COMMON ERRORS IN PREPARATION OF FORM NO. 3CEB

- Introduction to transfer pricing

With the advent of liberalization in 1991, India started to emerge as the new ‘global economic hotspot’ which resulted in globalization and there emerged a need to introduce new requirements relating to taxation and other laws as many multinational corporations began investing in India and local companies started acquiring companies outside India.

The Finance Act, 2001 introduced the Transfer Pricing (TP) regime in India in the form of sections 92 to 92F (w.e.f. 1 April 2002) to cover cross border transactions within its ambit.The transfer pricing provisions enable cross border transactions between two related parties to be undertaken at arm’s length, i.e. as if they were undertaken between two third parties, such that countries of either companies do not lose-out on their fair share of revenue due to influence which exists between two closely held / related enterprises.

Over the last 20 years, Indian TP legislation has seen some drastic changes both on the judicial as well as regulatory front. India introduced various reforms in the last two decades like introduction of Advance Pricing Agreements, Safe Harbour Rules, Other Method prescribed under Rule 10AB as the sixth method, secondary adjustment, etc. The Indian TP Regulations have also evolved over the years to catch up with the international principles on implementation of OECD’s Base Erosion and Profit Shifting (‘BEPS’) recommendations, i.e. introduction of Master File, Country-by-Country Reporting, interest limitation rules, etc.

- Application of transfer pricing provisions

For applying the principles of transfer pricing, one has to undertake a detailed functional and economic analysis, i.e. identifying the functions performed, assets employed and risks assumed (FAR) within the transaction. This is followed by economic characterization of the tested party, post which one selects the most appropriate method for benchmarking the transaction and then determines the arm’s length price of the transaction.

The maintenance of TP documentation capturing the FAR and arm’s length analysis, is one of the key steps in building robust defences to justify the arm’s length mechanism before the Transfer Pricing Officers (TPOs) during TP assessments. It provides a contemporaneous analysis undertaken by the taxpayer for establishing the arm’s length nature of related party transactions.

- Transfer pricing audit – Form No. 3CEB

1. Applicability and contents

As per section 92E of the Income-tax Act, 1961, every person who has entered into an international transaction or specified domestic transaction during a previous year shall obtain a report from an accountant and furnish such report on or before the specified date in the prescribed form duly signed.

The term ‘Accountant’ is defined under section 288 to mean a chartered accountant as per section 2(1)(b) of the Chartered Accountants Act, 1949 who holds a valid certificate of practice. Rule 10E of the Income-tax Rules, 1962 requires to furnish a report in Form No. 3CEB.

Integral parts of Form No. 3CEB:

- Accountant’s report: Certifying true and correct particulars of the transactions captured and accountant’s opinion on information maintained and records examined

- Part A of Annexure to Form No. 3CEB: General information of the taxpayer along with the aggregate value of international transactions and specified domestic transaction

- Part B of Annexure to Form No. 3CEB: Requires the taxpayer to provide the details of the international transactions and specified domestic transactions entered into during the Financial Year. This covers details in a tabular format like name and address of associated enterprise (AE), nature of transaction, most appropriate method adopted, value of transactions, arm’s length price, etc.

2. Who has to file Form No. 3CEB?

Every person who has entered into an international transaction or specified domestic transaction is required to prepare and e-file Form No. 3CEB.

The term ‘every person’ includes foreign companies, permanent establishment of a foreign company, etc. It has been held by the Hon’ble Income-tax Appellate Tribunal (ITAT) in the case of a foreign company1 that the assessee’s claim that it had obtained a report from an Independent Accountant in Form No. 3CEB and filed the same along with the returns is not sufficient. The ITAT observed that the requirement of furnishing Form No. 3CEB in terms of section 92E and the documents to be maintained under section 92D are different. Accordingly, the ITAT concluded that mere submission of Form No. 3CEB with accountant’s report will not be treated as documents submitted under section 92D of the Act.

It can be seen from the above decision that the ITAT has accepted the Form No. 3CEB filed by the foreign company, there by reiterating the interpretation that the filing of Form No. 3CEB includes foreign companies within its purview.

International Transaction refers to the transactions between two or more associated enterprises, where at least one of the parties is a non-resident. Section 92B and Explanation have elaborated the definition of international transaction.

