Disciplinary Procedures and Code of Ethics Of ICAI: A Recent Overview

Introduction:

The Institute of Chartered Accountants of India (ICAI) is a statutory body established by an Act of Parliament, the Chartered Accountants Act, 1949, for regulating the profession of Chartered Accountancy in the country. The ICAI has a well-defined Code of Ethics and disciplinary mechanism in place to ensure that its members adhere to the highest standards of professional conduct and integrity.

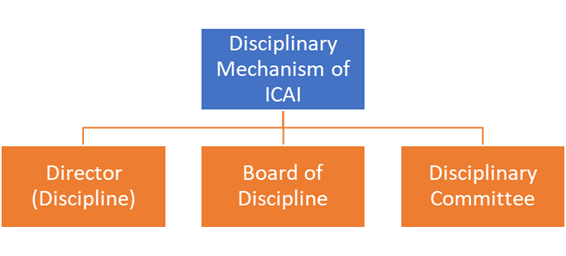

DISCIPLINARY MECHANISM OF ICAI

As the premier accounting body, the ICAI has delivered to the world high class CA professionals apart from setting bench- marks in the quality of financial reporting not only in India but across the Globe.

ICAI not only performs its statutory duties as a regulator of the profession of Chartered Accountancy in India by formulating Accounting Standards in keeping pace with changing economic-scenario but also has enforced the ethical values as enshrined in Code of Ethics and proactively taken action against its erring members, found guilty of professional misconduct through its well-defined disciplinary mechanism as provided under the Chartered Accountants Act, 1949 and the Rules framed thereunder.

DISCIPLINARY MECHANISM OF ICAI HAS THE FOLLOWING THREE LIMBS:

Director (Discipline): Director (Discipline) is appointed under Section 21 (read with Section 16) of the Chartered Accountants Act, 1949 as head of the Disciplinary Directorate to investigate any complaint and to arrive at a prima facie opinion on the occurrence of the alleged misconduct

Board of Discipline: Board of Discipline has been constituted under Section 21A of the Chartered Accountants Act, 1949 to deal with the cases wherein either the member has been held prima facie Not Guilty or where the member has been held prima facie Guilty of Professional and/or Other Misconduct falling within the meaning of any of the items specified under the First Schedule.

Disciplinary Committee: Disciplinary Committee has been constituted under Section 21B of the Chartered Accountants Act, 1949 to deal with the cases wherein the member has been held prima facie Guilty of the Professional and/or Other Misconduct falling within the meaning of any of the items specified either under the Second Schedule or both the Schedules of the Chartered Accountants Act, 1949.

The detailed procedures to be adopted by all the above three limbs of the Disciplinary Mechanism of ICAI in carrying out its functions have been prescribed in the Chartered Accountants (Procedure of Investigations of Professional and Other Misconduct and Conduct of Cases) Rules, 2007 notified by the Central Government in terms of the provisions of Section 21(4) of the Chartered Accountants Act, 1949

RECENT UPDATES

The ICAI has recently revised its Code of Ethics. The 12th edition of the Code of Ethics came into effect from 1st July, 2020. However, due to the prevailing situation due to Covid-19, certain provisions of Volume-I of Code of Ethics, 2020 were deferred till further notification. These deferred provisions come into force w.e.f 1st April, 2022.

THE ROLE OF ICAI IN PROMOTING ETHICAL CONDUCT

In order to update its members regarding Professional Ethics, ICAI has come up with a compilation of case law referencer which brings out clearly the Disciplinary cases that a member in practise and service should keep in mind while performing their duties

The Case Laws Referencer which will be Code of Ethics (Volume-III) along with the revised Volumes I and II will act as complete set of guidance on Professional Ethics for the Members.

The Volume III of the recent Code of Ethics published by ICAI has given exhaustive real life case laws which can be referred to by members of ICAI pertaining to both the scheules of Code of Ethics

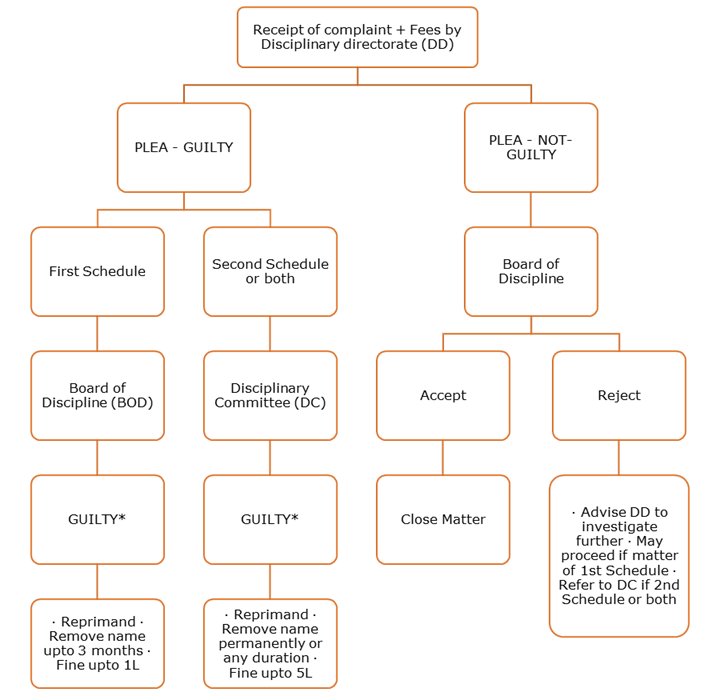

FLOW CHART OF DISCIPLINARY PROCEEDINGS

*If not found guilty → Matter closed

Recent Case Studies:

Recent cases can be referred to by a member at https://disc.icai.org/disciplinary-mechanism/

One such recent case has been produced below for your reference

Allegations of Misconduct Against a Chartered Accountant

Key Allegations:

- The CA allegedly convinced the client and his relatives to invest based on false and fabricated assurances.

- After six months, the promised returns were not provided, and only Rs. 15 lakh was returned to the client.

- The CA allegedly tried to silence the client through threats and intimidation.

Key Players:

- Mr. Sharma and relatives: Complainants alleging financial deception and professional misconduct by the CA.

- Respondent CA: Denies all allegations and argues the accusations stem from personal animosity.

- Disciplinary Committee: Responsible for investigating and adjudicating the complaint against the CA.

Timeline of Events:

- December 2005: Alleged investment in Builders & Promoters Pvt. Ltd. facilitated by the CA.

- June 2006: Six months pass with only Rs. 15 lakh returned, prompting Mr. Sharma’s inquiries and concerns.

- November 2006: Mr. Sharma starts recording conversations with the CA, capturing alleged admissions of deceit.

- December 2014: Formal complaint filed against the CA with the Institute of Chartered Accountants of India (ICAI).

- March 2015: Preliminary Investigation Report (PFO) released by the ICAI’s Director (Discipline), outlining possible grounds for disciplinary action.

- August 2015: Hearing held before the Disciplinary Committee to hear arguments from both parties.

- March 2016: Disciplinary Committee issues its final order on the complaint.

Opening Statements:

- Complainant (Mr. Sharma):

- Reiterated the allegations of misrepresentation, financial deception, and professional misconduct by the CA.

- Emphasized the recorded conversations as key evidence, highlighting specific moments that allegedly revealed the CA’s deceptive tactics.

- Advocated for the application of a “beyond reasonable doubt” standard of proof.

- Respondent CA:

- Categorically denied all accusations, characterizing the complaint as baseless and motivated by personal animosity.

- Challenged the admissibility of the recordings due to the lack of an authenticity certificate.

- Argued for a “preponderance of probabilities” standard of proof in the Disciplinary Committee proceedings.

- The CA denies all allegations, claiming the complaint is baseless and motivated by personal animosity.

- He refutes any involvement with Builders & Promoters Pvt. Ltd. and denies having knowledge of any fraudulent scheme.

- He argues that the complainant failed to provide concrete evidence, relying on assumptions, invalid recordings, and unreliable witnesses.

- He emphasizes his professional standing and reputation as a CA and expresses confidence in his innocence.

Evidence & Witness Testimony:

- Complainant’s Side:

- Presented the recorded conversations as central evidence, potentially outlining specific excerpts or timestamps deemed crucial.

- Presented witness testimonies from relatives involved in the alleged investment scheme, corroborating Mr. Sharma’s claims.

- Might have presented financial documents related to the investment or communication with Builders & Promoters Pvt. Ltd.

- Respondent’s Side:

- Contested the recordings’ validity and reliability, potentially questioning recording methods or context.

- Presented witness testimonies, if any, from individuals who could support the CA’s version of events or cast doubt on the accusations.

- Might have presented financial documents or evidence related to their professional interactions with Mr. Sharma.

Legal Arguments:

- Standard of Proof: Both sides likely presented arguments supporting their preferred standard of proof (“beyond reasonable doubt” vs. “preponderance of probabilities”) for disciplinary proceedings. The Committee might have discussed relevant legal precedents and guidelines regarding this issue.

- Admissibility of Recordings: The respondent’s challenge to the recordings’ admissibility due to the lack of an authenticity certificate would have been a significant point of contention. Arguments around potential alternative forms of authentication or admissibility based on content might have been raised.

- Interpretation of Evidence: Both sides likely analyzed the presented evidence, including recordings, documents, and testimonies, highlighting aspects that supported their respective narratives. The Committee’s task would have been to weigh the evidence objectively and assess its credibility.

Closing Arguments:

- Complainant: Summarized their case, emphasized the severity of the accusations and potential harm caused, and reiterated their call for disciplinary action against the CA.

- Respondent CA: Reiterated their innocence, emphasized the lack of concrete evidence against them, and appealed to the Committee to dismiss the complaint based on its unsubstantiated nature.

Committee Deliberation:

After both sides concluded their arguments, the Disciplinary Committee would have entered into deliberation to analyze the presented evidence, legal arguments, and the overall case. Their decision would depend on evaluating the credibility of the claims and evidence, applying relevant rules and procedures, and determining whether the accusations had been proven to a sufficient degree.

Possible Outcomes:

- Dismissal of the complaint: If the Committee found insufficient evidence or deemed the allegations unsubstantiated, the complaint could be dismissed.

- Disciplinary action: Depending on the severity of the findings, the CA could face disciplinary action ranging from a warning or reprimand to suspension or expulsion from the ICAI.

- Further investigation: In case of unclear evidence or discrepancies, the Committee might order further investigation or legal proceedings to reach a definitive conclusion.

Learning Points:

- The importance of maintaining ethical and professional standards in the financial industry.

- The need for thorough due diligence before making investments.

- The challenges of providing evidence and proving misconduct in professional disciplinary cases.

- The complexity of legal proceedings and the role of different standards of proof.

CONCLUSION:

The ICAI, through its Code of Ethics and disciplinary mechanism, ensures that its members maintain the highest standards of professional conduct. The recent updates to the Code of Ethics reflect the changing dynamics of the profession and the need for maintaining public trust in the profession.