Cross-border M&A – Overview of income-tax provisions

Background:

In this era of globalization and revolutionary business ideas, it is not uncommon for established businesses as well as budding startups, to expand their presence overseas from India or vice versa. The spread of business operations over multiple jurisdictions may create the need for cross border structuring and arrangements.

Cross border mergers and acquisitions are a means of achieving commercial and/or geographical consolidation or segregation, winding up of presence in a particular jurisdiction and inward or outward fund remittance in a tax efficient and regulatory compliant manner. Cross-border mergers are complex than domestic mergers as they involve compliance of legal and regulatory rules of multiple jurisdictions.

The past decade has witnessed an exceptionally large volume of cross border transactions, some of them were incredible examples, such as:

- Walmart acquired second biggest ecommerce retailer in India i.e., Flipkart. Walmart is registered in the US and Flipkart has operations in India and registered in Singapore, (2018);

- Reliance Retail (an Indian company), as part of its global expansion strategy acquired Hamleys (a UK-based company) to enter the toy retail market, (2019);

- The merger of Vodafone (British Company) and Idea (Indian Company) in order to survive the competitive markets together, (2020);

- Adani Green Energy acquired 100% interest in SB Energy India from SoftBank Group Corp (80%) and Bharti Group (20%), (2021), etc.

With and intent of enabling the ease of doing business and maneuvering operations from one jurisdiction to another, India has over a period of time eased the procedural and legal barriers with regard to cross border structuring, over a period of time.

The Indian tax and regulatory framework allows for carrying out of cross border M&A transactions within the scope of the following regulations:

- Companies Act, 2013 and Companies Rules;

- FEMA Cross Border Regulations, 2018;

- Income-tax Act, 1961 (“IT Act”)

The current articles seeks to focus on the Indian income-tax aspects[1], added up by the key nuances/ issues, structuring options and income-tax implications surrounding the same.

- Key income-tax provisions[2] applicable to cross border M&A transactions:

- Merger:

As per section 2(IB) of the IT Act, merger qualifies as an ‘amalgamation’ based on satisfaction of the following conditions:

- All properties and liabilities of the transferor company[3] / amalgamating company to become all the properties and liabilities of the transferee[4] company / amalgamated company; and

- Shareholders holding 75% or more (in value) of the shares in the transferor company become shareholders of the transferee company by virtue of the amalgamation (Shares in the transferor company already held by the transferee company or its nominee or subsidiary are not considered in calculating the aforesaid limit of 75% in value).

Subject to fulfillment of certain additional conditions, such an amalgamation may be regarded as ‘tax-neutral’ and exempt from capital gains tax as discussed in the ensuing paragraph below.

- In the context of an amalgamation, Section 47 of the IT Act specifically exempts the following transfers from capital gains tax:

| # | Tax neutrality (Pursuant to a scheme of amalgamation) | Key conditions/ aspects for availing such capital gains exemption | |

| In the hands of: | For: | ||

| (i) | Transferor Company [section 47(vi)] | Transfer of capital assets to the transferee company | Such transferee company is an ‘Indian Company’ |

| (ii) | Shareholders of the transferor company [section 47(vii)] | Transfer of shares held in transferor company | Such transfer is made against the consideration of transferee company’s shares i.e., shares have been allotted by the transferee company (except where the shareholder itself is the amalgamated company); and transferee company is an ‘Indian Company’ |

| (iii) | Amalgamating foreign company [section 47(via)] | Transfer of ‘shares held in an Indian company’, to the amalgamated foreign company | At least 25% of the shareholders of the amalgamating foreign company continue to remain shareholders of the amalgamated foreign company. Such transfer does not attract capital gains tax in the amalgamating company’s country of incorporation. |

| (iv) | Amalgamating foreign company [section 47(viab)] | Transfer of ‘shares held in a foreign company deriving substantial value from India’, to the amalgamated foreign company | [same conditions as per point (iii) above] |

- Additional considerations for the shareholders:

- The Honorable Supreme Court of India has held[5] that a transfer of shares of the amalgamating company constitutes an “extinguishment of rights” in capital asset and hence falls within the definition of ‘transfer’ under Section 2(47) of the IT Act; but has been specifically exempted from capital gains tax in the hands of the shareholders by virtue of section 47(vii). Consequently, if conditions w.r.t tax neutrality provided under Section 47(vii) [as per point (ii) in paragraph A above] are not met, one would have to evaluate based on first principles.

- Pursuant to the exemption for the shareholders u/s 47(vii) of the IT Act:

- The cost of acquisition[6] and the period of holding[7] of the shares of the transferor company – travels to the shareholders with respect to the new shares received from the transferee company;

- Receipt of the shares of the transferee company – exempt from section 56(2)(x)[8]

- Unlike a case of an amalgamation where the transferee company is an Indian Company and exemption to the shareholders is available u/s 47(vii) of the IT Act; there is no exemption for the shareholders of the amalgamating foreign company, in case of amalgamation with another foreign company. Hence, even though tax neutrality is accorded to the transferor foreign company under sections 47(via) and 47(viab); one will have to evaluate (based on first principles) whether such merger could attract capital gains tax for the ‘shareholders of the amalgamating foreign company’.

- Demerger:

Upon satisfaction of certain prescribed conditions, a demerger should qualify as a ‘Demerger’ within the meaning of section 2(19AA) for income-tax purposes. One of the key conditions with respect to issuance of shares is as under:

- In consideration of the demerger, the resulting company must issue its shares to the shareholders of the demerged company on a proportionate basis (except where the resulting company itself is a shareholder of the demerged company);

- Shareholders holding at least 75% (in value) of shares in the demerged company become shareholders of the resulting company by virtue of the demerger. (Shares in the demerged company already held by the resulting company or its nominee or subsidiary are not considered in calculating the aforesaid limit of 75% in value).

Subject to fulfilment of certain additional conditions, such a demerger may be regarded as ‘tax-neutral’ and exempt from capital gains tax as discussed in the ensuing paragraph below.

- In the context of a demerger, section 47 of the IT Act specifically exempts the following transfers from capital gains tax:

| # | Tax neutrality (pursuant to a scheme of demerger) | Key conditions/ aspects for availing such capital gains exemption | |

| In the hands of: | For: | ||

| (i) | Demerged company [section 47(vib)] | Transfer of capital assets to the Resulting company | Such Resulting company is an ‘Indian Company’ |

| (ii) | Demerged foreign company [section 47(vic)] | Transfer of ‘shares held in an Indian company’, to the resulting foreign company | Shareholders holding at least 75% in value of the shares of the demerged foreign company continue to remain shareholders of the resulting foreign company; and Such transfer does not attract capital gains tax in the country of incorporation of the demerged foreign Company |

| (ii) | Demerged foreign company [section 47(vicc)] | Transfer of ‘shares held in a foreign company deriving substantial value from the shares in India’, to the resulting foreign company | [same conditions as per point (iii) above] |

- Additional considerations for the shareholders:

- Section 47(vid) of the IT Act provides that – “any transfer or issue of shares by the resulting company, in a scheme of demerger to the shareholders of the demerged company if the transfer or issue is made in consideration of demerger of the undertaking”.

Basis the language of the above provision, one may realize that (unlike amalgamation), there is no specific exemption accorded to the shareholders of the demerged company. Hence, one will have to analyze (based on first principles) whether there is any actual ‘transfer’ in the hands of such shareholders, since such shareholders continue to remain the shareholders of the demerged company as well.

- Despite of the above, the following is provided for the shareholders of the demerged company:

- The period of holding of the shares of the resulting company – inclusive of the period for which shares of the demerged company had been held[9];

- The formula for the cost of acquisition of the shares in the resulting company –

cost of acquisition of demerged company’s shares * net book value of the assets transferred in a demerger / net worth of the demerged company immediately before such demerger[10].

- The cost of acquisition of the original shares held by the shareholder in the demerged company – deemed to have been reduced by the amount so arrived above[11].

- Other Modes of cross-border restructuring typically involve:-

- Overseas Acquisition by an Indian Company, by way of:

- Primary or secondary acquisition of shares of a Foreign Company; or

- acquisition or expansion of business in an overseas jurisdiction;

- Foreign Investment into India, by way of:

- Primary or secondary acquisition of shares of an Indian Company; or

- Acquisition or expansion of business in India

<<this space has been intentionally left blank>>

- Basics structures of cross border M&A along with their income-tax implications:

Note: We have not commented or evaluated on the feasibility of such structures from a legal, regulatory and corporate laws standpoint.

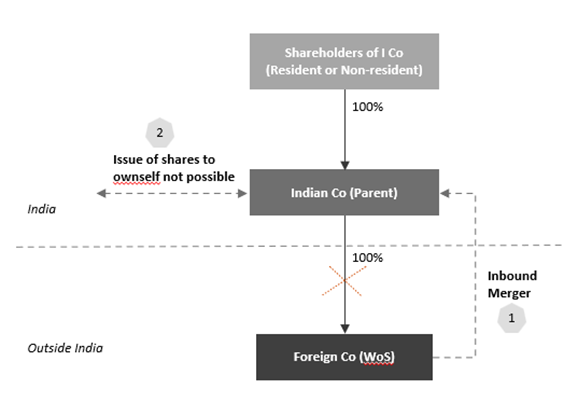

- Inbound merger of a Foreign wholly-owned subsidiary (‘WoS’) into an Indian Parent Company

Such types of mergers are usually done to transfer the control of the foreign business in India, under the Indian Holding/Parent Company.

Key Construct:

- Foreign Co (transferor company or ‘F Co’) to merge into Indian Co (transferee company or ‘I Co’);

- As a consideration for such merger, issuance of shares by the transferee company (I Co) to the shareholders of the transferor company (i.e., I Co itself) – I Co thus cannot issue shares to own self.

Income-tax implications on the above:

| In the hands of: | Income-tax implications |

| Transferor (F Co) | The said merger qualifies as an ‘amalgamation’ for income-tax purposes since the transferee is an Indian Company – exemption u/s 47(vi) available. |

| Shareholders of F Co (i.e., I Co itself) | Exemption u/s 47(vii) available, as:- the condition of issuance of shares by transferee company in consideration to the shareholders, need not be fulfilled where such shareholders and transferee company is the same; andtransferee Co is an Indian Company |

| Transferee (I Co) | In a domestic merger (where both transferor and transferee are Indian companies), brought forward losses or WDV or unabsorbed depreciation (‘UAD’)or accumulated profits – typically travel to the transferee company. However, it would be interesting to evaluate whether such losses or WDV or UAD or accumulated profits of the foreign transferor company should be allowed for carry-forward to the Indian transferee company. Some points for consideration are: The brought-forward losses or WDV or UAD or accumulated profits of the foreign company may have not been ‘assessed to tax’ in India; and Moreover, the mode of computation of such losses or WDV or UAD may not be as per the Indian tax laws. Hence, one will have to analyze that had the said amalgamation not taken place, then whether such accumulated loss or UAD would have been allowed[12] to the foreign company |

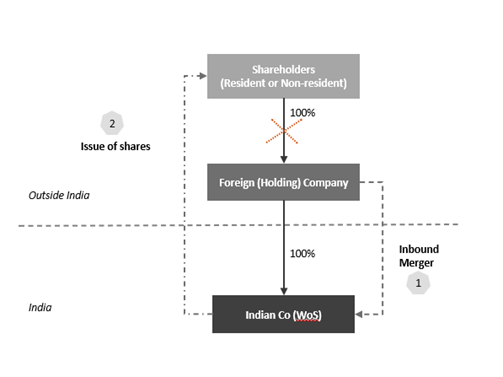

Inbound merger of a Foreign Holding Company into an Indian WoS

Such mergers are usually done to eliminate the intermediary Holding Company overseas, such that the shareholders directly hold shares in India and control the Indian Company’s business.

Key Construct:

- Foreign Holding Co (transferor company or ‘FHC’) to merge into Indian subsidiary (transferee company or ‘I Co’);

- As a consideration for such merger, issuance of shares by the I Co to the shareholders of FHC.

Income-tax implications on the above:

| In the hands of: | Income-tax implications |

| Transferor (FHC), Transferee (I Co) | (same as 3.1 above) |

| Shareholders of FHC | Exemption as per section 47(vii) may be available, as:- The condition of issuance of shares by transferee company in consideration of the merger, stands fulfilled; andTransferee Co is an Indian Company |

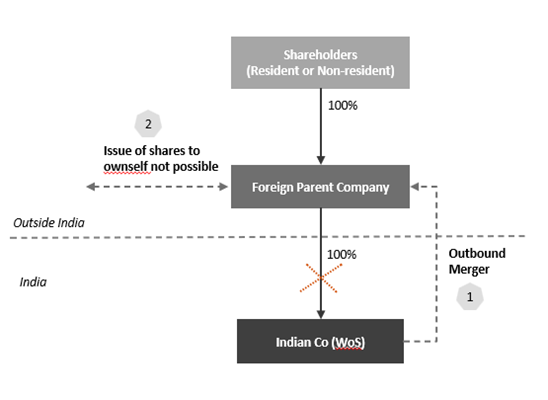

Outbound merger of an Indian wholly-owned subsidiary (‘WoS’) into Foreign Parent Company

Such types of mergers are usually done to shift the Indian operations overseas and to transfer the control of the Indian business under the Foreign Parent Company/Shareholders level.

Key Construct:

- Indian WoS (transferor company or ‘I Co’) to merge into its Foreign Parent (transferee company or ‘F Co’);

- As a consideration for such merger, issuance of shares by the transferee company (F Co) to the shareholders of the transferor company (i.e., F Co itself) – F Co thus cannot issue shares to own self.

Income-tax implications on the above:

| In the hands of: | Income-tax implications |

| Transferor (I Co) | No tax neutrality has been provided u/s 47(vi), since the transferee Co is not an Indian Company. Hence, one may have to evaluate (based on first principles) that whether the capital gains arising on the transfer of assets pursuant to the merger, may be taxable in the hands of I Co; based on the following arguments: Whether any ‘consideration’ has been actually received by I Co? Typically, in a merger; it is the shareholders who receive ‘consideration’ in the form of ‘shares of transferee Company’. The Transferor Company ceases to be in existence and receives no consideration on the assets transferred by it. Accordingly, one may explore the view that, in the absence of ‘any consideration’ received by I Co, a ‘charge’ u/s 45 may not be created. Hence, one may further explore the argument that; where a case is outside the ambit of the charging section 45, then section 50CA or any other provision of the ‘capital gains’ chapter, may also not be held as applicable. |

| F Co (as Shareholders of I Co) | No tax neutrality has been provided u/s 47(vii), since the transferee Co is not an Indian Company. Hence, one may have to evaluate (based on first principles) that whether the capital gains arising on the transfer of ‘shares held in I Co’, may be taxable in the hands of the shareholders of I Co., based on the following: One would need to analyze that there has been ‘mere cancellation of I Co’ shares, without any ‘receipt’ of fresh shares by F Co. Hence, without any ‘consideration’, it may be argued that there is no charge u/s 45 (similar argument as above). However, it may be possible that the tax authorities allege that consideration for F Co. is actually present in the form of ’business received by it from I Co.’ Interestingly, one may also defend the said allegation based on the following arguments: The ‘business’ received by F Co, is nothing but the ‘vesting of such business due to amalgamation’ i.e., it is only due to the amalgamation, that such business has been vested onto F Co. Hence, one may argue that the ‘acquisition of business by discharging a consideration’ is different than ‘vesting of such business only pursuant to an amalgamation’. Further, it cannot be denied that in the present facts; F Co is playing a dual role of ‘transferee company’ as well as the ‘shareholder of transferor company’. Accordingly, when F Co is under the shoes of the shareholder, it seems that the only consideration could have been in the form of ‘fresh shares received from the transferee company’. Consequently, from a shareholder’s perspective, such consideration may be said to be ‘absent’ for F Co. Accordingly, one may further proceed on the argument that – in the absence of ‘consideration’ where a case is outside the ambit of the charging section 45, then section 50CA or any other provision of the ‘capital gains’ chapter, may also not be held as applicable. |

The above positions in case of taxability (i.e., the absence of tax neutrality) in an outbound merger scenario, has been untested and hence the ambiguity prevails in various aspects.

[1] The structuring scenarios, and issues provided herewith are strictly from an income-tax perspective, and do not cover any implications with respect to other Indian legal and regulatory aspects (such as Corporate laws or FEMA, etc.) or with respect to overseas laws

[2] In this article, wherever implications in the hands of Foreign Company are mentioned, we have not commented on the implications as per the IT Act and not as per the DTAA/treaty. One can evaluate the treaty implications or the treaty benefits available to foreign company, on a case to case basis.

[3] the terms ‘transferor company’ and ‘amalgamating company’ have been used interchangeably

[4] the terms ‘transferee company’ and ‘amalgamated company’ have been used interchangeably

[5] In the case of Grace Collis, CIT v. Grace Collis [2001] 248 ITR 323 (SC).

[6] As per section 49(2) of the IT Act

[7] As per Explanation 1(c) to section 2(42A) of the IT Act

[8] As per the provio (IX) to section 56(2)(x) of the IT Act

[9] As per Explanation 1(g) to section 2(42A) of the IT Act

[10] As per section 49(2C) of the IT Act

[11] As per section 49(2D) of the IT Act

[12] For the purposes of section 72A of the IT Act, an extract of the definitions of the meaning provided for ‘accumulated loss’ and ‘unabsorbed depreciation’ is as under:

- “accumulated loss” means so much of the loss of the amalgamating company under the head “Profits and gains of business or profession” (not being a loss sustained in a speculation business) which such amalgamating company would have been entitled to carry forward and set off under the provisions of section 72 if the amalgamation had not taken place;

- “unabsorbed depreciation” means so much of the allowance for depreciation of the amalgamating company, which remains to be allowed and which would have been allowed to the amalgamating company under the provisions of this Act, if the amalgamation had not taken place