Cashflows & Tax Management Of The Top 1%

Warren Buffet, according to Forbes’ 2015 List of Billionaires, was the 2nd richest personin this world. At that time, more than 14000 US taxpayers (presumably individuals) reported in their tax returns, an “income” higher than Buffet.

In 2018, 25 of the wealthiest like Buffet, were worth $1.1 trillion. Around 14.3 million ordinary American taxpaying individuals put together that same amount of wealth.

The personal federal (income) tax bill for the top 25 in 2018— $1.9 billion only (in total). For those ordinary taxpayers— $143 billion.

ProPublica, in their words, is “an independent, non-profit newsroom that produces investigative journalism with moral force.” They obtained Internal Revenue Service (IRS, which is USA’s CBDT) data on the tax returns of thousands of the nation’s wealthiest people, covering major part of last two decades. That data providedProPublicaan unprecedented look inside the financial lives of America’s titans, including Warren Buffett, Jeff Bezos,Elon Musk and Mark Zuckerberg. It showed not just their income and taxes, but also their investments, stock trades, gambling winnings and even the results of audits.

They published a report on the 8th of June, 2021, titled “The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax”. This article tries to understand the cash flow and tax management strategies as discussed in that report, which enables the super-rich to have very less “income” (as a proportion to their wealth) and thereby have a very less income tax incidence. It further attempts to link the strategies in Indian context. This article ignores the “true tax rate” concept used by ProPublica as it calculates tax rate on asset-value appreciation. In reality, any income tax is levied on gains from sale of capital assets and not on a mere increase in value. This article also ignores tax management strategies like private trusts, investments in/from foreign companies, etc.

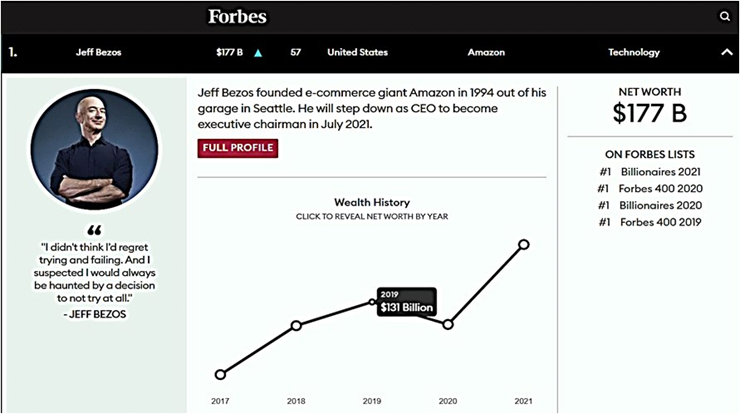

In the last article, we saw how A maz o n do dg e d I ndian regulators, relating to FDI, e- commerce and other norms. Let’s now know about Jeff Bezos’ federal tax data, the man behind Amazon.

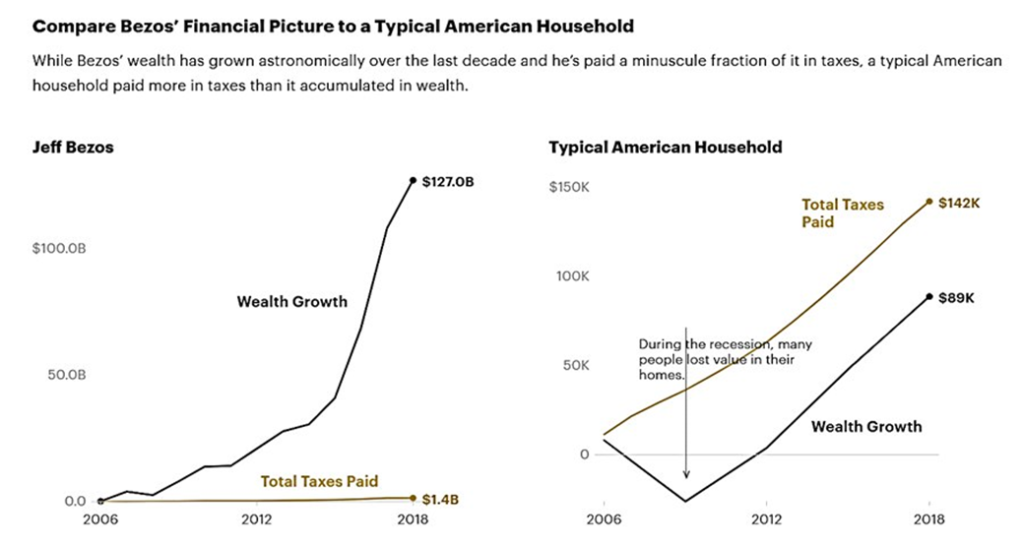

To begin with, from 2006 to 2018, Bezos’ wealth increased by $127 billion, primarily because of increase in value of investments. Forbes list of 2019 valued his wealth at around $131 billion. For those years, he reported a total of $6.5 billion in income and paid $1.4 billion in personal federal taxes.