Specified domestic transactions is defined to mean any of the following transactions, not being an international transaction, namely:

- any transaction referred to in section 80A;

- any transfer of goods or services referred to in section 80-IA(8);

- any business transacted between the assessee and other person as per section 80-IA(10);

- any transaction, referred to in any other section under Chapter VI-A or section 10AA, to which provisions of sub-section (8) or sub-section (10) of section 80-IA are applicable; or

- any business transacted between the persons referred to in 115BAB(6)

- any other transaction as may be prescribed(not yet prescribed),

¹Convergys Customer Management Group Inc [TS-690-ITAT-2020(DEL)-TP]

and where the aggregate of such transactions entered by the assessee in the previous year exceeds a sum of twenty crore rupees.

3. What are the thresholds for filing Form No. 3CEB

As per the provisions of section 92 to 92F, there are no thresholds for reporting an international transaction in Form No. 3CEB and hence, any person who has entered into an international transaction, shall file Form No. 3CEB irrespective of the of value of transactions.

Further, the qualification of specified domestic transaction requires the aggregate value of such transactions to exceed twenty crore rupees. Hence, one may interpret that if the threshold of twenty crore rupees is not crossed, then such transactions would not qualify as specified domestic transactions and hence, no reporting is required in Form No. 3CEB.

4. Due date of furnishing Form No. 3CEB

The due date for filing a report pertaining to international and/or specified domestic transactions in Form No. 3CEB is the date2 one month prior to the due date for furnishing the return of income under section 139(1).The original due date for filing Form No. 3CEB for AY 2021-22 was 31st October 2021whereas based on the extension granted by CBDT Circular3, the revised due date is 31st January 2022.

5. Maintenance of transfer pricing documentation

As per section 92D read with Rule 10D(4) the information and documents specified under rule 10D need to be contemporaneous and should exist latest by the specified date i.e. before furnishing Form No. 3CEB electronically. Hence, it is pertinent to carry out a detailed functional analysis, selection of most appropriate method, benchmarking analysis, determination of arm’s length price, before the filing of Form No. 3CEB.

6. Amendment to Form No. 3CEB

With the omission of clause (i) of section 92BA w.e.f. 01.04.2017 by Finance Act, 2017, which included the provisions of section 40A(2) within the purview of specified domestic transactions, a similar amendment was undertaken in the Form No. 3CEB. The erstwhile clause 22 was omitted4 w.e.f. 01-10- 2020 and hence, from AY 2017-18 onwards, there is no requirement to report any transactions entered between parties covered under section 40A(2).

Further, a new clause 24 has been inserted5, which encompasses details of any business transacted between the persons referred to in section 115BAB(6). Hence, from AY 2020-21 onwards, any person claiming beneficial rate of 15% under section 115BAB, should comply with the provisions of section 92E, if the value of transactions exceeds the thresholds given in section 92BA for qualifying as specified domestic transactions.

²Amendment made to the definition of ‘specified date’ w.e.f. 1-4-2020

³CBDT Circular No. 17 of 2021 dated 09 September 2021

⁴Income-tax (Twenty Second Amdt.) Rues, 2020 w.e.f. 01-10-2020

⁵Income-tax (Twenty Second Amdt.) Rues, 2020 w.e.f. 01-10-2020

7. UDIN Requirement

The Professional Development Committee of ICAI implemented an innovative concept of UDIN i.e. Unique Document Identification Number with effect from 1st February, 2019, which requires Chartered Accountants having full-time Certificate of Practice to register on UDIN Portal and generate UDIN before attesting or certifying the documents. Form No. 3CEB is a report which is to be obtained from an accountant and hence, attestation of Form No. 3CEB should contain the UDIN generated from the UDIN portal.

The schema for filing From No. 3CEB from the income-tax portal does not have any specific tab for capturing UDIN, however, as practical measure some professionals include it under the ‘Address’ tab so that the uploaded ‘xml’ of Form No. 3CEB contains the UDIN at the time of filing.

8. Reliance on signed Financial Statements and Statutory Auditors’ Report

In case of a company, the chartered accountant signing Form No. 3CEB may place reliance on the financial statements prepared by the management and the report of the statutory auditor6. The reference to the audited financial statements can be brought out by the Accountant in the Form No. 3CEB – Accountant’s Report.

The Accountant may place reliance on the related party disclosure made by the management in the notes to accounts forming part of the financial statements, however, in addition to the same, the Accountant should undertake independent evaluation as well. Though the definition of AE as per section 92A or rule 10A may not be the same as related parties under Accounting Standard 18, which is reflected in the notes to accounts, but one may draw reference from this disclosure to verify the arithmetic accuracy and nature of transactions.

Since, Form No. 3CEB is a type of an audit report where an accountant provides an opinion, the auditor must obtain a detailed representation7 from the management which may encompass listing of associated enterprises, shareholding structure, transaction listing, data regarding comparable uncontrolled transactions, segmental data, etc. As per ICAI8, one must follow the principles provided in ‘SA 230 – Audit Documentation’.

