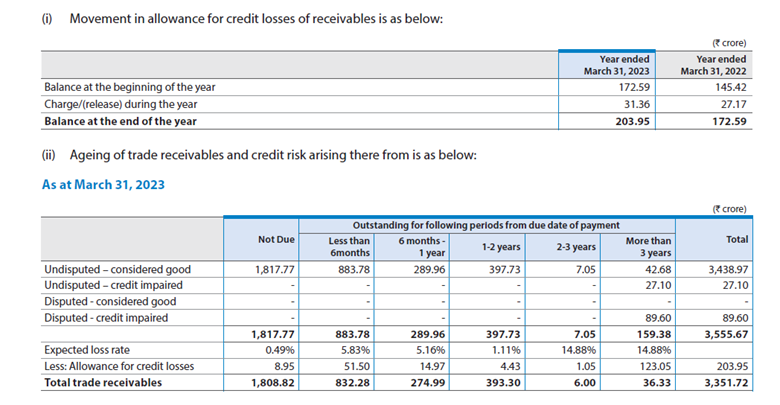

B] Trade Receivable Ageing

New Requirement:

For trade receivables outstanding, ageing schedule shall be given.

Implementation Challenges:

Previously, companies were not required to provide detailed ageing data for Trade receivable, leading to a lack of adequate systems to generate such data, including tracking of disputed debtors. The revised Schedule III amendment now demands comprehensive ageing information, necessitating ERP system modifications or manual computations in cases where system changes were not feasible.

To comply with expected credit loss computation, many companies opted for a simplified approach, adapting their provision matrix to account for default risk based on detailed age-wise analysis of Trade Receivables. Stakeholders will closely scrutinize provisioning assumptions based on the trend of Trade Receivables’ ageing bucket.

Challenges arose in distinguishing between Disputed and Undisputed Trade Receivables, as the Schedule III does not provide specific definitions. As per the Guidance note on Revised Schedule III to Companies Act 2013 “A dispute is a matter of facts and circumstances of the case; however, dispute means disagreement between two parties demonstrated by some positive evidence which supports or corroborates the fact of disagreement” This classification has led to differing opinions between companies and auditors, prompting discussions with management and auditors. Robust internal controls and documentation are vital for accurate categorization.

Illustrative Disclosure:

Extract of Annual Report of TATA STEEL for FY 2022-23

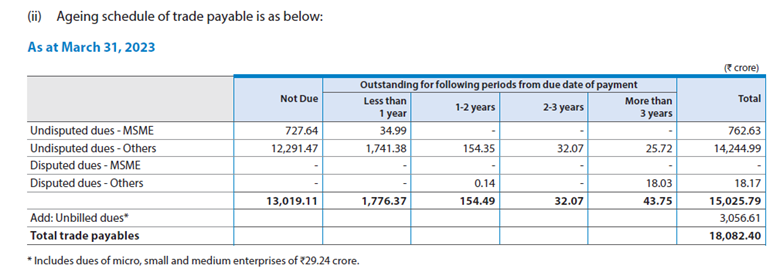

C] Trade Payable Ageing

New Requirement:

For trade payable outstanding, ageing schedule shall be given:

Implementation Challenges:

The challenges relating to ageing and classification of Disputed and Undisputed dues are similar to those as considered above in Trade receivables disclosure requirement above.

Illustrative Disclosure:

Extract of Annual Report of TATA STEEL for FY 2022-23

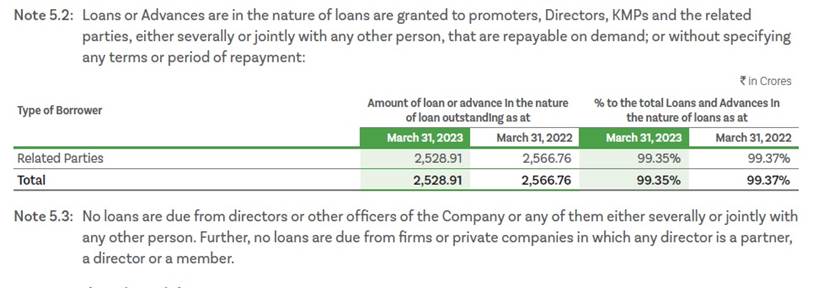

D] Loans or Advances granted to Promoter, Director, KMP or the Related Parties –

New Requirement:

This disclosure mandates companies to furnish specific information about loans or advances, categorized as repayable on demand or without defined terms of repayment, granted to promoters, directors, Key Management Personnel (KMPs), and related parties. The disclosure should consider the relationship as of the loan date, with the outstanding amount as of the balance sheet date.

Implementation Challenges:

As per the Business requirements, many companies extended loans to subsidiaries or other related parties without maintaining adequate documentation, including the absence of specified terms of repayment, such Companies had to disclose information as mentioned above. However, in response to this disclosure mandate, we noted several companies had revised their documentation practices prospectively to avoid such disclosures in the future.

Illustrative Disclosure:

Extract of Annual Report of UltraTech Cement Limited for FY 2022-23

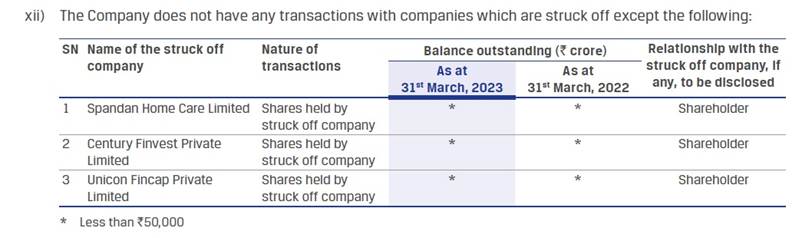

E] Relation with struck-off companies –

New Requirement:

Where the company has any transactions with companies struck off under section 248 of the Companies Act, 2013 or section 560 of Companies Act, 1956, the Company shall disclose the details of transactions and Balance outstanding with those Companies.

Implementation Challenges:

In the context of Schedule III disclosure for struck off companies, multiple challenges have surfaced, creating complexities for companies. Firstly, the absence of a master list of struck-off companies on the MCA website makes it arduous to prepare a updated consolidated list of Companies whose name is Struck off from various circulars issued by each ROC which are in non-editable PDF format.

Since collation of List was a time-consuming process. Many small Companies manually verified CIN numbers for each entity on the MCA website to ascertain their status – active or struck off. In contrast, large corporates had to manually consolidate lists from circulars across all ROCs or rely on third-party vendors for assistance in obtaining the list of struck-off companies or assistance in identifying the list of parties whose name is struck off.

Another ambiguity arises concerning the disclosure requirement when a company engages in a transaction with another company, and subsequently, the latter’s name is struck off. Determining whether such transactions necessitate disclosure remains unclear.

Moreover, issues were observed with the master data of Vendors and Customers, where proper updating was lacking, and the inclusion of CIN numbers was absent in some Companies due to no reporting requirements. This led to substantial challenges for companies as they had to first update all master data before proceeding with the identification of struck-off companies.

Illustrative Disclosure:

Extract of Annual Report of JSW ENERGY LIMITED for FY 2022-23

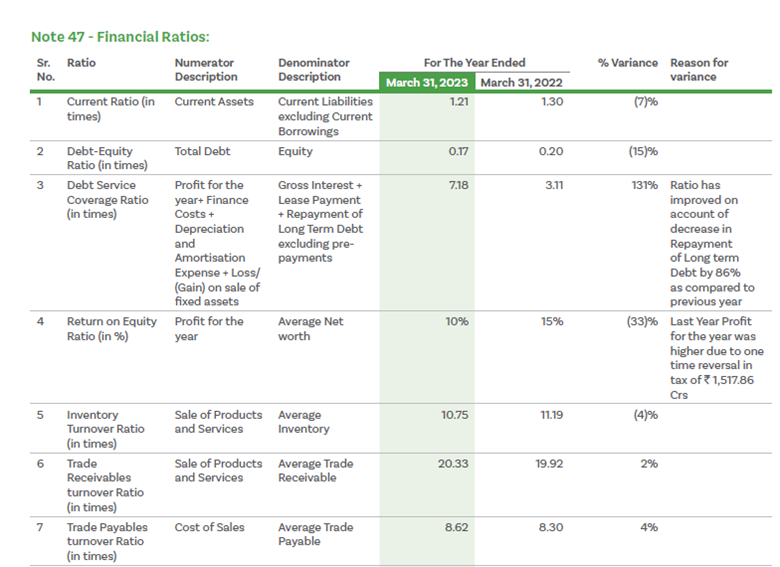

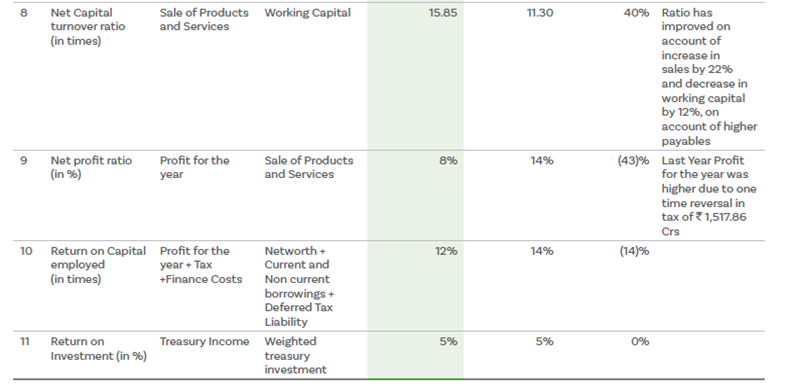

F] Ratio Analysis –

New Requirement:

As per this disclosure, the company must furnish analytical ratios and elucidate the components included in both the numerator and denominator used in calculating these ratios. Additionally, a comprehensive commentary is required to explain any variation exceeding 25% in the ratio compared to the preceding year

Implementation Challenges:

The revised Schedule III introduces a significant change by requiring all companies to provide financial ratios and disclosures, a departure from SEBI LODR’s requirement for only listed entities to do so in their Annual Reports, rather than financial statements. As the ratios where not defined in the amendment, Many companies referred to the Definitions as provided in the Guidance Note issued by ICAI but we found that many Companies calculated using their own approach, however the Formula used for calculations were defined in the Financial statements.

This enhanced transparency will be instrumental in enabling lenders and various stakeholders to access audited data on various Key Performance Indicators (KPIs) of the company.

Illustrative Disclosure:

Extract of Annual Report of UltraTech Cement Limited for FY 2022-23

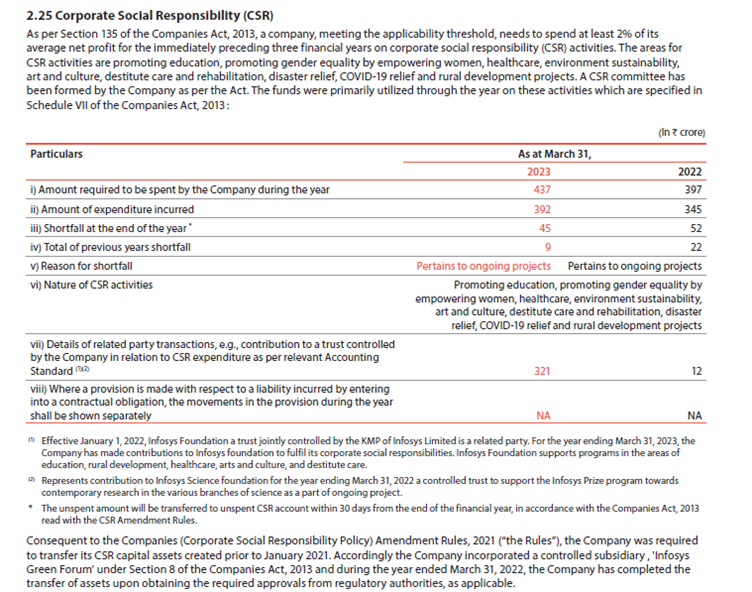

G] Corporate Social Responsibility (CSR) –

New Requirement:

Under the Companies Act 2013, companies falling under Section 135 must now additionally disclose their Shortfalls, reasons for shortfall etc

Implementation Challenges:

This amendment highlights the regulators’ increased emphasis on CSR. The focus is on ensuring that companies appropriately track and disclose their CSR spending in accordance with the requirements of the Act. Detailed disclosure of CSR expenditure is now mandatory for corporates.

In line with the “Technical Guide on Accounting for Expenditure on Corporate Social Responsibility Activities” issued by the ICAI, certain guidelines have been provided:

- A provision for liability must be recognized in the financial statements for any unspent amount.

- Any excess amount spent can be carried forward to the following year, subject to passing of Board resolution.

In some cases, Companies have contributed amounts to the institutions whose purpose matches the CSR spending of the Company, in such cases auditors should obtain documentary evidence verifying that the amount contributed was utilised by the year end or not and report accordingly. Getting the documentation from these institutions was very challenging and time consuming.

