“Amalgamation and Demerger including Outbound and Inbound Scenarios. Transfer of Business (Slump Sale, Slump Exchange and itemized sale)”

The World is restructuring and so the Corporate are……..

Yes, you read it right, the world is restructuring. In almost last two years what we have undergone is nothing but the way nature is restructuring the earth. Lot of discussions have happened all around the world on the implications of pandemic, the vaccines, the way of living etc. The pandemic has changed the way we live, the way we do business, the though process etc. The things that were taken for granted suddenly were high in demand.

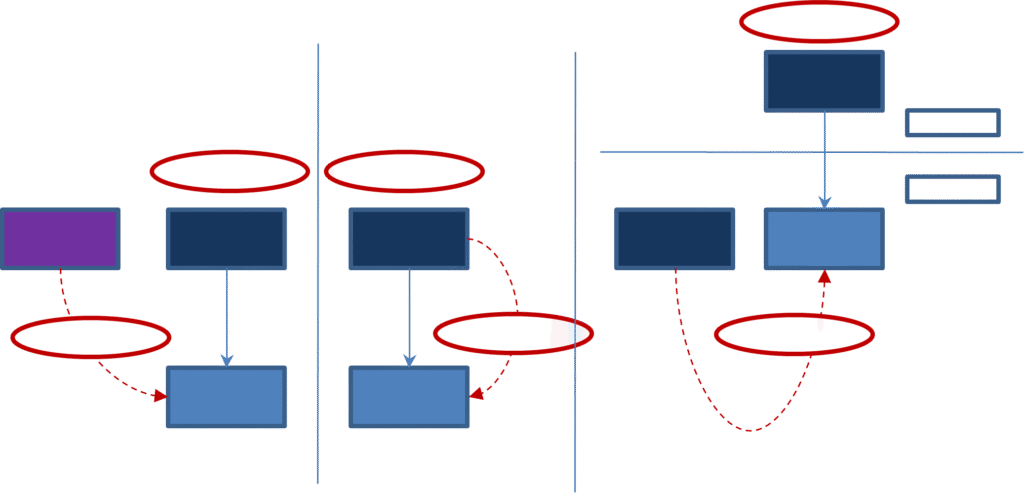

Mergers / Demergers / Capital Reduction are nothing but type of restructuring which an organisation undergoes to conduct its business /growth / survival. Restructuring happens by way of expansion of business, forward integration, background integration, balance sheet right sizing etc. Each and every type of restructuring has its implications. The scope of this article is limited to tax implications arising on various modes of restructuring:

Before we discuss the implications let us first understand what the different types of restructuring and its objectives:

- Merger / Amalgamation – Consolidation of business though amalgamation

- Demerger – for value unlocking, raising funds for business transferred to resulting company or for subsequent sale

- Slump Sale of business for exit / fund raising/ joint venture

- Itemised sale – Monetisation of not required assets for meeting cash requirements

- Capital Reduction – leaning the balance sheet of company, return of capital, exit to selective shareholders

Amalgamation

Amalgamation (Section 2(1B) of Income-tax Act, 1961): means merger of either one or more companies with another company or merger of two or more companies to form one company in such a manner that:

- All the property/liability of the amalgamating company/companies becomes the property/liability of amalgamated company.

- Shareholders holding minimum 75% of the value of shares in the amalgamating company (other than shares already held therein immediately before the amalgamation by, or by a nominee for, the amalgamated company or its subsidiary) become shareholders of the amalgamated company.

Any amalgamation to be tax neutral has to satisfy above conditions and conditions specified in Section 47. In case of merger of wholly owned subsidiary into its holding company there would not be any issue of shares. Still it would be tax neutral merger since company cannot issue shares to itself. Now take a scenario where a company is getting merged with its wholly owned subsidiary. In this case can one say that all assets and liabilities are getting transferred pursuant to merger as investments of company into wholly owned subsidiary will get cancelled.

Discharge of consideration

Can the company issue preference shares instead of equity shares. The section talks about of issue of shares. It can be equity / preference or mix. In the scheme of amalgamation of Minda Industries Limited there was an option given to shareholders to either opt for equity or preference. We can say that this was an option given to some shareholders to take exit from the company.

There is no mention of cash as consideration in the section. So can the consideration be discharged in the form of cash. In scheme of amalgamation of Shriram Piston and Rings Limited consideration was discharged in the form of preference share and cash.

Now let us understand implications in hands of company as well as shareholders”

| In the hands of | Taxability / Treatment | Section | Conditions |

| Amalgamating Company | No capital gains on transfer of assets | 47(vi) | Amalgamated Company should be an Indian Company |

| Shareholders of Amalgamating Company | No Capital Gains on transfer of shares | 47(vii) | Consideration to be in form of shares in amalgamated company (except where the amalgamated company itself is a shareholder)Amalgamated company should be an Indian company |

| Cost of acquisition of shares received on amalgamation by the shareholders | = Cost of acquisition of shares held by the shareholders in the amalgamating company | 49(2) | Transfer as referred u/s. 47(vii) |

| Period of holding of shares received on amalgamation by the shareholders | Includes period of holding of shares held by the shareholders in the amalgamating company | Expln. (i)(c) to 2(42A) | Transfer as referred u/s. 47(vii) |

| Cost of Assets for Amalgamated Company: – Stock – Capital Assets – Depreciable Assets | = Cost of acquisition of the stock / capital assets to the amalgamating company = WDV of depreciable assets held by amalgamating company | – 43C – Expln. 7 to 43(1) – 49(1) – Expl. 2 to 43(6)(c) | Amalgamated company should be an Indian company |

| Period of holding of capital assets received by Amalgamated company pursuant to amalgamation | Includes period for which capital assets were held by the amalgamating company | Expln. (i)(b) to 2(42A) r.w.s. 49(1) and 47(vi) |

Now one important question that arises is depreciation on goodwill. Finance Act 2021 has amended the provisions to prohibit depreciation on goodwill as goodwill is no longer an intangible asset. So what would be the implication on other intangibles acquired pursuant to merger and recorded as goodwill? Can the company record the difference between net assets acquired and consideration paid as intangibles in the form of IPR, Brands etc.

Carry forward of business losses and unabsorbed depreciation

As per section 72A accumulated business loss and unabsorbed depreciation of the amalgamating company shall be deemed to be business losses or unabsorbed depreciation (as the case may be) of the amalgamated company for the previous year in which the amalgamation is affected. But this is available only to industrial undertaking, banking company and public sector 6company. Companies not falling under above can look for carry forward of unabsorbed depreciation u/s 32.The carry forward of losses shall get fresh life of 8 years. Carry forward is subject to certain conditions as given in section 72A. One has to also analyse implications u/s 79 in case of change in shareholding pursuant to merger.

Demerger

Demerger (Section 2(19AA)): means the transfer of one or more undertakings to any resulting company pursuant to a scheme of arrangement under Sections 391 to 394 of the Companies Act, 1956 in such a manner that:

- All the property/liability of the undertaking becomes the property/liability of the resulting company.

- All the property/liabilities are transferred at book value (excluding increase in value due to revaluation).

- The resulting company issues shares to the shareholders of demerged company on a proportionate basis, except where resulting company is a shareholder of the demerged company.

- Shareholders holding minimum 75% of the value of shares become shareholders of the resulting company (other than shares already held therein immediately before the demerger by, or by a nominee for, the resulting company or its subsidiary).

- The transfer of an undertaking is on a going concern basis.

- The demerger is in accordance with the conditions notified under Section 72A (5) of IT Act, 1961.

“Undertaking” shall include any part of an undertaking, or a unit or division of an undertaking or a business activity taken as a whole, but does not include individual assets or liabilities or any combination thereof not constituting a business activity [Explanation 1 to Section 2(19AA)]

“Demerged company” means the company whose undertaking is transferred to a resulting company pursuant to demerger [section 2(19AAA)]

“Resulting company” means one or more companies (including a wholly owned subsidiary thereof) to which the undertaking of the demerged company is transferred in a demerger and, the resulting company in consideration of such transfer of undertaking, issues shares to the shareholders of the demerged company and includes any authority or body or local authority or public sector company or a company established, constituted or formed as a result of demerger [section 2(41A)]

In the hands of Taxability / Treatment Section Conditions Demerged Company No capital gains on transfer of assets 47(vib) Resulting company should be an Indian company Shareholders of Demerged Company No capital gains tax on receipt of shares from the resulting company 47(vid) Cost of acquisition of shares received on demerger by the shareholders = Cost of acquisition of shares in demerged company be split on the basis of net book value of the assets transferred bearing to the Net worth of the Demerged Company immediately before such demerger 49(2C) Period of holding of shares received on demerger by the shareholders Includes period of holding of shares held in the demerged company Explanation 1(i)(g) to Section 2(42A) Cost of Assets for Resulting Company: – Depreciable Assets – Capital Asset = WDV of depreciable asset to be the same as WDV in the hands of the Demerged Company = No specific provision for cost of Capital Asset acquired Expln 7A to 43(1) – Expln 2B to 43(6)(c) – 49(1) Resulting company should be an Indian company Period of holding of capital assets Includes period of holding of capital assets held by the demerged company Expln 1(i)(b) to 2(42A) r.w.s. 49(1) and 47(vib)

