Case Study on Related Party Transaction – Indian tax and regulatory implications

- The scope of this article is to present a case study on related party transactions and analyse the implications from the perspective of various tax and regulatory framework. The article intends to bring out the common themes as well as divergence among these statutory codes.

- Let us consider the following case study:

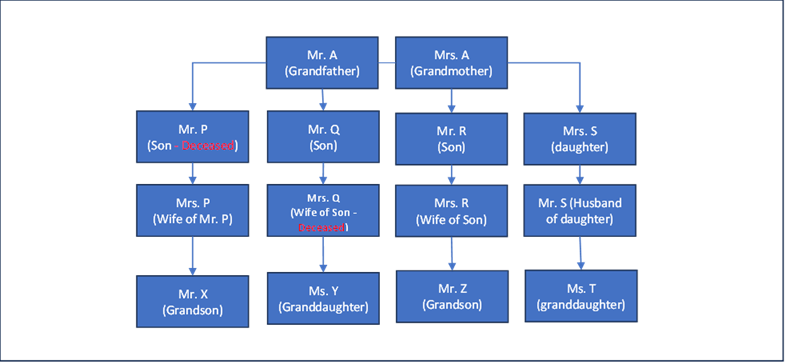

- There is a prominent Chheda family in the CVO community which is engaged in multiple businesses, some of which are listed and some of which are private. The family members consist of the following individuals:

- All the family members are Indian citizens. Further, they are Indian tax and fema residents, other than Mrs. S, Mr. S and Ms. T, who are settled in London for more than a decade.

- The family runs the following businesses:

- ABC Private Limited carries out wholesale trading of cloth and textile products and owns the trademark “ABC”

- XYZ is a Limited Liability Partnership which is engaged in manufacturing of denim and linen products and owns the trademark “Chheda products”.

- PQR is a Public Listed Company which has established chain of branded stores across the countries which has shirting, suiting and “made to measure” services.

- The details of partners and shareholders in the aforesaid companies / LLP are as under:

| Sr. No. | Business entity | Shareholders / Partners / Directors |

| 1. | ABC Pvt Ltd | Mr. A (55%), Mr. Q (20%), Mr. R (10%), Mrs. S (10%), Ms. Y (5%). All the shareholders are also directors in the company (other than Ms. Y). |

| 2. | XYZ LLP | Chheda Family Trust holds 70% controlling and economic partnership rights and the balance is held by Mr. A |

| PQR Ltd | The family members owns in aggregate around 72% stake in the listed company. Specifically, Mr. A has gifted his 30% stake to Ms. T couple of years back, who is now the largest shareholder and a declared promoter. |

- As the 3rd generation of the family have started getting involved into the various businesses, there is a growing philosophy within the family to give more operating authority to certain individuals and also come up with a sandbox model wherein some family members would be given the rights / ownership to certain brands and businesses and would be encouraged to operate it on their own.

- To achieve the above, the family has decided to carry out some kind of an internal restructuring to enable the aforesaid objectives for the ultimate benefit of the larger family. The family would continue to stay together and in most cases, continue to share the benefits of the old and new businesses in some agreed manner. Hence for the purposes of our case study, we are presuming that this is not a family separation or a family settlement.

- The broad steps involved in the overall restructuring are as under:

- Ms. Y shall draw a handsome salary from ABC Pvt Ltd, while her contribution to the said company shall be negligible. The “ABC” brand owned by ABC Pvt Ltd shall be transferred to Ms. Y for a NIL consideration, who shall set up a new traditional wear business under her own company. Ms. Y shall give a limited right to ABC Pvt Ltd for a NIL consideration to enable the said company to use the “ABC” brand for the limited purposes of its wholesale trading business.

- The brand owned by XYZ LLP shall be transferred for NIL consideration to one of the partners, viz. Chheda family Trust (which has been settled by Mr. A for the benefit of the overall Chheda family). The said brand shall be licensed to the said LLP for a nominal annual consideration to run the denim manufacturing business.

- XYZ LLP owns certain treasury in the form of stock market investments. The said treasury shall be transferred to Mr. X who shall sell the same and shall use the proceeds to set up a new business in the field of kids fashion.

- The manufacturing unit of linen products shall be transferred by XYZ LLP to a new LLP owned by Mr. Z, who shall individually run the said division under a new brand and expand it in future.

- The brand owned by the listed company, PQR Ltd shall be licensed to Ms. T for the European territory for an arms length licence fee. She would set up similar stores in Europe (initially starting with UK) in the field of shirting, suiting and “made to measure” services.