Illustrative Disclosure:

Extract of Annual Report of JSW ENERGY LIMITED for FY 2022-23

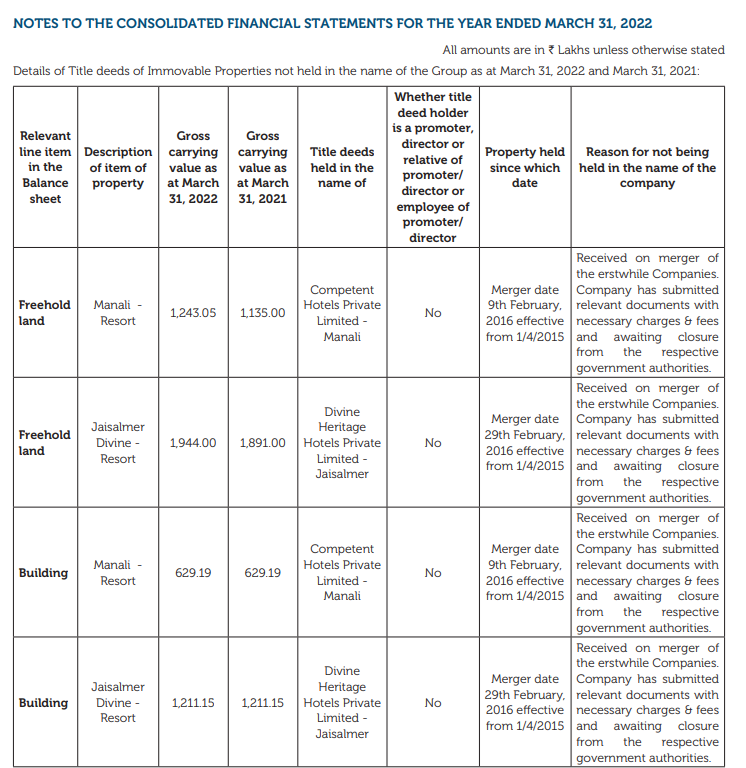

H] Title deeds of Immovable Properties not held in the name of the Company –

New Requirement:

As per the disclosure requirements, the company is obligated to furnish details of all immovable property whose title deeds are not held in the company’s name.

Implementation Challenges:

In the preparation of this schedule till last year Auditors’ were required to report in their Audit report, however after the amendment to Schedule III, the same is required to be disclosed as a part of Financial Statement. One of the Special focus points is when the Company has undertaken any Mergers & Acquisition transactions. Due to the regulatory framework involved in transferring of the Title deeds, this process is time consuming and may result in Title deeds not being transferred to the new owner and thus disclosure under this schedule becomes applicable.

Illustrative Disclosure:

Extract of Annual Report of Mahindra Holidays & Resorts India Limited for FY 2021-22

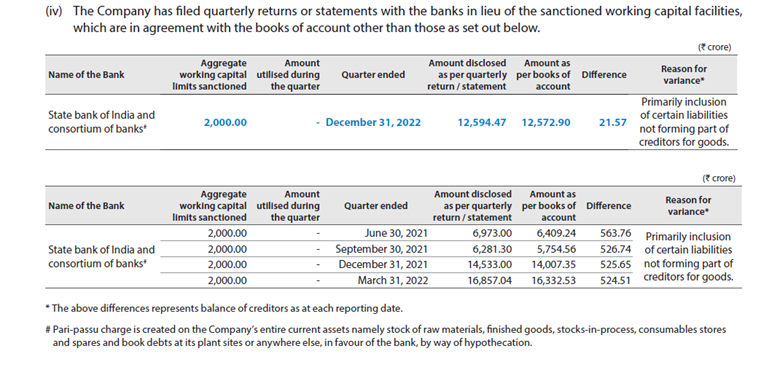

I] Borrowings obtained on the basis of security of current assets –

New Requirement:

Where the company has borrowings from banks or financial institutions on the basis of security of current assets, it shall disclose the following:

a) Whether quarterly returns or statements of current assets filed by the company with banks or financial institutions are in agreement with the books of accounts;

b) If not, summary of reconciliation and reasons of material discrepancies, if any to be adequately disclosed.

Implementation Challenges:

Schedule III requires to provide the disclosure in case of all types of borrowing which are obtained basis current assets security. However, CARO reporting is only required in case of sanctioned working capital is in excess of INR 5 crores.

Instances of differences may be relating to difference in value of stock, amount of debtors, ageing analysis of debtors, etc. between the books of account and the returns / statements submitted to banks/financial institutions. The auditor needs to exercise his professional judgement to determine the materiality and the relevance of the discrepancy to the users of financial statements while reporting under this clause.

Illustrative Disclosure:

Conclusion:

Companies may need to realign their Financial Statements Close Process (FSCP) and internal control over financial reporting to ensure that information and data relating to new clauses are compiled appropriately and on timely basis to avoid last minutes hassles in preparation of financial statements.

This Article does not attempt to provide an in-depth analysis or conclusive views on the new changes. Rather, it aims to highlight key consideration which companies should be aware of while implementing these changes. Reference should be made to the text of the pronouncements before taking any decisions or actions. The views expressed in the publication need to be evaluated in light of the facts and circumstances of each Company.