Definition of undertaking plays important role in demerger. What constitutes an undertaking has to be evaluated properly for the demerger to be tax neutral. It is not necessary that all assets and liabilities are to be transferred pursuant to demerger of undertaking. If the undertaking can function independently with certain assets on standalone basis, then also it is fine. Requirement is going concern and functioning as a business unit. So whatever assets and liabilities are required to function as an independent unit if only those assets and liabilities are transferred then also it will in compliance with demerger.

Recently disinvestment of public sector units is in limelight. Before disinvestment government is separating non-core assets from the company and then going for disinvestment. For example in case of BEML limited has undertaken a scheme of arrangement for demerger, transfer & vesting of the identified surplus / non-core assets from BEML Limited. Now one may question whether it would be in compliance with definition of demerger as no undertaking is getting transferred. Finance Act 2021 has made amendment in Section 2(19AA) where in even if the definition of undertaking in case of Public Sector Company is not satisfied it would be considered as demerger if it fulfils conditions notified by Central Government.

In case of demerger can a company other than resulting company issue shares as consideration to shareholders of demerged company. One can look at schemes of arrangement Havells India Limited where in pursuant to demerger instead of resulting company, holding company of resulting company issued to shares as consideration. Such type of restructuring is also used for externalisation i.e moving structure out of India. One can look at schemes of arrangement of Globep Financial Services (India) Limited, Vyome Therapeutics limited , Reckitt Benkiser (India) Private Limited. Also in case of demerger of Ajmera Realty Limited, the demerged company itself is issuing shares to shareholders pursuant to demerger.

Definition of undertaking plays important role in demerger. What constitutes an undertaking has to be evaluated properly for the demerger to be tax neutral. It is not necessary that all assets and liabilities are to be transferred pursuant to demerger of undertaking. If the undertaking can function independently with certain assets on standalone basis, then also it is fine. Requirement is going concern and functioning as a business unit. So whatever assets and liabilities are required to function as an independent unit if only those assets and liabilities are transferred then also it will in compliance with demerger.

Recently disinvestment of public sector units is in limelight. Before disinvestment government is separating non-core assets from the company and then going for disinvestment. For example in case of BEML limited has undertaken a scheme of arrangement for demerger, transfer & vesting of the identified surplus / non-core assets from BEML Limited. Now one may question whether it would be in compliance with definition of demerger as no undertaking is getting transferred. Finance Act 2021 has made amendment in Section 2(19AA) where in even if the definition of undertaking in case of Public Sector Company is not satisfied it would be considered as demerger if it fulfils conditions notified by Central Government.

In case of demerger can a company other than resulting company issue shares as consideration to shareholders of demerged company. One can look at schemes of arrangement Havells India Limited where in pursuant to demerger instead of resulting company, holding company of resulting company issued to shares as consideration. Such type of restructuring is also used for externalisation i.e moving structure out of India. One can look at schemes of arrangement of Globep Financial Services (India) Limited, Vyome Therapeutics limited , Reckitt Benkiser (India) Private Limited. Also in case of demerger of Ajmera Realty Limited, the demerged company itself is issuing shares to shareholders pursuant to demerger.

Carry forward of business losses and unabsorbed depreciation

Where accumulated business losses and unabsorbed depreciation are directly relatable to the undertaking demerged [Section 72A(4)(a)] – Entire amount of directly relatable business losses and unabsorbed depreciation is allowed to be carried forward and set off in the hands of the resulting company

Where accumulated business losses and unabsorbed depreciation are not directly relatable to the undertaking demerged [Section 72A(4)(b)] – The accumulated business loss and unabsorbed depreciation should be apportioned between the resulting company and the demerged company in the ratio of the assets transferred to the resulting company and assets retained by the demerged company and be allowed to be carried forward and set off in the hands of the demerged company or the resulting company, as the case may be.

There is no fresh life of 8 years for carry forward of losses. Only balance period can be availed.

Below are certain scenarios which need to be evaluated before going for demerger:

- Can an investments in shares and securities be considered as undertaking (Investment vs investment in SPVs – case of demerger of India Bulls Real estate)

- Can a company having only one undertaking, be demerged? (Spectra Motor Case)

- Can a project under construction be considered as an undertaking?

- If certain common assets / back-office operations are not transferred, will it jeopardize the nature of undertaking?

Tax holidays

Before considering demerger one also has to evaluate implications for companies enjoying tax holidays.

MAT Credit

- MAT payable on book profits in the absence of Nil / lower tax profits

- Credit for MAT allowable to the assessee company who has paid such taxes

- Amalgamating company ceases to exist after amalgamation

No specific provision in the IT Act for carry forward of MAT credit in case of amalgamation or demerger. However, Mumbai ITAT and Ahmedabad ITAT have endorsed a favourable view in case of amalgamation and demerger (proportionate basis) respectively

Section 56:

No implications on receipt of properties in the hands of the Transferee Company pursuant to amalgamation or demerger – Clause (IX) to the proviso of Section 56(2)(x)

Slump Sale

As per section 2(42C) – Slump sale is

- the transfer of one or more undertakings

- by any means for a lump sum consideration

- without values being assigned to individual assets and liabilities in such sales

- Explanation – Determination of value of an asset or liability for the sole purpose of payment of stamp duty, registration fees or other similar taxes or fees shall not be regarded as assignment of values to individual assets or liabilities

Capital gains

Capital gains in the hands of seller Section 50B:

- Capital Gains = Consideration less Net Worth (deemed COA) of Undertaking

- No indexation benefit will be available

- Net worth = Aggregate value of total assets of the undertaking – Book value of liabilities of such undertaking

- Value of total assets = Tax WDV of depreciable assets + Book value of other assets • Capital Gains will be classified as long-term, if undertaking is held for more than 3 years

Slump Exchange is a scenario where instead of lump sum cash consideration, shares are issued to the transferor company. There were litigations on taxability of such transaction. But now even slump exchange is covered under the ambit of slump sale and taxable as per the provisions of section 50B.

Earlier companies used to transfer business under slump sale to its wholly owned subsidiary (WOS) at tax net worth and subsequently selling the WOS or raising stake in WOS at fair value. However post amendment in 2021 now Slump sale has to be done at fair market value even if it is slump sale to WOS.

Recently Cipla Limited has filed one scheme of arrangement wherein it is transferring two undertakings to two wholly owned subsidiaries without any consideration. Even Lakshmi Machine Works Limited is doing slump sale of its aerospace division for which consideration will be discharged in the form of debentures.

Itemised Sale

- Not defined under IT Act

- Involves individual sale of assets

- Consideration is identifiable against each asset

- Buyer discharges consideration to the seller for the asset acquired

Tax Implications:

| Nature of Assets | Nature of Income |

| Depreciable Assets | Provisions of Section 50 are applicable − Short term capital gains (if the consideration > WDV of the relevant block of asset) |

| Non-Depreciable Assets | Short term capital gains / Long term capital gains (Depending on the period of holding) |

| Current Assets | Business Profits |

Capital reduction

Capital reduction is resorted to by a company in following scenarios:

- Writing of accumulated losses against Equity capital / securities premium

- Return of capital to shareholders

- Giving exit to selective shareholders

- Distribution of investments to shareholders

Tax Implications:

| Tax implications in the hands of Company | Distribution to shareholders by a Company on the reduction of its capital is deemed as dividend to the extent to which the Company possesses accumulated profits, whether capitalized or notDeemed dividend u/s 2(22)(d) is subject to withholding tax u/s 194 |

| Tax implications in the hands of shareholders | Reduction of share capital by a company and pro-rata distribution of cash / assets to the shareholders amount to transfer and therefore, taxable as capital gainsFor determining the amount liable to capital gain tax, full value of consideration is reduced by the amount, which has been reckoned as dividend |

| Other provisions | Capital loss on account of capital reduction in the hands of the shareholders not involving payment of any consideration cannot be allowed under the provisions of IT Act. [Bennett Coleman & Co. Ltd. v. The Addl. CIT (ITA No 3013/MUM/2007)] As there is no receipt of shares by the company, Section 56(2)(x) – Not Applicable |

As discussed above the companies undertake restructuring taking into consideration its objective, growth prospects, changing business scenario etc. Before undertaking any restructuring one has to analyse the commercial as well as tax implications so that the ultimate objective achieved to be is cost effective and beneficial to the company. Restructuring if done properly it can be a boon or it can become self-destructing weapon.

Stay tuned for regulatory implications in mergers and acquisition.