Key provisions and challenges in E-commerce in Indirect Tax

Introduction

E-commerce has emerged as a game-changer in the global economy, transforming the way businesses operate and consumers shop. India is no exception to this digital revolution, with the e-commerce sector witnessing exponential growth in recent years. However, this growth has not been without its share of challenges, especially in the realm of Indirect Taxes (IDT). In this article, we will delve into the key provisions and challenges that the e-commerce industry faces in the context of IDT, with a particular focus on GST (Goods and Services Tax) in India.

Basic definition of E- commerce :

- “Electronic Commerce” has been defined u/s 2(44) of the CGST Act, 2017 which states that “the supply of Goods or Services or both including digital products over digital or electronic network”

- In common parlance, an activity of buying and selling of goods and services over the internet is called E-Commerce.

- E-commerce Operator [here after to be referred as “ ECO”] has been defined u/s 2(45) of the CGST Act, 2017 which states as “any person who owns, operates or manages digital or electronic facility or platform for electronic commerce”

- In common parlance, the person who operates the E-commerce platform is called an ECO. Main examples of such operators selling goods are Amazon, Flipkart, and operators selling services are Uber, Urban Clap

- Thus to facilitate the above transaction there is requirement of following three things:

- A buyer

- A seller and

- ECO

Types of Business Models in the E-Commerce Industry

There are two main kinds of models in the e-commerce industry.

- The Inventory based Model

- The Market Place / Aggregator based Model

Let us take a look at both of these models in depth.

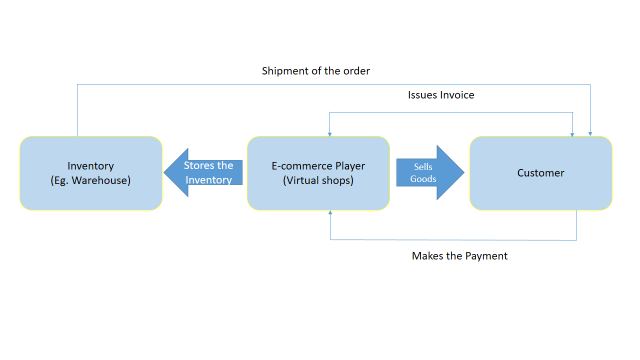

- Inventory based E-commerce Business Model:-

- In this model the inventory of goods and services is owned by the E-commerce entity. The entity will list its own products in its own website and the consumers explore the website and place orders on the website itself. Later, the products are delivered to the addresses of consumers. Eg. Lenskart.

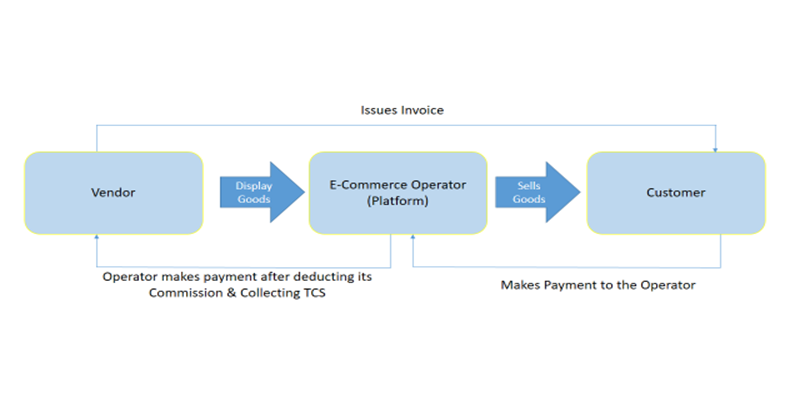

- Market Based E-commerce Business Model:-

- In this model, the ECO will facilitate the supply of Goods and services between the supplier and the buyer. The ECO will not have any title over the goods or services transacted through its platform. Eg. Amazon, Flipkart etc.

- This model is further divided into following two sub categories

- Supplier providing Specified services only under section 9(5) of CGST Act, 2017 through an ECO

- Supplier providing goods and services other than specified services under section 9(5) of CGST Act, 2017 through an ECO.

Specified services covered under section 9(5) of the CGST Act, 2017”

In terms of Notification 17/2017-CT(R) dated 28th June 2017 and Notification 23/2017-CT(R) dated 22nd August 2017 the following services are specified

- Services by way of transportation of passengers by a radio-taxi, motor cab, maxi cab and motor cycle; – Example: Ola, Uber

- Services by way of providing accommodation in hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes, except where the person supplying such service through e-commerce operator is liable for registration under Section 22(1) of CGST Act. Example: OYO hotels.

- Services by way of house-keeping, such as plumbing, carpentering etc, except where the person supplying such service through e-commerce operator is liable for registration under section 22(1) of the CGST Act. Example: Urban Company

To evaluate the GST provisions lets bifurcate the above E-commerce models into three categories:

- Inventory based E-commerce Model – Category 1

- Market based E-commerce model where supplier provides specified services – Category 2

- Market based E-commerce model where supplier provides services other than specified services – Category 3

Registrations

After understanding primary models of E-Commerce Industry, now let us understand registration requirements of the said sector;

- Section 24: Compulsory registration in certain cases (Relevant Part)

“Notwithstanding anything contained in sub-section (1) of section 22, the following categories of persons shall be required to be registered under this Act,-

- Persons who are required to pay tax under sub-section (5) of section 9,

- Persons who supply goods or services or both, other than supplies specified under sub- section (5) of section 9, through such electronic commerce operator who is required to collect tax at source under section 52

- Every electronic commerce operator,

- Every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person

| Category 1 | Category 2 | Category 3 |

| In terms of Sec 22 of CGST Act,2017- every supplier shall be liable to be registered under this act in the state or UT from where he makes a taxable supply of goods or services or both, if his aggregate turnover exceeds a specified threshold limit. | In terms of Sec 24(iv) of CGST Act,2017- a person who is required to pay tax under Sec 9(5) of CGST Act is liable to take registration. In the instant case, the ECO are required to take GST registration (Regular), irrespective of the aggregate turnover (i.e., Sec 22 of CGST Act,2017). However, the suppliers of such services shall take GST registration if their aggregate turnover exceeds a specified threshold limit | ECO: In terms of Sec 24(x) of CGST Act,2017 shall take a GST registration mandatorily whether or not its aggregate turnover exceeds the specified threshold limit. (Irrespective of Sec 22(1) of CGST Act,2017) Suppliers: At the same time, in terms of Sec 24(ix) of CGST Act,2017- persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator who is mandatorily required to take GST registration irrespective of whether the aggregate turnover is exceeding the threshold limit. However, an exemption has been granted to service Provider from taking the registration if their aggregate Turnover doesn’t exceeds Rs 20Lakhs vide Notification 65/2017 dated 15.11.2017 |

From the above it can be noted that, in case of Persons getting covered u/s 9(5) E-Commerce Aggregator are required to take up registration regardless of the threshold limit. However, the supplier making supplies through such aggregator would be allowed to take up advantage of threshold limit of GST registration. In all other cases Sec 24 mandates the supplier to compulsory acquire registration for supplies made through ECO.

- Levy and collection of Taxes u/s 9(5):-

- “The Government may, on the recommendation of the Council, by notification, specify categories of services the tax on intra-State supplies of which shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the person liable for paying the tax in relation to the supply of such services:

- Provided that where an electronic commerce operator does not have a physical presence in the taxable territory, any person representing such electronic commerce operator for any purpose in the taxable territory shall be liable to pay tax

- Provided further that where an electronic commerce operator does not have a physical presence in the taxable territory and also he does not have a representative in the said territory, such electronic commerce operator shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax. ”

| Category 1 | Category 2 | Category 3 |

| In terms of Sec 9(1) of CGST Act,2017 and Sec 5(1) of IGST Act,2017 – the tax shall be levied on the supply of goods or services on all intra-state and inter-state supplies on the value determined under Sec 15 and shall be paid by the taxable person. Therefore, the E-commerce Seller shall pay the taxes to the Government. | By virtue of section 9(5)’ if the specified services are supplied by any supplier through the E-commerce platform, then the E-commerce operator is liable to pay GST on the same as if he is the supplier of the service. | In terms of Sec 9(1) of CGST Act,2017 and Sec 5(1) of IGST Act,2017 – the tax shall be levied on the supply of goods or services on all intra-state and inter-state supplies on the value determined under Sec 15 and shall be paid by the taxable person. · In the instant case, the suppliers are liable to pay the GST by collecting the same from the end customer, for the goods or other than specified services provided by it using the e-commerce platform. At the same time, for the services provided by ECO to the suppliers, ECO shall pay taxes to the Govt by collecting from its sellers. |

- INVOICING:

- In case of Goods: In terms of Sec 31(1) of CGST Act,2017 – A registered person supplying taxable goods shall before or at the time of removal of goods for supply to recipient shall issue a tax invoice, where the supply involves the movement of goods. In all other cases, at the time of delivery of goods to the recipient the tax invoice shall be issued.

- In case of services: In terms of Sec 31(2) of CGST Act,2017 read with Rule 47 of CGST Rules,2017- A registered person supplying taxable services shall, before or after the provisions of service but within a period of 30 days from the date of supply of service (45 days in case of Banking, FI, NBFC) shall issue a tax invoice.

| Category 1 | Category 2 & 3 |

| I. ECO shall issue the tax invoice for the supply of goods or services to the end consumer in terms of the aforesaid deadlines. II. If goods are procured and not manufactured then, supplier of such goods would also issue an Invoice on ECO | I. The suppliers shall issue the tax invoice for the supply of goods or services made through the ECO to the end consumer in terms of the aforesaid deadlines. · II. At the same time, ECO shall issue invoice for the facilitation services provided to the suppliers. |

- TAX COLLECTED AT SOURCE ON E – COMMERCE OPERATOR

- Section 52: Collection of tax at source

“Notwithstanding anything to the contrary contained in the Act, every electronic commerce operator (hereinafter referred to in this section as the “operator”), not being an agent, shall collect an amount calculated at such rate not exceeding one percent, as may be notified by the Government on the recommendations of the council, of the net value of taxable supplies made through it where the consideration with respect to such supplies is to be collected by the operator.

Explanation.- For the purposes of this sub-section, the expression “net value of taxable supplies” shall mean the aggregate value of taxable supplies of goods or services or both, other than services notified under sub-section (5) of section 9, made during any month by all registered persons through the operator reduced by the aggregate value of taxable supplies returned to the suppliers during the said month.”

Tax Collected at Source (TCS) provides for mechanism, wherein the e-commerce operator is required to collect a specified percentage of payment to e-commerce supplier, when the supplier make supply of specified goods or service using its portal. The said amount of TCS collected must be remitted to government within 10th of next month, from the month in which the invoice is generated.

The supplier who has supplied the goods or services or both through the operator shall claim credit of such TCS, in his electronic cash ledger.

| Category 1 | Category 2 | Category 3 |

| In this model, as the E-commerce entity is supplying its own products using its own platform, it is not required to deduct the TCS. Therefore, the provisions of TCS will not apply and the entity need not take TCS registration. | The services specified u/s 9(5) have been specifically excluded u/s 52 i.e. ECO providing such services neither take TCS registration under GST nor collect the TCS from the consideration that is received from the consumers on behalf of the supplier, while remitting the same to the supplier of specified service. | In this model, as the suppliers are supplying the goods or services other than the specified services through ECO. ECO shall take TCS registration under GST and collect the TCS on the consideration payable to sellers. |

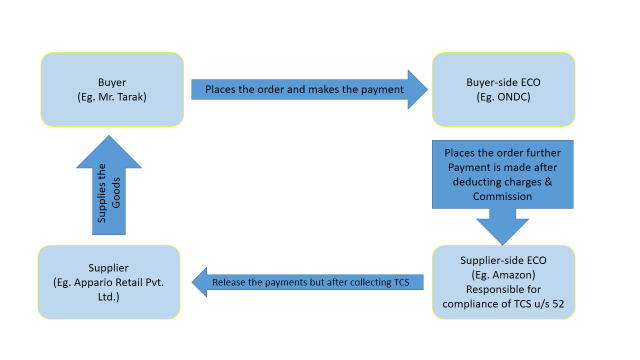

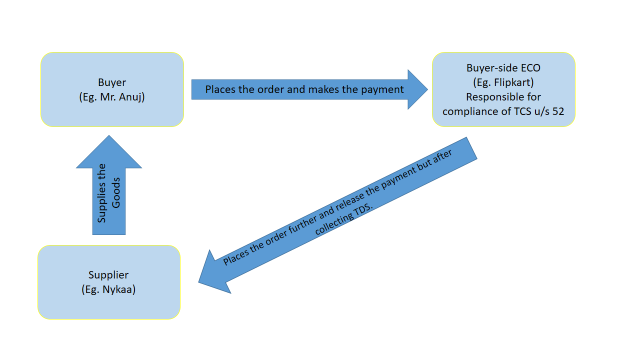

TCS Provisions in case of Multi E-commerce Operators in one transaction

In the case of the ONDC (Open Network for Digital Commerce) Network or similar other arrangements, there can be multiple ECOs in a single transaction – one providing an interface to the buyer and the other providing an interface to the seller. In this setup, buyer-side ECO could collect consideration, deduct their commission and pass on the consideration to the seller-side ECO. A clarification has been issued vide circular No 194/06/2023-GST dated 17.07.2023 so as to who will collect the TCS. There are following two scenarios:

- In a situation where multiple ECOs are involved in a single transaction of supply of goods or services or both through ECO platform and where the supplier side ECO himself is not the supplier in the said supply.

- In a situation where multiple ECOs are involved in a single transaction of supply of goods or services or both through ECO platform and the Supplier-side ECO is himself the supplier of the said supply.

- Place of Supply

- GST is a destination based tax, i.e., the goods/services will be taxed at the place where they are consumed/used and not at the origin. So, the state where they are consumed will have the right to collect GST.

- The Place of supply of goods under GST defines whether the transaction will be counted as intra-state or inter-state, and accordingly levy of SGST, CGST & IGST will be determined.

- In very simple words, where you are selling from does not matter. Where your goods are going is relevant. This would apply to all e-commerce platforms, sellers such as those who sell on Amazon.

- Let us go through the few examples of the place of supply for goods:

- Example 1: Intra-state sales

Mrs. Pakhi of Mumbai, Maharashtra orders a Laptop from Amazon. The seller M/s. Satyam Electronics is registered in Nagpur, Maharashtra.

The place of supply is Mumbai in Maharashtra. The location of the supplier is in Mumbai. Since the place of supply is in the same state as that of the location of the supplier, CGST & SGST will be charged.

- Example 2: Inter-State sales

Mr. Rahul of Mumbai, Maharashtra orders a mobile from Amazon. The seller Mobile Junction is registered in Bangalore, Karnataka.

The place of supply here is in Mumbai, Maharashtra. Since the location of the supplier( i.e. Bangalore) is in a different State when compared with the place of supply (i.e. Mumbai) IGST will be charged.

- Example 3: Send to a third party

Mr. Vikram of Mumbai, Maharashtra orders a watch from Amazon to be delivered to his friend in Punjab as a gift. M/s Kunal Electronics (online seller registered in Rajasthan) processes the order and sends the watch accordingly and Mr. Vikram is billed by Amazon.

It will be assumed that the buyer Mr. Vikram in Maharashtra has received the mobile even though it was actually delivered to his friend.

The place of supply here is in Mumbai, Maharashtra. Since the location of the supplier ( i.e. Rajasthan)

is in a different State when compared with the place of supply (i.e. Mumbai) IGST will be charged.

- GST Returns Filing

- Every E-commerce suppliers/aggregators are required to file Form GSTR-1 and GSTR 3B monthly and GSTR-9 & GSTR 9C is to be filed annually (subject to its applicability based on Turnover) If the Turnover doesn’t exceeds Rs 5cr, then QRMP scheme can be opted for.

- ECO are required to file their GST return in form GSTR 8 on monthly basis.

- Form GSTR 8 is a statement that contains the details of supplies made to customers through the taxpayer’s E-commerce portal by both registered taxable persons and unregistered persons, customer’s basic information, the amount of tax collected at source(TCS), tax payable, and tax paid. It is the most important form.

- E-commerce suppliers/aggregators are required file GSTR 7A to accept the TCS credit collected by ECO.

- Challenges in E-commerce Industry

- Complexity of GST Compliance:

Registration – Almost all e-commerce businesses, regardless of their turnover, are required to register for GST. This can be a time-consuming and costly process for small businesses.

Multiple Registration – E-commerce businesses need to register for GST in each state where they have a physical presence, such as a warehouse or office. This can be cumbersome for businesses that operate across multiple states.

Tax collection at source (TCS): E-commerce platforms are required to collect TCS on behalf of the government on all sales made by sellers on their platform. This can be an additional burden for e-

Commerce platforms, especially in cases where they have a large number of sellers

Return Filing: E-commerce entities are required to file regular GST return which can be complex and time consuming for small players.

Thus this increased compliance burden has led to increased costs for e-commerce companies, particularly smaller players

- Cross Border Transactions:

E-commerce often involves cross-border transactions, which have their own GST implications. Businesses need to navigate customs duties, integrated GST (IGST), and other international tax regulations, which can be quite intricate

- GST on discounts and Promotion:

Determining the GST liability on discounts, vouchers, and promotional offers can be challenging. The treatment of these discounts under GST is not always clear, leading to disputes between businesses and tax authorities.

- Return Matching:

In each transaction, e-commerce merchants and sellers will have to upload invoice details in their respective returns and the GST system will match them. Any supply reported by the platform and not reported by the marketplace, unless reconciled, will be added to the liability of the seller, which will penalize the seller

- Impact on small Suppliers:

The introduction of GST has had a significant impact on small and medium-sized enterprises primarily suppliers from Tier II and Tier III cities which are were earlier making supplies through e-commerce platforms. Such Suppliers selling through e-commerce platforms are required to register for GST and comply with GST regulations. The compliance burden and increased costs have made it challenging for such small and medium –sized enterprises to operate in the e-commerce industry, leading to a decline in the number of small and medium –sized enterprises selling through e-commerce platforms.

- Concluding Remarks:

- The E-commerce has transformed the way consumers shops by providing convenience of shopping online coupled with vast consumer base for the suppliers. Thus in my view the overall implementation of GST on e-commerce is appreciable.

- Various GST provisions have reshaped tax compliance for e-commerce businesses and are crucial in regulating this dynamic sector. However, the sector faces numerous challenges, from complex compliance to cross-border transactions and tax evasion.

- In my view, in the ever-evolving landscape of e-commerce and indirect taxes in India, adaptation and collaboration will be key to success. As the government and industry stakeholders work together to address challenges, the future holds promise for continued growth and innovation in the Indian e-commerce ecosystem