- The tax and regulatory implications of the restructuring steps involving related party transactions have been analysed in detail as under:

- Step 1.1: Ms. Y to receive salary from ABC Pvt Ltd without any significant contribution

- As per Section 40A(2) of the Income-tax Act, 1961, under the following circumstances, an Assessing Officer can disallow the excessive or unreasonable expenditure made to a “specified person” having regard to any of the following factors:

- Fair market value of services (arms length test)

- Legitimate needs of the business (proprietary test)

- Benefit derived by the business (benefit test)

- The term “specified person” includes the following:

| Category of Taxpayer | Specified person coverage (illustrative) |

| Company | Director Relative[1] of Director Shareholder holding 20% voting rights Relative of the aforesaid Shareholder |

- In the instant case, the salary paid by ABC Pvt Ltd to Ms. Y [a specified person under Section 40A(2)] is likely to be regarded as excessive and unreasonable having regard to the tests laid down under the said Section and an appropriate portion of the salary regarded as excessive/unreasonable, could be subject to disallowance. However, irrespective of such disallowance, the said salary shall be taxable in the hands of Ms. Y.

- From a GST law perspective, a salary transaction is not subject to any GST.

- From the perspective of Companies Act, 2013, the following implications arises:

- Unlike the Income-tax Act, where the related party definition under Section 40A includes a person with substantial interest (viz. voting rights of 20% or above), the concept of related party under the Companies Act [viz. Section 2(76) and Section 188] is linked more to the ability to control (viz. Directors and Key Management Personnel) rather than a position of benefits (viz. shareholders)

- Under the Companies Act, a related party would include a Director and his relative.

- The term “relative” under the Companies Act Vs the Income-tax Act is wider in some sense (for instance, it would include a son-in-law and daughter-in-law, which is not covered under Section 2(41) / 40A of the Income-tax Act, though covered under Section 56 of the Income-tax Act) and narrower in some sense (a grandfather is not covered, unless the grandfather and grandson / granddaughter are members of a Hindu Undivided Family – whereas, under the Income-tax Act, the same shall be covered irrespective of the condition regarding these members being part of the same HUF).

- Payment of salary by ABC Pvt Ltd to Ms. Y would be regarded as a related party transaction under the Companies Act.

- As per Section 188 of the Companies Act, a related party transaction needs to be approved by the board of directors.

- The related party transaction further needs to be approved the shareholders in a general meeting by passing an ordinary resolution, provided the transaction crosses a particular threshold (10% of the turnover, in case of services). In the present case, salary payment to Ms. Y is unlikely to cross the said threshold and hence a shareholders approval may not be required.

- Step 1.2: Transfer of “ABC” brand by ABC Pvt Ltd to Ms. Y for NIL consideration

- A transfer of brand by ABC Pvt Ltd to Ms. Y would not invoke the provisions of Section 40A(2), since no expenditure has been “incurred” by the said company.

- The interesting issue which arises is whether such a distribution of valuable asset by ABC Pvt Ltd to Ms. Y (a shareholder holding 5% equity shares) can be regarded as a dividend under Section 2(22)(a) of the Income-tax Act, which states that dividend includes “any distribution by a company of accumulated profits whether captialised or not, if such distribution entails the release by the company to its shareholdres of all or any part of the assets of the company”.

- Assuming that ABC Pvt Ltd has enough accumulated profits in its financial statements which corresponds to the market value of the brand distributed to Ms. Y, there is an exposure that the said distribution may be regarded as taxable dividend in the hands of the said shareholder.

- As an alternate view, there is an argument that a distribution to a single shareholder should not tantamount to a dividend as envisaged under Section 2(22)(a) and such a distribution may be tested for taxation under other provisions of the Income tax Act (for instance, Section 56). The term “distribution ‘distribution’ and ‘payment’ have different meanings; distribution is all about division amongst several persons. It connotes an idea of apportionment among more than one person. In the case of ‘distribution’ the recipients would be more than one, while in the case of ‘payment’ the recipient may be a single person[2].

- If one were to analyse whether the receipt of the brand would be regarded as a deemed taxable gift in the hands of Ms. Y, one may infer that Section 56 refers only to a limited set of assets received without adequate consideration and a receipt of an intangible asset is not covered under the said deeming fiction.

- A wider debate exists under the recently made amendment under Section 28 r.w.s. 194R wherein value of any benefit or perquisite arising from business or profession is chargeable to income-tax under the head “Profits and Gains from Business or Profession”. In the current context, Ms. Y is not receiving the said intangible asset in lieu of any of her existing business or profession and hence these provisions should not be attracted.

- Lastly, one may finally refer to Section 2(24)(iva), which defines “income” to include the value of any benefit obtained from a company by a director or an equity shareholder holding 20% voting rights. In the instant case, since Ms. Y falls under neither of the two categories, the said provision may not be applicable.

