Cash Flow Statement Analysis: Unveiling the Bad and Good Companies

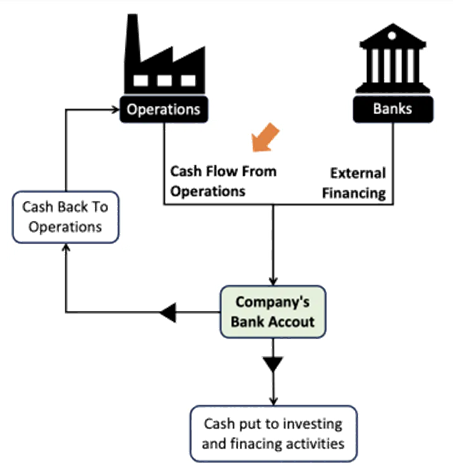

Positive net cash flow from operations is a fundamental indicator of a company’s financial health. It represents the cash generated by a company’s core operations. It is cash generated from the sale of goods and services, minus the cash paid for operating expenses.

The cash flow statement plays a crucial role in financial statement analysis, providing valuable insights into the financial health and sustainability of a company. There are three cash flow types that companies should track and analyze to determine the liquidity and solvency of the business: cash flow from operating activities, cash flow from investing activities and cash flow from financing activities. All three are included on a company’s cash flow statement.

In conducting a cash flow analysis, businesses correlate line items in those three cash flow categories to see where money is coming in, and where it’s going out. From this, they can draw conclusions about the current state of the business.

A positive net cash flow from operations showcases the company’s ability to generate cash internally. This cash flow is vital for its day-to-day operations. Moreover, such cash flows can also be used for investing in growth opportunities and meeting financial obligations.

A company with a strong cash flow can fund its operations without relying heavily on external financing. This financial strength provides stability, as the company is less vulnerable to liquidity issues during challenging economic periods.

Companies with consistent cash flow from operations have shown greater resilience during economic downturns. Such companies often outperformed their peers in terms of stock performance.

Depending on the type of cash flow, bringing in money in isn’t necessarily a good thing. And, spending money it isn’t necessarily a bad thing. A cash flow analysis illustrates whether your business earns enough income to cover financial obligations, and if you’ve got money left over after the bills are paid.

This article will delve into the significance of cash flow statement analysis when evaluating investments. We will examine real-life examples of both underperforming companies and multi-bagger stocks in the Indian market, drawing insights from their respective cash flow statements. Additionally, various analytical ratios derived from cash flow statements will be discussed to gauge a company’s financial performance.

Parameters for analyzing Cash Flow Statements:

- Operating Cash Flow

- Identify declining net cash from operating activities:

This negative trend indicates that the company’s core operations are failing to generate sufficient cash flow. Consistent positive cash flows indicate the company’s ability to weather economic downturns and generate long-term value for investors. Here are some statistics of large companies facing negative cash flows and the same is already getting reflecting in how investors are reacting to their results:

| Stock | Net Cash Flow YoY Growth % | CFO Activity Annual | CFO Activity Annual 1Yr Ago | CFO Activity Annual 2Yr Ago | Net Cash Flow Annual 1Yr Ago | Net Cash Flow Annual 2Yr Ago | Current Price | Market Cap. |

| Crompton Greaves Consumer Electricals Ltd. | -2.84% | 552.60 | 723.40 | 830.30 | (92.20) | 238.40 | 290.80 | 18,618 |

| Navin Fluorine International Ltd. | -9.20% | (63.60) | 74.80 | 237.30 | (56.10) | (44.90) | 3,120.55 | 15,469 |

| Route Mobile Ltd. | -35.26% | 73.20 | 134.60 | 229.40 | 119.80 | 214.40 | 1,597.20 | 10,029 |

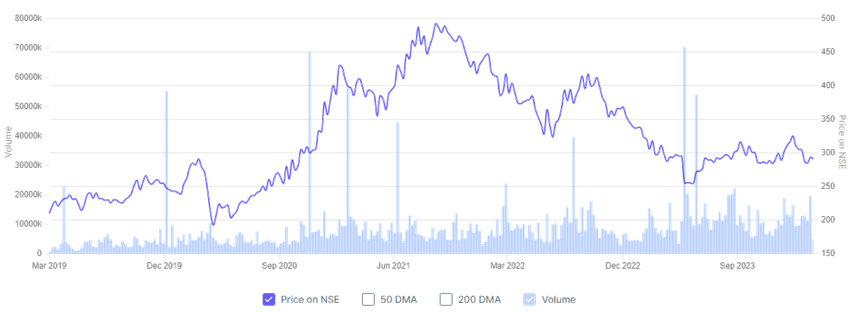

Price Chart of Crompton Greaves Consumer Electricals Ltd.:

Source: Screener

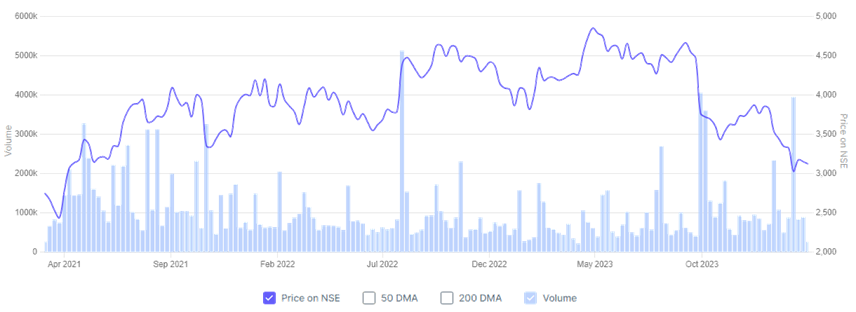

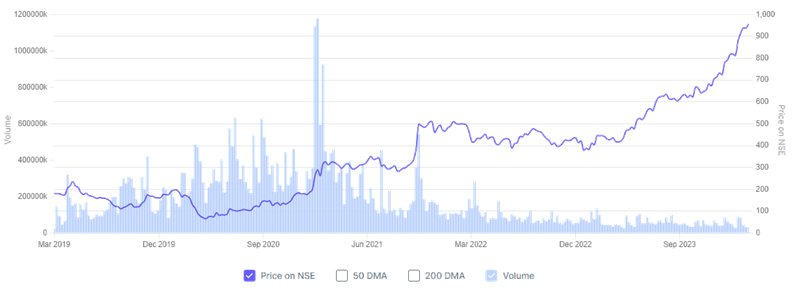

Price Chart of Navin Fluorine International Ltd.:

Source: Screener

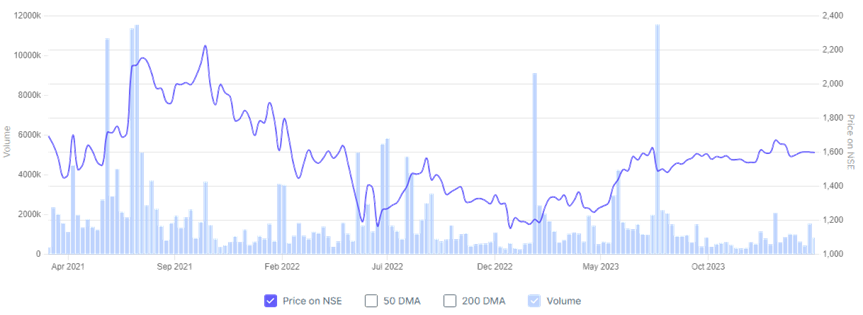

Price Chart of Route Mobile Ltd.:

Source: Screener

- Focus on the operating cash flow ratio:

A decreasing ratio reveals that operating cash flows are decreasing in proportion to earnings, suggesting inefficiencies. A high proportion indicates robust and efficient operations. Here are list of few companies having market capitalization more than Rs. 10,000 crore and having good operating cash flow ratio over multi-period:

| S. No. | Name | CMP (in Rs.) | Mar Cap (in Rs. Cr.) | Cash Flow Ratio for Last year | Cash Flow Ratio for Preceding Ratio | Cash Flow Ratio for 5 years | Cash Flow Ratio for 10 years |

| 1 | Tata Motors Ltd. | 953.75 | 348,869 | 3 | 5 | 4 | 2 |

| 2 | CEAT Ltd. | 2,816.00 | 11,391 | 2 | 2 | 2 | 1 |

| 3 | Birla Corporation Ltd. | 1,718.05 | 13,231 | 2 | 1 | 1 | 1 |

| 4 | The Ramco Cement Ltd. | 849.60 | 20,075 | 2 | 1 | 1 | 1 |

| 5 | Tata Communications Ltd. | 1,910.75 | 54,456 | 2 | 2 | 2 | 2 |

| 6 | Bharti Airtel Ltd. | 1,128.70 | 666,188 | 2 | 2 | 2 | 2 |

| 7 | GMR Airports Infrastructure Ltd. | 84.82 | 51,197 | 2 | 2 | 1 | 2 |

| 8 | Hindustan Copper Ltd. | 255.65 | 24,722 | 2 | 3 | 4 | 2 |

| 9 | Shipping Corporation of India Ltd | 226.30 | 10,541 | 2 | 1 | 2 | 2 |

Source: Screener

The performance of few of such companies can be clearly evident from their price chart below showcased:

- Tata Motors

Source: Screener

- Birla Corporation Ltd

Source: Screener

- Assess changes in working capital:

A significant reduction indicates efficient management of accounts receivable, inventory, and payable, resulting in improved cash flow.

- Study the cash conversion cycle:

A shorter cash conversion cycle implies tighter control over working capital and faster cash generation.

- Cash Flow from Financing Activities

- Analyze the debt-to-cash flow ratio:

A high ratio may suggest the company’s inability to generate enough cash flow to service its debt obligations.

- Scrutinize interest payments:

Consistently high interest payments can negatively impact cash flow, making it difficult for the company to reinvest in growth or generate profits.

- Cash Flow from Investing Activities

- Assess capital expenditures:

A company with limited cash inflows from operations and extensive capital spending may struggle to generate positive cash flows.

- Monitor the dividend payout ratio:

A moderate payout ratio combined with healthy cash flows indicates the company’s stability and potential for long-term growth.

- Net Cash Flow

- Monitor changes in investing and financing activities:

A higher proportion of cash spent on investments or raised through financing can indicate cash flow issues. This will also highlight scenarios of short term funds used for long term purposes and diversion of funds.

- Investigate free cash flow:

A positive free cash flow signifies the company’s ability to reinvest in growth, undertake acquisitions, or return capital to shareholders.

Conclusion:

Effective cash flow statement analysis is crucial for identifying good and bad investments. Analyzing key ratios derived from cash flow statements allows investors to assess a company’s financial health, debt sustainability, operating efficiencies, and growth potential. By understanding the nuances of cash flow statement analysis and applying them to real-life examples from the Indian market, investors can make informed investment decisions, potentially avoiding poor investments and identifying multibagger stocks with healthy cash flow statements.

Do Your Own Research:

This content is intended to be used and must be used for information and education purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find in this article and wish not to rely upon, whether for the purpose of making an investment decision or otherwise.