Concept of Related Party Transactions Under Companies Act Including SEBI Regulations

This article primarily intended to highlight the Compliance requirements of Related Party Transactions covered under the Companies Act,2013 (the Act) and SEBI (Listing Obligations And Disclosure Requirements) Regulations,2015 [SEBI (LODR), 2015].

- Definition of Related Party :-

The term related party as per Companies Act, 2013 /SEBI (LODR) Regulation, 2015

| Sr. No. | Companies Act | SEBI (LODR) Regulation, 2015 |

| 1 | Section 2(76) “related party”, with reference to a company, means— (i) a director or his relative; (ii) a key managerial personnel or his relative; (iii) a firm, in which a director, manager or his relative is a partner; (iv) a private company in which a director or manager or his relative is a member or director; (v) a public company in which a director or manager and holds along with his relatives, more than 2% of its paid-up share capital; (vi) any body corporate whose Board of Directors, managing director or manager is accustomed to act in accordance with the advice, directions or instructions of a director or manager; (vii) any person on whose advice, directions or instructions a director or manager is accustomed to act: Provided that nothing in sub-clauses (vi) and (vii) shall apply to the advice, directions or instructions given in a professional capacity; (viii) any company which is— (A) a holding, subsidiary or an associate company of such company; or (B) a subsidiary of a holding company to which it is also a subsidiary; (C) an investing company or the venturer of the company;”; “the investing company or the venturer of a company” means a body corporate whose investment in the company would result in the company becoming an associate company of the body corporate. (ix) such other person as may be prescribed (a director other than an independent director or key managerial personnel of the holding company or his relative with reference to a company, shall be deemed to be a related party) The term Relative means 2 (77) “relative’’, with reference to any person, means anyone who is related to another, if— (i) they are members of a Hindu Undivided Family; (ii) they are husband and wife; or (iii) one person is related to the other in such manner as may be prescribed. 2 (55) “member”, in relation to a company, means— (i) the subscriber to the memorandum of the company who shall be deemed to have agreed to become member of the company, and on its registration, shall be entered as member in its register of members; (ii) every other person who agrees in writing to become a member of the company and whose name is entered in the register of members of the company; (iii) every person holding shares of the company and whose name is entered as a beneficial owner in the records of a depository; “Person” shall be deemed to be the relative of another, if he or she is related to another in the following manner, namely:- (1) Father includes “Step-Father” (2) Mother includes the “Step-Mother” (3) Son includes the “Step-Son” (4) Son’s wife (5) Daughter (6) Daughter’s Husband (7) Brother includes the “Step-Brother” (8) Sister includes the “Step-Sister” | Regulation 2(zb) “related party” means a related party as defined under sub-section (76) of section 2 of the Companies Act, 2013 or under the applicable accounting standards: Provided that: (a) any person or entity forming a part of the promoter or promoter group of the listed entity; or (b) any person or any entity, holding equity shares: (i) of 20% or more; or (ii) of 10% or more, in the listed entity either directly or on a beneficial interest basis as provided under section 89 of the Companies Act, 2013, at any time, during the immediate preceding financial year; shall be deemed to be a related party: Provided further that this definition shall not be applicable for the units issued by mutual funds which are listed on a recognised stock exchange(s); |

- Concept of Related Party Transactions:-

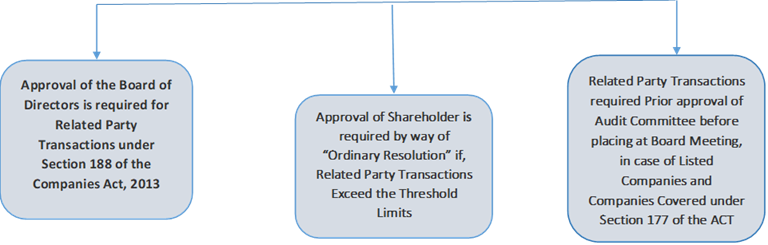

No Company shall enter into any related party transaction unless the approval of Board /Audit Committee /Shareholder, as the case may be, is obtained before entering into related party transactions as per the provisions of Section 188 of Companies Act,2013 and SEBI (LODR),2015.