- From a GST perspective, the transfer of brand to Ms. Y should be regarded as a supply of services. The issue is whether the said transaction is regarded as a transaction between related party and if yes, at what valuation should GST be applicable. The GST provisions in this context are summarised below:

- Generally, the value of services supplied is linked with the transaction value – essentially, the actual price paid or payable for the given supply (Section 15 of the Central Goods and Services Tax Act, 2017 read with the State Goods and Services Tax Act, 2017). However, distinct regulations come into effect when the transaction involves “related persons[3]” or when the price is not the sole factor under consideration.

- In situations where the transaction involves “related persons”, the valuation is determined using the following principles (Rule 28 of the Central Goods and Services Tax Rules, 2017 read with the State Goods and Services Tax Rules, 2017):

- Open Market Value: Full value in money of the underlying goods or services in a scenario where the supplier and the recipient of the supply are not related, and the price is the sole consideration.

- Value of supply of goods or services of like kind and quality: If it is not feasible to determine the open market value, the value can be inferred from goods or services that closely resemble the characteristics, quality, quantity, functional aspects, materials, and reputation of the goods or services being supplied.

- Alternative approaches: If neither the open market value nor the value of comparable goods or services can be determined, there are alternatives:

- 110% of Production or Acquisition Cost: The value can be set at 110% of the cost incurred in producing, manufacturing, or acquiring the goods, or in providing the service.

- Reasonable Means: The value can be arrived at using sensible methods, although these methods are not explicitly defined.

- There are 2 exceptions to the above valuation methodology:

- Exception 1: When goods are intended for resale as-is by the recipient, the supplier has the choice to value them at 90% of the price charged for similar goods by the recipient to his unrelated customers.

- Exception 2: Where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be the open market value of the goods or services.

- In nutshell, the value of supplied goods or services usually relies on the transaction value. However, specific rules apply in cases involving related parties or when price is not the sole consideration. These rules encompass assessing open market value, drawing from similar goods or services, and using alternative methods when necessary. There are two exceptions to this valuation approach: one for goods intended for resale and another for recipients eligible for full input tax credit. Recently the CBIC has further clarified that in case where full credit is available any value on the invoice shall be deemed to be Open Market Value.

- Interestingly, a transaction between a company and a minority shareholder is not covered under the related party definition as provided under the GST Act. To this extent, the coverage of related party within the GST law seems to be narrower as compared to other laws. However a transaction between a company and its director is covered within the related party definition, if there exists an employer-employee relationship.

- Consequently, in the instant case, the transfer of brand at NIL consideration by ABC Pvt Ltd to Ms. Y (being a director/employee) for NIL consideration could attract GST and the said GST would have been leviable at the deemed market value of such a brand, since the recipient (viz. Ms. Y), in the absence of any business carried on in a proprietorship capacity where such a brand may have been used, may not have been eligible for full input tax credit. A possible way out to avoid any adverse GST implications is for Ms. Y to charge a nominal royalty in step 1.3 when its gives ABC Pvt Ltd a limited right to use the brand name. In such a case, a possible one to one nexus can be built for the transaction and it could be argued that recipient would be eligible for a full tax credit.

- As regards the Companies Act, as explained in para 3.1.5, the transfer of brand to Ms. Y would require a prior board approval under Section 188 and if the value of the said brand exceeds 10% of the company’s turnover, the same would also require an approval of the shareholders under a general meeting.

- Step 1.3: Ms. Y shall give a limited right to ABC Pvt Ltd for a NIL consideration to enable the said company to use the “ABC” brand for the limited purposes of its wholesale trading business.

- There are no income-tax implications under provisions of Section 40A, 56, etc, nor any implications under Section 28(iv) r.w.s. 194R. The said provisions cover any benefit arising from business. The said receipt of licence for NIL consideration to use the brand should not be regarded as “arising” from ABC Pvt Ltd’s business.

- Further, one can argue that such a licence to use the brand for a limited purpose by Ms. Y to ABC Pvt Ltd is not in the course of her business and hence no further GST implications need to be considered, since the said transaction would not be covered under Section 7 of the Central Goods and Services Act, 2017 relating to “scope of supply”. In any case, the recipient, viz. ABC Pvt Ltd would have received a full input tax credit and hence no market value could be imputed on such a supply of service by Ms. Y to ABC Pvt Ltd.

- There are no implications under the Companies Act, 2013.

- Step 2.1: The “Chheda products” brand owned by XYZ LLP shall be transferred for NIL consideration to the Chheda family Trust (which shall be settled by Mr. A for the benefit of the overall Chheda family).

- There are no income-tax implications on XYZ LLP as well as the Family Trust.

- In this case, since the family trust controls the LLP, the said transaction shall be regarded as a supply of goods / services between related parties. In this case, there is a high exposure that the GST could be leviable at the deemed market value of such a brand. However, it can be argued that the recipient (viz. Chheda Family Trust) is able to get a full input tax credit of the GST against the liability of GST arising in step 2.2, viz. licensing the brand to XYZ LLP for a nominal consideration and hence, due to this one to one nexus between the transactions, there should not be any deemed imputation of market value for the purposes of GST levy.

- Step 2.2: The brand shall be licensed to the XYZ LLP by the Family Trust for a nominal annual consideration to run the denim manufacturing business.

- There are no adverse implications under the Income-tax Act. The Family Trust shall discharge its tax liability on the nominal income earned every year from the licensing arrangement and the LLP shall claim an annual deduction of such an expenditure.

- From a GST perspective, it would be regarded as a transaction between related parties. However, the market valuation should not be imputed in the instant case, if the recipient (viz. XYZ LLP) is eligible for full input tax credit. Hence, no adverse GST implications should arise.

- Step 3: The treasury investments owned by XYZ LLP shall be transferred to Mr. X for NIL consideration.

- Receipt of the treasury investments shall be regarded as a taxable income in the hands of Mr. X under Section 56 of the Income-tax Act. There would be no adverse implications in the hands of XYZ LLP.

- From a GST perspective, transfer of securities are not subject to any GST, since securities are excluded from the definition of the term “goods” and “services”.

- Step 4: The manufacturing unit of linen products shall be transferred by XYZ LLP to a new LLP owned by Mr. Z

- There are no adverse implications under the Income-tax Act. The provisions of section 56 should also not apply, since an “undertaking” is not covered within the specified list of assets, the receipt whereof could create a taxable event in the hands of the recipient in the absence of inadequate consideration.

- From a GST perspective, while a transfer of an undertaking on a going concern basis is considered as a supply of services, the same is chargeable to tax at NIL rate as per entry no. 2 of the Notification No. 12/2017-Central Tax (Rate) dated 28th June, 2017.

- Step 5: The brand owned by the listed company, PQR Ltd shall be licensed to Ms. T for the European territory for an arms length licence fee.

- No adverse implications from an Income-tax Act perspective. The listed company would be subject to tax on the annual licence fee. Since Ms. T (a non-resident) holds more than 26% of the voting power in the listed company, it would be regarded as an associated enterprise of the listed company and the said transaction would need to comply with the Transfer Pricing provisions with respect to arms length test, appropriate documentation and compliance under the Income-tax Act.

- From a GST perspective, it would need to be ascertained whether Ms. T is directly or indirectly controlling the listed entity. In any case, since the transaction is at arms length, there are no adverse GST implications. In any case, the said transaction may be regarded as an “export of services” (provided payment is made in foreign currency and other procedural conditions relating to export of services are complied) on which no GST is payable.

- As regards the Companies Act, as explained in para 3.1.5, the licensing of brand to Ms. T would require a prior board approval under Section 188 and if the value of the said brand exceeds 10% of the company’s turnover, the same would also require an approval of the shareholders under a general meeting.

- Since the company is a listed entity, it would also need to comply with the Regulation 23 of the SEBI (Listed Obligations and Disclosure Requirements) Regulations, 2015 as under:

- The licensing transaction would require a prior approval of the Audit Committee wherein only independent directors can vote.

- If the transaction is regarded as material, it would also require a prior approval of the shareholders in a general meeting, wherein related parties / promoters would not be allowed to vote.

- A brand licensing transaction to be entered into individually or taken together with previous transactions during a financial year would be regarded as material, if a transaction involving payments made to a related party with respect to brand usage or royalty, exceed 5% of the annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity.

- Concluding Remarks

4.1 The aforesaid fictional case study showcases the implications of a related party transaction under the Income-tax Act, GST Law, Companies Act and SEBI Regulations. As highlighted in few cases, frequently, the definition of related party is significantly different under these various statutes and adequate care needs to be taken while undertaking any related party transaction. The current case study also leaves enough scope and homework for the readers to structure the overall family arrangement in a far more refined manner as compared to what was originally planned by the illustrious Chheda family.

[1] As per Section 2(41) of the Income-tax Act, 1961, the term “relative” of an individual, means the husband, wife, brother, sister or any lineal ascendant or descendant of the said individual.

[2] CIT vs. P.V. John [1990] 52 Taxman 221 (Ker.)

[3] Under GST Act, persons shall be deemed to be “related persons” if,-

- such persons are officers or directors of one another’s businesses;

- such persons are legally recognised partners in business;

- such persons are employer and employee;

- any person directly or indirectly owns, controls or holds twenty-five per cent. or more of the outstanding voting stock or shares of both of them;

- one of them directly or indirectly controls the other;

- both of them are directly or indirectly controlled by a third person;

- together they directly or indirectly control a third person; or

- they are members of the same family;

- the term “person” also includes legal persons;

- persons who are associated in the business of one another in that one is the sole agent or sole distributor or sole concessionaire, howsoever described, of the other, shall be deemed to be related.