Penalty on accountants for furnishing incorrect information in reports

The Finance Act 2017 has introduced section 271J for levying penalty of ten thousand rupees on accountants for furnishing incorrect information in reports or certificates furnished under any provisions of the Act or the rules made there under.

9. Penalty for non-filing or delayed filing

Penalty for non-filing:

Penalty of a sum of one hundred thousand rupees under section 271BA may be levied by the AO if any person fails to furnish report as per section 92E, i.e. Form No. 3CEB.

⁶Refer Para 2.30 of the Guidance Note on Report Under Section 92E of the Income-tax Act, 1961 (Transfer Pricing)published by ICAI (Revised 2020) (‘ICAI Guidance Note’)

⁷Refer Para 2.32 of the ICAI Guidance Note

⁸Refer Para 2.26 of the ICAI Guidance Note

The Chandigarh ITAT in the case of Shree Ram Dass Rice & General Mills9 held that no penalty “shall be” imposed if the assessee “proves that there was a reasonable cause for the said failure”. In the instant case, the assessee pleaded ignorance in regard to the said legal requirement and has demonstrated that the said Form was made available in the assessment proceedings to the AO which fact is not disputed by the revenue also. Further, no transfer pricing adjustment was proposed by the TPO. Since, this was the first year of reporting the international transaction, the ITAT has allowed the claim of the assessee being bonafide and fit case to drop the penalty proceedings.

Whether delay in filing of Form No. 3CEB may entail penalty u/s 271BA?

Section 92E specifies that the report from an accountant in Form No. 3CEB needs to be furnished before the specified due date. Thus, what is required is timely filing of the Form No. 3CEB. Hence, in case there is a delay in filing Form No. 3CEB, there may be a levy of penalty under section 271BA.

Whether delay in filing of Form No. 3CEB may entail penalty u/s 271AA?

Section 271AA deals with levy of penalty equal to two percent of value of the international transaction in case of (a) failure to maintain documentation as per section 92D, or (b) failure to report transaction, or (c) maintaining and furnishing incorrect information.

In case of Tussor Machine Tools10, the company had filed Form No. 3CEB after 2 days of the finalisation of assessment by the AO without making a transfer pricing adjustment. The AO initiated penalty proceedings under section 271AA, which were upheld by the CIT(A). The Chennai ITAT held that provisions of section 271AA apply to a case where the assessee fails to keep and maintain its documents in respect of international transactions. The ITAT concluded that, “this is not failure of the assessee to keep and maintain the record. Rather, it is a case of not producing the record before assessment’s finalization which is not covered by the tenor of the provisions.”Thus, one may say that no penalty under section 271AA may be leviable for delay in filing Form No. 3CEB. However, ITAT made a passing remark that for such cases, there is a specific penalty provision u/s 271G.

Penalty for non-reporting of transaction

A penalty under section 271AA equal to two percent of value of the international transaction may be leviable for non-reporting a transaction in Form No. 3CEB. Further, penalty provisions under section270A inserted vide Finance Act, 2016 w.e.f. 1-4-2017 have provided for a penalty equal to two hundred per cent of tax payable on under-reported income if such income is in consequence of any misreporting.

As per section 270(9), failure to report any international transaction or any transaction deemed to be an international transaction or any specified domestic transaction, to which the provisions of Chapter X apply, shall be considered as mis-reporting. Further, the provisions of section 271AA start with the words ‘Without prejudice to the provisions of section 270A……’. Hence, one may face a double whammy of dual penalty exposure for failure to report any transaction (271AA and 270A). However, such a position of law is not yet tested in jurisprudence.

⁹Shree Ram Dass Rice & General Mills Vs DCIT (ITAT Chandigarh) (ITA No. 833/CHD/2018)

¹⁰Tussor Machine Tools India (P) Ltd [TS-42-ITAT-2013(CHNY)-TP]

10. Reporting of typical transactions

Deemed International Transactions

As per the provisions of section 92B(2), a transaction between an enterprise and a third party shall be deemed to be an international transaction, if

- there exists a prior agreement in relation to the relevant transaction between third party and the AE, or

- the terms are in substance determined between third party and the AE where either or both of them are non-residents irrespective of whether the third party is a non-resident or not.

Thus, a transaction between the taxpayer and domestic third party may also get covered under the ambit of deemed international transaction if the AE of the taxpayer has a prior agreement with such third party or terms of transaction between taxpayer and third party are influenced by the AE.

Such a transaction would not get reflected under the related party disclosure in the financial state- ments, hence, the accountant should ensure diligence to identify such arrangement, if any, or seek representation from the management.

Share Application Money

There has been immense discussion on the reporting of issue of equity shares by tax payer to its associated enterprise. The Hon’ble Bombay High Court in the case of Vodafone India Services Private Limited11 held that issue of equity shares by an Indian company to non-resident company does not give rise to any income and thus, provision of Chapter X of the Act is not applicable. This decision of Bombay High Court has been accepted by the CBDT vide Instruction No. 2/2015 dated 29 January 2015. However, the Bombay High Court did not delve into the question whether issue of equity shares is an international transaction which needs to be reported in Form No. 3CEB.

The decision of Bombay High Court has enunciated the basic principles of taxation that only income which is chargeable to tax can be governed by the provisions of Chapter X. Hence, a question arises that if there is no income which emanates from issue of shares, then can one argue that such a transaction is not an international transaction as per section 92, r.w.s. 92B. However, there is no clarity on this position yet.

The Mumbai ITAT in case of BNT Global Private Ltd12. upheld the levy of penalty under section 271BA of the Income-tax Act, 1961 (the Act) for taxpayer’s failure to file the audit report in Form No. 3CEB in respect of its international transaction of receiving foreign remittance from its Non-Resident Indian (NRI) Director who was also a beneficial shareholder, on account of share capital and share premium in its own company.

Thus, a practical view would be to report the transaction of issue of equity shares in Clause 16 of the Form no. 3CEB out of abundant caution and capture a brief note stating that no income is emanating from such transaction and that the reporting is without prejudice to the contention that issue of equity shares is not an international transaction. Generally, issue of shares to non-resident would be undertaken by obtaining a valuation report from an independent valuer. Hence, ‘Other Method’ as prescribed by Rule 10AB may be considered as the most appropriate method for reporting the transaction in Form No. 3CEB.

¹¹Vodafone India Services Private Limited [WP No. 871 of 2014, (2014) 50 taxmann.com 300 (Bombay), dated 10th October, 2014]

¹²BNT Global Pvt. Ltd.(ITA No. 4111/Mum/2016) (Mumbai ITAT)

Trade Receivables / Trade Payables

Clause 14 of Form No. 3CEB requires the reporting of international transactions in respect of lending or borrowing of money including any type of advance, payments, deferred payments, receivable, non- convertible preference shares/debentures or any other debt arising during the course of business as specified in Explanation (i)(c) below section 92B(2).

In case of Bartronics India13, the TPO has noted that the assessee has not reported the outstanding receivables in Form No. 3CEB and also initiated penalty proceedings under section 271AA. However, there is no discussion of the same in the merit order of ITAT.

The Delhi High Court in case of Kusum Healthcare14 held that if arm’s length price of the main sale transaction computed under TNMM is accepted, no separate adjustment on account of outstanding receivables can be made. The TPO tried to impute interest income on such outstanding receivables which was rejected by the Deli High Court. Similar ruling has been passed by Mumbai ITAT15.

One may argue that the ‘receivable’ mentioned under clause (c) (capital financing including….) apply to the loan funds only. Hence, the charging of interest is applicable only with the lending or borrowing of funds and not in the case of commercial over-dues / trade receivables, which is already subjected to transfer pricing. The outstanding receivable is on account of certain commercial circumstances and general business practices, one may choose to apply ‘Other Method’ as prescribed by Rule 10AB as the most appropriate method for reporting the transaction in Form No. 3CEB.

Further, in case of trade payables, no such interest imputation is possible as the provisions of section 92(3) restricts such action. Hence, one may take a practical position to report the transaction of trade receivables and ignore trade payables in Form No. 3CEB.

Loan taken / advanced / repaid

Since as per section 92B, lending and borrowing money qualifies as an international transaction, though the loan is a capital account transaction, the same should be reported in Form No. 3CEB. Similarly, any addition to loan or repayment should also be reported in the year when the transaction takes place. Since, there can be no separate benchmarking undertaken for the transaction of loan, one may report the most appropriate method adopted for benchmarking interest, even for the loan transaction.

11. Mentioning Notes to Form no. 3CEB

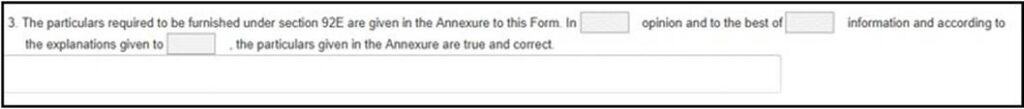

Paragraph 3 of Form No. 3CEB requires the accountant to state whether the prescribed particulars are furnished in the annexure to the report and whether in his opinion and to the best of his information and according to the explanations given to him, they are true and correct. The accountant may have a difference of opinion with regard to the particulars furnished by the assessee and he has to bring these differences under various clauses in Form No.3CEB. As per ICAI16, the accountant should make a specific reference to those clauses in Form No. 3CEB in which he has expressed his reservations, difference of opinion, disclaimer etc. in this paragraph.

¹⁴Kusum Healthcare (P.) Ltd [TS-412-HC-2017(DEL)-TP]

¹⁵Rusabh Diamonds [TS-145-ITAT-2016(Mum)-TP]

¹⁶Refer Para 2.35 of the ICAI Guidance Note

Since, However, the online filing schema did not provide for a facility for documenting notes by the accountant in each of the relevant clauses or Annexure to Form No.3 CEB, ICAI had suggested that the assessee may consider filing the Form No. 3CEBalong with the applicable notes with the Indian tax department.

However, the online version of Form No. 3CEB released for AY 2020-21 contained a separate column for capturing the ‘observations, if any’ for each transaction. Hence, if any amount is reported out of abundant caution, one may specifically capture a brief note in the observation column. It would also be a good-to-have practice to physically sign a copy of Form No. 3CEB to cover all points, notes, etc. in detail.

12. Requirement of e-filing

As per Rule 12(2) of the Income-tax Rules, 1962, Form No. 3CEB needs to be furnished electronically on the income-tax portal.

Can we file Form No. 3CEB after filing income-tax return?

The provisions of section 92 enable computation of income emanating from international transactions entered between two related parties having regard to arm’s length price. Hence, the income computed as per section 92 needs to be charged to income-tax while preparing the computation of total income. Hence, computation of income and filing of return of income cannot precede filing of Form No. 3CEB.

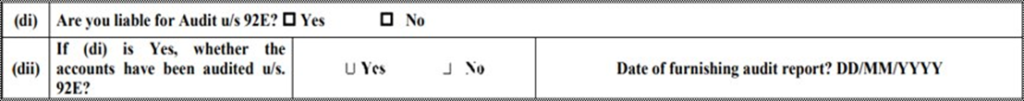

Requirement of reporting the details of filing Form No. 3CEB in ITR-6

Below is the screenshot of the details required to be filled in ITR-6 applicable to companies (other than companies claiming exemption under section 11):

13. Revision of Form No. 3CEB

There is no provision in the Income-tax Act, 1961 which permits or restricts the furnishing of a revised Form No. 3CEB. However, as a matter of general law and natural justice, correction of a mistake in any form / report should be permissible. This position has been tested in jurisprudence and held in the favour of the assessee.

In case of Ashok Leyland17, the TPO had rejected the filing of revised Form No. 3CEB by the assessee before the completion of assessment. TPO treated the revised Form No. 3CEB as belated and held that the time limit for filing Form No. 3CEB was along with the income-tax return. The assessee referred to the provisions of section 92CA(3) and contended that there was no time limit specified for filing revised Form No. 3CEB. The ITAT stated that the report of the CA cannot be ruled out and also factual position had to be considered to correct any mistake in calculating of ALP for valuation, and hence, the ITAT set aside the matter and directed AO to consider revised Form No. 3CEB filed by the assessee for calculation of arm’s length price.

Is there any due date for revising Form No. 3CEB?

No timeline has been prescribed under the Income-tax Act for revision of Form No. 3CEB. However, can one argue that the time limit for filing belated returns or revised returns should be followed for revision of Form No. 3CEB. However, there have been certain instances in jurisprudence18, where Form No. 3CEB has been accepted at the stage of assessment as well. As per practical experience, the erstwhile income-tax portal allowed to file revised returns without any restrictions on the time limit.

- Conclusion:

Furnishing of Form No. 3CEBis the first step in complying with the arm’s length principles enunciated in the Income-tax Act, 1961. Form No. 3CEB acts as the first line of defence before the income-tax office in justifying arm’s length price of all the transactions in an appropriate manner. Further, since the penal provisions for non-filing of Form No. 3CEB and non-reporting of transactions are stringent, one should comply with these provisions on a timely manner.

After the adoption of the new income-tax portal, no updated version of Form No. 3CEB has been updated on the portal. Hence, one would need to keep a close tab on the income-tax portal to see if there is any updation in the Form No. 3CEB or the filing procedure for complying with the transfer pricing provisions for AY 2021-22.