| Related Party Transactions As per Section 188 of Companies Act,2013 | Threshold Limits As per Section 188 of Companies Act,2013 | Related Party Transactions As per SEBI (LODR),2015 |

| (a) sale, purchase or supply of any goods or materials; | Amounting to 10% or more of the Turnover of the Company | 2 (zc) “related party transaction” $ means a transaction involving a transfer of resources, services or obligations between: (i) a listed entity or any of its subsidiaries on one hand and a related party of the listed entity or any of its subsidiaries on the other hand; or (ii) a listed entity or any of its subsidiaries on one hand, and any other person or entity on the other hand, the purpose and effect of which is to benefit a related party of the listed entity or any of its subsidiaries, regardless of whether a price is charged and a “transaction” with a related party shall be construed to include a single transaction or a group of transactions in a contract: Provided that the following shall not be a related party transaction: (a) the issue of specified securities on a preferential basis, subject to compliance of the requirements under the SEBI (ICDR) Regulations, 2018; (b) the following corporate actions by the listed entity which are uniformly applicable/offered to all shareholders in proportion to their shareholding: i. payment of dividend; ii. subdivision or consolidation of securities; iii. issuance of securities by way of a rights issue or a bonus issue; and iv. buy-back of securities. (c) acceptance of fixed deposits by banks/Non-Banking Finance Companies at the terms uniformly applicable/offered to all shareholders/public, subject to disclosure of the same along with the disclosure of related party transactions every six months to the stock exchange(s), in the format as specified by the Board: Provided further that this definition shall not be applicable for the units issued by mutual funds which are listed on a recognised stock exchange(s); |

| (b) selling or otherwise disposing of, or buying, property of any kind; | Amounting to 10% more of Net Worth of the Company | |

| (c) leasing of property of any kind; | Amounting to 10% or more of the Turnover of the Company | |

| (d) availing or rendering of any services; | Amounting to 10% or more of the Turnover of the Company | |

| (e) appointment of any agent for purchase or sale of goods, materials, services or property; | ||

| (f) such related party‘s appointment to any office or place of profit in the company, its subsidiary company or associate company; and | Monthly Remuneration exceeding Rs.2,50,000/- | |

| (g) underwriting the subscription of any securities or derivatives thereof, of the company: | Exceeding 1% of the Net Worth | |

| Explanation.- It is hereby clarified that the limits specified in sub-clause (a) to (e) shall apply for transaction or transactions to be entered into either individually or taken together with the previous transactions during a financial year.The turnover or net worth referred in the above sub-rules shall be computed on the basis of the audited financial statement of the preceding financial year.In case of wholly owned subsidiary, the resolution is passed by the holding company shall be sufficient for the purpose of entering into the transaction between the wholly owned subsidiary and the holding company. | ||

- Responsibility of Board of Directors and Audit Committee

- Timely Identifying Related Party, Nature of Related Party Transactions, Volume, Duration along with justification, etc.

- Preparation of Policy for the Related Party Transactions.

- To check that No related party transaction shall be entered by the company without prior approval of the Board of Directors/Audit Committee as the case may be.

- Where any contract or arrangement is entered into by a director or any other employee, without obtaining the consent of the Board or approval by a resolution in the general meeting it should be ratified by the Board or by the shareholders as the case may be.

- Board /Audit Committee should check that Interested Director should not participate and vote during Agenda of Related Party Transaction.

- To disclose all Related Party Transaction in the Financial Statement of the Company.

- To Identify material Transactions along with ongoing current transactions and take approval of Shareholders.

- To Keep Record all the Related party transactions including “Arm Length Transactions” and to do timely disclosures.

COMPLIANCE TO BE CARRIED OUT BY COMPANY FOR RPT

Restrictions / Exceptions /Exemptions /Related Party Transactions in ordinary course of business on an arm’s length basis

| Related Party Transactions with Restrictions / Exceptions /Exemptions | Restrictions / Exceptions /Exemptions of Related Party Transactions |

| No member of the company shall vote on such resolution, to approve any contract or arrangement which may be entered into by the company, if such member is a related party | Provided also that nothing contained in the second proviso shall apply to a company in which 90% or more members, in number, are relatives of promoters or are related parties |

| Provided also that nothing in this sub-section shall apply to any transactions entered into by the company in its ordinary course of business other than transactions which are not on an arm’s length basis | Transactions entered into by the Companies in Ordinary Course of Business and on an arm’s length basis will not required to take approval. “Arm’s Length Transaction” means a transaction between two related parties that is conducted as if they were unrelated, so that there is no conflict of interest |

| Provided that no contract or arrangement, in the case of a company having a paid-up share capital of not less than such amount, or transactions exceeding such sums^, as may be prescribed, shall be entered into except with the prior approval of the company by a resolution ^ As per the Threshold hold limits | Requirement of passing the resolution under first proviso shall not be applicable for transactions entered into between a holding company and its wholly owned subsidiary whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval. |

| Audit Committee may make omnibus approval for related party transactions proposed to be entered into by the company subject to such conditions Omnibus approvals shall be valid for a period not exceeding 1 year and shall require fresh approvals after the expiry of one year: Applicability to Constitute Audit Committee:- Every Listed Public CompanyThe Public Companies having paid up share capital of Rs. 10 crore or more; orThe Public Companies having turnover of Rs. 100 crore or more; orThe Public Companies which have, in aggregate, outstanding loans, debentures and deposits, exceeding Rs. 50 crore | All related party transactions shall require approval of the Audit Committee and the Audit Committee may make omnibus approval for related party transactions proposed to be entered into by the company subject to the following conditions, namely (1) The Audit Committee shall, after obtaining approval of the Board of Directors, specify the criteria for making the omnibus approval which shall include the following, namely:- (a) maximum value of the transactions, in aggregate, which can be allowed under the omnibus route in a year; (b) the maximum value per transaction which can be allowed; (c) extent and manner of disclosures to be made to the Audit Committee at the time of seeking omnibus approval; (d) review, at such intervals as the Audit Committee may deem fit, related party transaction entered into by the company pursuant to each of the omnibus approval made; (e) transactions which cannot be subject to the omnibus approval by the Audit Committee. Omnibus approval shall be valid for a period not exceeding 1 Financial Year and shall require fresh approval after the expiry of such financial year. Omnibus approval shall not be made for transactions in respect of selling or disposing of the undertaking of the company. |

Preparation /Intimation /Approval /Filing of Related Party Transaction with ROC, Stock Exchange, etc.

- Every contract or arrangement entered shall be referred to in the Board’s report to the shareholders along with the justification for entering into such contract or arrangement in Form AOC-2. (Annexure 1)

- Listed entity shall make such disclosures every 6 months within 15 days from the date of publication of its standalone and consolidated financial results Disclosure Of Related Party Transactions as per Regulation 23(9) SEBI (LODR) Regulations, 2015, (Annexure 2)

- Preparation Register in Form MBP-4 [Register of contracts with related party and contracts and Bodies etc. in which directors are interested] (Annexure 3)

5. Applicability of Section 185 & 186 Companies Act, 2013 with respect to Related Party Transactions.

Section 185 of Companies Act, 2013, provide reference with respect to Loan to Directors, /Guarantee/Security.

- Restrictions on giving Loan/Guarantee/Security by Company to following persons:-

- Any Director of Company ; or

- Any Director of Company which is its Holding Company; or

- Any Partner of Directors of Lending Company; or

- Any relative of Directors of Lending Company or

- Any Firm in which any of Directors of Lending Company is Director; or

- Any Firm in which any Relative of Director of Lending Company is Director

- Giving Loan/Guarantee/Security by Company to following Persons Allowed /Not Allowed based on Passing of Special Resolution*:-

| Not Allowed, if fails to pass Special Resolution:- | Allowed, if pass Special Resolution:- |

| Any Private Company of Which any such Director is a Director or Member; | Any Private Company of Which any such Director is a Director or Member; |

| Body Corporate in which 25% or more voting power rest with one or more directors | Body Corporate in which 25% or more voting power rest with one or more directors |

| Body Corporate whose Board accustomed to act on directions of Board of Directors of Lending Company | Body Corporate whose Board accustomed to act on directions of Board of Directors of Lending Company |

- Exemption /Exceptions /Conditions by which Company can give Loan/Guarantee/Security

| Conditions | Exemption /Exceptions |

| The giving of any loan to a managing or whole-time director | A Company Can give loan to MD / Whole Time Directors as a part of the conditions of service extended by the company to all its employees; orpursuant to any scheme approved by the members by a special resolution |

| A Company can give Loan/Guarantee/Security in ordinary Course of Business | In the ordinary course of its business to provides loans or gives guarantees or securities for the due repayment of any loan and in respect of such loans an interest is charged at a rate not less than the rate of prevailing yield of 1 year, 3 years, 5 years or 10 years Government security closest to the tenor of the loan For Eg:- The main business of Banks/NBFC are to give loans to the Companies against security/Guarantee of company by charging Interest on Loan, such activities are considered as in ordinary course |

| A Special resolution is passed by the Company in General Meeting The loans are utilised by the borrowing company for its “Principal Business Activities” | A Company Can give Loan/Guarantee/Security by Special Resolutions and conditions mentioned in above* The Word “Principal Business Activities” generally means funds utilized in main business but as per RBI, principal business Activities means when a company’s financial assets constitute more than 50 per cent of the total assets and income from financial assets constitute more than 50 per cent of the gross income. |

| Any loan made by a holding company to its wholly owned subsidiary company or any guarantee given or security provided by a holding company in respect of any loan made to its wholly owned subsidiary company; or | A Holding Company can give Loan/Guarantee/Security to its Wholly Owned Subsidiaries |

| Any guarantee given or security provided by a holding company in respect of loan made by any bank or financial institution to its subsidiary company: | A Holding Company can only give Guarantee or Security to its Subsidiaries companies, but cannot give Loans |

Section 186 of Companies Act, 2013, provide reference with respect to Loan and Investments by Companies.

A Company Loan/Guarantee/Security/investments to Company, Any person, Body Corporate or make any investments subject to Conditions

| If Loan/Guarantee/Security/investments is made by company not exceeding, 60% of its paid-up share capital, free reserves and securities premium account or 100% of its free reserves and securities premium account | Only by way of Passing Board Resolutions |

| If Loan/Guarantee/Security/investments is made by company exceeding, 60% of its paid-up share capital, free reserves and securities premium account or 100% of its free reserves and securities premium account, whichever is more. | Only by way of Passing Special Resolution in General Meeting |

Section 186( Except Section 186(1) shall not apply to

- Loan/Guarantee/Security/investments made by

- banking Company, or

- an Insurance Company, or

- housing Finance Company in ordinary course of its business, or

- industrial or Infrastructural Finance Company

- To any investment

- made by an Investment Company#;

- made in shares allotted pursuant sections 62(1)(a) i.e. Right Issues of shares;

- made, in respect of Investment or lending activities by NBFC and whose principal business is the acquisition of securities

# The expression “Investment Company” means a company whose principal business is the acquisition of shares, debentures or other securities; and a company will be deemed to be principally engaged in the business of acquisition of shares, debentures or other securities, if its assets in the form of investment in shares, debentures or other securities constitute not less than 50% of its total assets, or if its income derived from investment business constitutes not less than 50% as a proportion of its gross income.

6. Practical Difficulties while complying the regulatory requirements

- Related party transactions can present a conflict of interest and may not be consistent with the best interests of the company and its shareholders.

- In Small Companies due to lack of knowledge /understanding of Board /Audit Committee of Company they may find difficult to identify related party relationships and transactions.

- The Relate Party Transactions are Complex in nature and therefor there may be difference of opinion between Board of Directors /Audit Committee while identifying the Related Party Transactions and Nature.

- During course of Audit, it may not be particularly feasible for auditor to identify related-party transactions.

7. Consequences on the failure to comply with Related Party Transactions /Disclosures

As per Section 188 (3)

Where any contract or arrangement is entered into by a director or any other employee, without obtaining the consent of the Board or approval by a resolution in the general meeting under sub-section (1) and if it is not ratified by the Board or, as the case may be, by the shareholders at a meeting within 3 months from the date on which such contract or arrangement was entered into, such contract or arrangement shall be voidable at the option of the Board or, as the case may be, of the shareholders and if the contract or arrangement is with a related party to any director, or is authorised by any other director, the Directors concerned shall indemnify the company against any loss incurred by it.

As per Section 188 (4)

Without prejudice to anything contained in sub-section (3), it shall be open to the company to proceed against a director or any other employee who had entered into such contract or arrangement in contravention of the provisions of this section for recovery of any loss sustained by it as a result of such contract or arrangement.

As per Section 188 (5)

If, Any director or any other employee of a company, who had entered into or authorised the contract or arrangement in violation of the provisions of this section shall be liable,

- in case of listed company a penalty of Rs.25,00,000/-

And

(ii) in case of any other company penalty of Rs.5,00,000/-

8. Regulatory requirements relating to RPT with respect to SEBI (LODR) 2015, RBI (NBFC & Bank), IRDAI, etc.

The SEBI has issued Listing Obligations and Disclosure Requirements (LODR) for the companies listed on a recognised Stock Exchange In India. Regulation 23 specifically deals with the compliance and disclosure requirements in relation to the Related Part Transactions. The Meaning, definition and Related Party Transactions$ as per SEBI LODR are already discussed above.

The listed entity shall formulate a policy on “Materiality of Related Party Transactions” and on dealing with related party transactions including clear threshold limits duly approved by the Board of Directors and such policy shall be reviewed by the board of directors at least once every 3 years and updated accordingly.

Materiality of Related Party Transactions require prior approval of Audit Committee and shareholders:-

| For All RPT considered material | If, individually or taken together with previous transactions during a financial year, exceeds Rs. 1,000/- crore OR 10% of the annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity, whichever is lower |

| Brand Usage or Royalty shall be considered material | If, the transaction(s) to be entered into individually or taken together with previous transactions during a financial year, exceed 5 % percent of the annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity |