FUND RAISING – A STAIRCASE TO BUSINESS TRIUMPH

“Funding raising is a mentorship for encouraging a business. It helps to travel through an enormous journey of mixed feelings of joy, happiness, sorrow, unworthy still starving for the fantasy of not being average. Fund raising builds memories, inspiring stories, great adventure and more other undefined adjectives for an Investor and also for an Average Person becoming an entrepreneur, a Magnate !!!”

Raising Capital by way of Issue of Shares / Debt Capital

An idea for incorporating a business is not worthy unless one has enough capital to translate it into a reality. It is an ironical truth that a business is almost impossible to start without money. Using up your savings is one option, but savings will eventually run out. Therefore, raising funds through different sources is important in order to finance business activities.

Choosing the right sources is, however, the next critical step in the process of capital-raising because it is invariably the determinant of the success and growth of any business. Extraordinary capital raising skills are required to obtain funds quickly and efficiently, through the most appropriate sources.

- What is capital raising?

It’s the process a business goes through in order to raise money, so the business can get off the ground, expand, or transform in some way to be a Tycoon. Fund raising is a prominent aspect and a verdict for a Startup Company i.e., a Private Company, to achieve the aim, objective, target for which the idea was conceived.

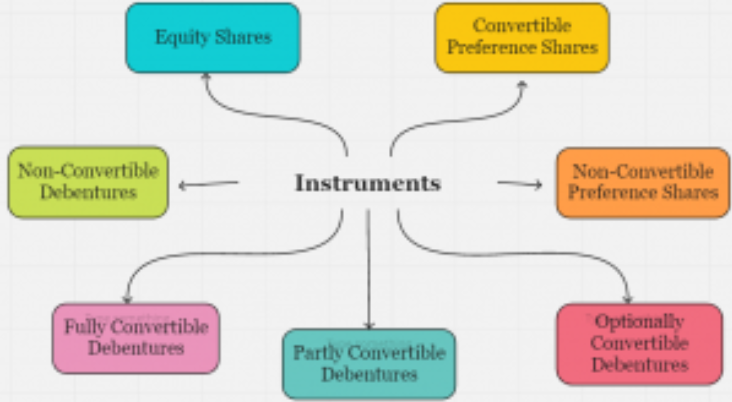

- Instruments that can be issued for the purpose of fund raising-

Companies issue different types of instruments covered under the umbrella of Companies Act, 2013 as under:

| Share financing is basically the process of issuing and selling shares, i.e., Equity and/or Preference Shares to raise money. Investors who buy shares of a company become Shareholders and earn investment gains if the stock price rises in value or if the company pays a dividend. | Debt financing occurs when an organization raises money for working capital or capital expenditures by selling debt instruments, i.e., debentures and/or convertible notes, to individuals and/or institutional investors. In return for lending the money, the individuals or institutions become creditors and receive a promise that the principal and interest on the debt will be timely repaid. |

Company at the time of funding raises through equity-based instruments, debt-based instruments or hybrid instruments (containing a combination of features of both equity and debt based instruments).

The nature of instruments to be issued by a company depends, to a large extent, on the valuation of the company obtained through different mechanisms.

The primary difference between the issue of equity and debt based instruments is the dilution of the shareholding of the existing shareholders of the company. While the issue of purely equity based instruments results in the immediate dilution of existing shareholding, the issue of debt instruments (if convertible in nature) will result in dilution of shareholding at a later stage in the shelf life of the company.

Dilution of shareholding means the reduction in total amount of shareholding percentage of existing shareholders caused by the issue/allotment of new equity shares to a new investor.

The instruments are issued on obtaining the latest Valuation Report wherein the securities premium is the major source of funds.

The Company along with the Founders and Investors executes chief agreements such as Shareholders Agreement, Share Subscription Agreement and Share Purchase Agreement.

| Shareholders Agreement | Share Subscription Agreement | Share Purchase Agreement |

| A Shareholders’ Agreement is an arrangement between the existing and new Investors, Founders and Company. It protects both the business and its investors. A Shareholders’ Agreement describes the rights and obligations of the Company, Founder and Investor, the issuance of shares, the operation of the business, and the decision-making process. The unanimous approval requirement, reserved matter rights, conditions precedent, and subsequent to raising the fund, the tag-along provision protects the interests of minority shareholders and other relevant rights and obligations of Company, Founder and Investor. | Share Subscription Agreement is basically an arrangement between Company, Founder, and the new Investor that involves the acquisition of ownership in the company by issuance of new shares. It is drafted mentioning the type of security issue, number of securities issues, face value and premium amount of securities, terms of securities, and other relevant arrangements. | Share Purchase Agreement is an agreement between the purchaser and seller of the share. The buyer and the seller can be an individuals and even a company. The Share Purchase Agreement is drafted into the following cases; either existing promoters will sell the shares or new investors will purchase shares from existing shares to give them an exit. |

- Share Capital –

A Company’s capital i.e., Share Capital, is divided into units known as Shares.