In 2007, he was not liable for any federal taxes. Bezos, who filed his taxes jointly with his then-wife, MacKenzie Scott, reported a paltry $46 million in income, largely from interest and dividend payments on outside investments (His annual “salary” is fixed at only $80,000). He was able to offset every penny he earned with losses from side investments and various deductions, like interest expenses on debts and the vague catchall category of “other expenses.”

(Interest expenses on “debts”? Why would a man like Bezos need any debt in personal capacity?)

In 2011, Bezos filed a tax return reporting he lost money, i.e. his income that year was less than his losses. What’s more, because, according to the tax law, he made so little, he even claimed and received a $4,000 tax credit.

Mean while, average Americans of his age paid more in taxes than they saw in wealth growth over that period.That is, for every $100 of wealth growth over that period, typical Americans paid $160 in taxes. Bezos paid only around $1.06.

For every $100 increase in wealth,an average American paid $160 in taxes. Jeff Bezos paid only $1.06.

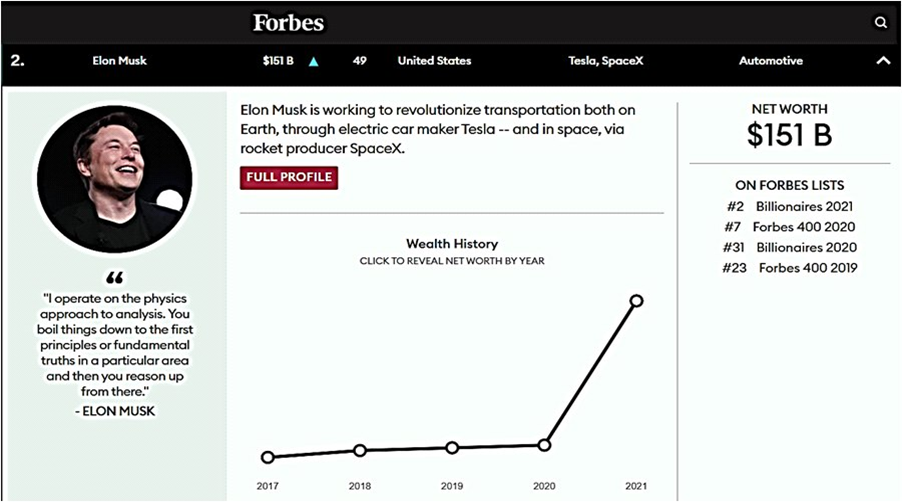

ProPublica apparently couldn’t get data on Bezos’ debt, however it could get some debt details of the second richest person in the world, Elon Musk.

For 2020, Tesla reported that Musk had pledged some 92 million shares, which were worth about $57.7 billion as on the 29th of May, 2021, as collateral for personal loans. Musk’s tax bills in no way reflect the fortune he has (as normally any ordinary taxpayer would perceive). In 2015, he paid $68,000 (only) in federal income tax. In 2017, it reduced to $65,000 and in 2018 he paid no federal income tax.

For 2018, Elon Musk paid no federal income tax.

The cash inflow is from debt funding lifestyle and the interest cost helps reduce/ nullify taxes. Voila!

When understood in depth, this “debt by investments as collateral” is a ruthless cycle with always increasing intensity. Simply because if Tesla’s share value falls drastically for any reason, Musk will have a hard time repaying the loans.

We have seen this happen in India, when Kingfisher Airlines’ value was hit hard due to the 2008 global recession. Although business loans were taken, however collateral included intangible assets and personal guarantee. When Mallya doesn’t repay the loans (about Rs 9,000 crore) along with accrued interest in spite of his personal guarantee, it can be inferred as he is indirectly using that money for his personal lifestyle expenses.