To raise funds, companies can issue the following types of shares:

| Equity Share | Preference Shares |

| Pursuant to Section 43 of Companies Act it defines as – “Any share that is not a preference share is an equity share” Issued either: (i) with voting rights; or (ii) with differential rights as to dividend, voting | Pursuant to Section 43 of Companies Act it defines as – Shares which carry preferential right with respect to— (a) payment of dividend; and (b) repayment, in the case of a winding up or repayment of capital. Different types of Preference Shares are issued such as Cumulative, Compulsory or Optionally Convertible. |

- Debt Capital –

Debt financing is borrowing money from a bank or other lenders. The principal amount of the loan has to be paid back, plus interest, which is the cost of borrowing.

Debt financing allows a business to leverage a small amount of money into a much larger sum, enabling more rapid growth than might otherwise be possible. The company does not have to give up any ownership control, as is the case with equity financing.

Debt Capital can be raised through providing loans, may or may not be convertible into shares as a fund or issuing instruments such as Debentures, Bonds, Convertible Notes may or may not be convertible into shares.

- Debt Financing vs. Shares Financing –

The main difference between debt and share financing is as follows:

| Share financing provides extra working capital with no repayment obligation. | Debt financing must be repaid, but the Company does not have to give up a portion of ownership in order to receive funds. |

Most companies use a combination of debt and equity financing. Companies choose debt or equity financing, or both, depending on which type of funding is most easily accessible, the state of their cash flow, and the importance of maintaining ownership control.

The Debt/Equity ratio shows how much financing is obtained through debt vs. equity. Creditors tend to look favorably on a relatively low Debt/Equity ratio, which benefits the Company if it needs to access additional financing in the future.

- Modes of fund raising –

- Private Placement {section 42 of Companies Act, 2013 & 14 of Companies (Prospectus and Allotment of Securities) Rules, 2014} –

Securities issued to a selected group of persons with the consent of the members of the company. On receiving the consent of the members of the company, i.e., by passing special resolution, the company shall report it to RoC in Form MGT-14 within 30 days. The identified persons shall not exceed 50 or more at the event of raising the fund, and shall not exceed 200 or more persons in a year.

The price of the security being issued is determined by obtaining a Valuation Report from a Register Valuer in adherence to section 248 of Companies Act, 2013.

The shares application money is to be received through any of the banking mechanism but not in cash, and a separate bank account is to be opened in a Schedule Bank for receiving such fund.

Form PAS 4 is circulated to the identified persons as Offer Letter before receiving the fund. A list of identified investors is to be prepared in Form PAS 5.

No company issuing securities under this section shall release any public advertisements or utilise any media, marketing or distribution channels or agents to inform the public at large about such an issue.

The Shares to be allotted to the Investors within 60 days of receiving the funds, if not complied with the funds have to be refunded back within 15 days from the expiry of 60th day. Form PAS 3 (Return of Allotment) to be filed with RoC within 15 days of allotment of shares.

- Preferential Allotment {section 62 of Companies Act, 2013 & Rule 13 of Companies (Share Capital and Debentures) Rules, 2014} –

The expression ‘Preferential Offer’ means an issue of shares or other securities, by a Company to any select person or group of persons on a preferential basis and does not include shares or other securities offered through a public issue, rights issue, employee stock option scheme, employee stock purchase scheme or an issue of sweat equity shares or bonus shares or depository receipts issued in a country outside India or foreign securities

The expression, “shares or securities” means equity shares, fully convertible debentures, partly convertible debentures, or any other securities, which would be convertible into or exchanged with equity shares at a later date.

In case of Preferential Allotment all the compliance of Private Placement are to be adhered to.

It is worthy to say that:

“Preferential Allotment and Private Placement go hand in hand; all the Preferential Allotments are Private Placement, but all Private Placements are not Preferential Allotments.”

This is because Private Placement covers all kinds of securities; however Preferential Allotment covers only equity shares and convertible securities.

- Right Issue (section 62(1)(a) of Companies Act, 2013) –

Shares are offered to existing equity shareholders of the company in proportion to their holdings. The equity shareholders of the company who shall be allowed to participate in the issue shall be determined by taking a cut-off, also known as record date, on which the said shareholders exist.

The issue shall be open for a period of atleast 15 days and not more than 30 days, know as Offer period. The notice of offer to be dispatched atleast 3 days before opening of the offer period.

Exemption is available to the Private Companies for keeping the offer period open for atleast 7 days and with the consent of 90% of the Members of the Company the notice period for dispatch of offer notice can be minimized.

If shareholders don’t wish to opt out of the issue, they may waive off the right or renounce their right to some other person as they wish to.

Form PAS 3 is to be filled within 30 days of allotting the shares.

- Transfer of securities (section 56 of Companies Act, 2013) –

Shares are transferred by way of gift or sale to introduce a new shareholder. The Founders transfer their stakes to the Investor to provide a decent and fair voting holding in the Company.

The shares are transferred by registering and executing Form SH 4 and reporting it to the company.

- Employee Stock Option Scheme (ESOP)/Management Stock Option Scheme/ Phantom Stock/ Stock Appreciation Rights (SAR), etc. {section 62(1)b of Companies Act, 2013 and Rule 12 of Companies (Share Capital and Debentures) Rules, 2014} –

ESOP benefits the Company as well as its employees. It benefits startups where employees can be rewarded after the company goes public. ESOP are denominated using different objectives, rights to cater the stocks to all levels of hierarchy in the Company.

Offering ESOP helps in retaining employees and builds affection, confidence towards the Company. The scheme offers ownership interest to the workforce and increases their participation in the Company.

Craving ESOP Pool and granting ESOP stocks helps the Founders to maintain adequate stack and control in the Company. It works as a peaceful funding option for the Company.

ESOP are issued by framing a policy and ESOP pool, approved by the Members of the Company. Post approval by Members by passing a Special Resolution, Form MGT 14 is required to be reported to RoC in Form MGT 14 within 30 days.

Issuance of the ESOP stock is to be approved by the Members. Members should be made well versed with the names of officers whom ESOP stock is planning to be issued along with the price of issue. Post approval by Members by passing a Special Resolution, Form MGT 14 is required to be reported to RoC in Form MGT 14 within 30 days.

Post approval ESOP stocks are granted to the employees, i.e., informing them of their eligibility for receiving the stock. On acceptance of the grant of ESOP a vesting period of minimum 1 year is levied on the stocks, which works as a right for employees to apply for the grant. After the expiry of the vesting period, ESOP stock can be exercised by employees.

Form PAS 3 is to be filled within 30 days from exercising the stock.

Incase of Private Company, an exemption is provided to pass all the resolutions relevant to ESOP through Ordinary Resolution.

*** In case of receiving Foreign Funding it has to be reported to the Reserve Bank of India pursuant to Foreign Exchange Management Act, wherein to adhere with the following filings:

| In case of new issue of Shares and Debentures | Form FC-GPR |

| In case of transfer of shares and debentures | Form FC-TRS |

| In case of Convertible Notes | Form CN |

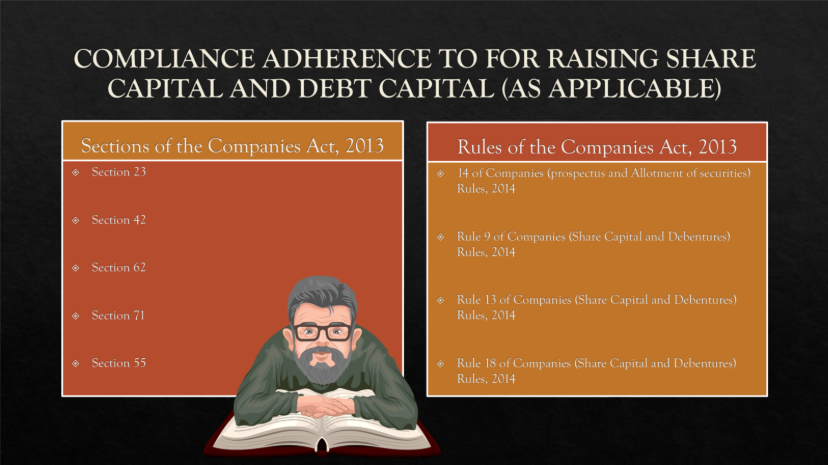

- Compliance to adhere with for Fund Raising –

- Conclusion –

This article summarizes the basic need to issue shares and raise capital and its importance to a company. Every organization needs funds for the sustenance and growth of its business. It can be concluded that issuing shares and debt securities for raising capital is an integral part of any business/company. It not only helps in getting investment from investors/shareholders but also helps the company in re-investing in itself. It can be seen that when a company is in a sound position it can take care of its employees, directors & shareholders and motivate them to do better.