In a recent update, the Bengaluru Debt Recovery Tribunal (DRT) has authorised the recovery officer for the sale of Mallya’s shares to recover “Rs 6,203 crore along with costs and interest at 11.5 per cent calculating from June 25, 2013, till the date of recovery”. As per the plan, the recovery officer will sell around 22 lakh shares of McDowell Holding Limited, 4.13 crore shares of United Breweries Limited and 25.02 lakh shares of United Spirits Limited in a block deal on the 23rd of June, 2021. At 18th June’s market price, McDowell Holdings will fetch Rs 13.8 crore, UBL stake will fetch Rs 5,565 crore while United Spirits shares will be sold at Rs 165 crore, totalling to around Rs 5743 crores only.[1]

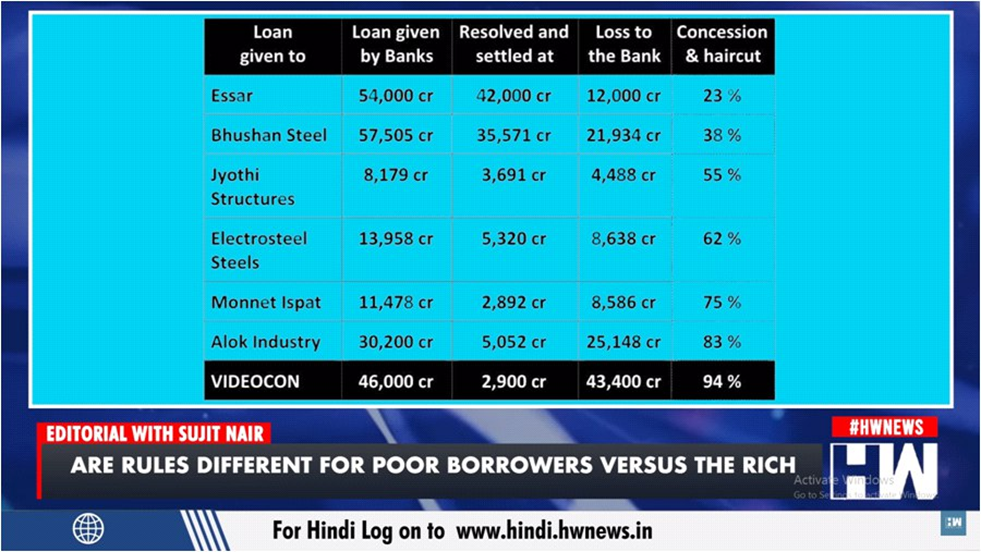

If the banks cannot recover 100% of their dues, they may have to settle for a lower amount, which is called a “hair cut”.

Banks have settled with a haircut multiple times in the past. As per data presented by HW News in an editorial, below are some significant “haircuts”[2]:

Subject to certain provisions (especially GAAR) and assessee-favouring litigative views, this lifestyle by debt funded cash flows and tax management by interest cost may be possible in India. And anyway we’ve seen how difficult it is to recover the debt in case of any default.

From a tax payer perspective, such tax management by the super-rich may be called as morally unjust. However our tax laws have been drafted in way to favour such people. Rs 1 crore in income from salary or dividend will attract a 30% tax rate (highest slab). However, expenses can be claimed against dividend. Wealth- wise, the person earning a dividend of Rs. 1 crore would be owning shares of atleastRs. 5 crore at face value (considering 20% payout) plus cash balance from that dividend. However a salaried person in that year will have a cash balance of around 65 lakhs only (assuming no personal expenditure).

Further, sole proprietors and partnership firms are taxed at 30% (highest rate), but for companies it is around

22-25% (subject to certain conditions). MSMEs usually do not prefer a corporate legal structure because of the complexity and costs involved.

Just like ordinary Americans, even we ordinary Indians seem to be paying more in taxes as proportion to wealth growth. Also, we are being hit by “haircuts” as any loss to bank is loss of tax-payer money. There seems to be no long term policy of the Central Government to overcome this issue.

Point to ponder:

MSMEs and Salaried individuals pay more in taxes compared to Companies and their founders.

We, the tax professionals, understand the best for our clients. Enlightened by this article, can we improve our tax management strategies? Will our clients from the ordinary class approve and appreciate our efforts?

Think over it. Think different!

Specific references: https://www.moneycontrol.com/news/business/sbi-led-banks-to-sell-vijay-mallyas-shares worth-rs-6200-crore-next-week-to-recover-kingfisher-airlines-loan-7055211.html

General references: