SA 300 – Planning an Audit of Financial Statements

- This Standard is effective for audits of financial statements for periods beginning on or after April 1, 2008.

- It deals with the auditor’s responsibility to plan an audit of financial statements. This SA is framed in the context of recurring audits. Additional considerations in initial audit engagements are separately identified.

- It covers various aspects of planning the audit engagement.

It is a known fact that the primary responsibility of an auditor is not to detect fraud. However, detection of fraud by an auditor is because of a well-planned audit.

Once audit strategy is in place, audit plan can then be developed which include the description of:

The nature, timing and extent of risk assessment procedures control risk + Inherent risk + Detection risk = Total audit risk.

The nature, timing and extent of further audit procedures (substantive tests + other substantive tests).

The nature timing and extent of other audit procedures.

Changes in Planning Decisions during Engagement

Planning is not a one-time activity, auditor may need to revisit the audit strategy and audit plan as changes in situation dictates (change in the nature, timing, and extent of audit procedure). Such changes occur due to

- Unexpected events

- Changes in condition e.g. Scope

- Audit evidence – The auditor may become aware of discrepancies in accounting records or conflicting or missing evidence.

- Acquiring information that is significantly different from the information the auditor had as at the time of planning.

Other factors that may cause change in the audit plan include:

The extent of misstatement that the auditor detects while performing substantive procedures may alter the auditor’s judgement about the risk assessments and may indicate a significant deficiency in internal control.

Analytical procedures performed at the overall review stage of the audit may indicate a previously unrecognized risk of material misstatement.

In such circumstances the auditor may need to re-evaluate the planned audit procedures, based on the revised consideration of assessed risks for all or some of the classes of transactions, account balances, or disclosures and related assertions.

A Report on Audit Quality Review Findings by Quality Review Board

Audit Plan made by the audit firm was not elaborate as it did not cover the nature, timing and extent of direction and supervision of engagement team member regarding the vouching part of the Audit engagement.

• The audit strategy and program did not include specific details about related parties and the material transactions as made known by the management and the same was not effectively communicated to the audit team members.

• The audit programs have not been filed and signed by the persons auditing and reviewing the assignment.

• Audit firm had not prepared any document to provide sufficient and appropriate record of the basis of audit report and evidence that the audit was planned and performed in accordance with auditing standards and applicable legal regulatory requirement.

• Audit strategy, audit plan and audit programme had been intermingled by the firm. However, the overall audit strategy should be documented separately in accordance with SA- 300, and the audit plan should also consider the Directions and sub- directions given by CAG u/s 619(3) of the Companies Act, 1956 to be complied with

In respect of Audit Planning and Risk Assessment, there was no detailed Audit Planning Memorandum; and audit procedures carried out were not complete.

• There was no evidence of any audit planning or risk assessment by audit firm. Improvement in Audit Programme &Procedure in the light of experience gained during audit was not evident and documented. The Audit Programme required improvement to enlarge the extent and scope of physical verification of security charged to minimize the perceived risk in this regard.

The Audit programme was initialled by the engagement partner and not by the concerned team members/assistants who have carried out the verification process.

• Firm did not include all the elements of how the audit plan assessed and addressed the fraud risk in the audit of financial statements.

SA 315 – Identifying and Assessing the Risk of Material Misstatement through understanding the Entity and its environment.

- This Standard is effective for audits of financial statements for periods beginning on or after April 1, 2010.

- It deals with the auditor’s responsibility to apply the concept of materiality in planning and performing an audit of financial statements.

- This Standard covers various aspects of audit materiality like determining materiality during the planning stage, revision of materiality during the audit.

The standard is iterative in nature, and the auditor is required to exercise professional judgment in determining the nature and extent of the procedures to be undertaken.

A Report on Audit Quality Review Findings by Quality Review Board

The risks of material misstatements to the financial statements were not identified at the planning stage and there were not sufficient documentation in case of any rebuttals.

• No formal risk assessment had been done by the firm to provide a basis for the identification and assessment of risks of material misstatement at financial report and assessment level.

• Audit risk analysis was not comprehensive to make it to commensurate with size and nature of the business.

• The firm had not documented the audit procedures performed during the course of audit for identifying and assessing the risk of material misstatement.

• Identification/assessment of risks was not found documented in the audit file.

• Audit procedures responsive to assessed risk s, were not found to be documented in the audit files and further there was no discussion paper held of possible discussions within the team regarding the susceptibility of the financial reports to material misstatements.

• The audit firm had no evidences of any audit planning or risk assessment performed by the firm.

The auditor should make a combined assessment of the inherent and control risk and enable himself to design and implement his responses to the assessed risk of material misstatement as it will help him to reduce the risk of material misstatement to an acceptably low level.

SA 320, Materiality in Planning and Performing an Audit

- This Standard is effective for audits of financial statements for periods beginning on or after April 1, 2010.

- It deals with the auditor’s responsibility to apply the concept of materiality in planning and performing an audit of financial statements.

- This Standard covers various aspects of audit materiality like determining materiality during the planning stage, revision of materiality during the audit.

Factors/ aspects that determine Materiality –

there are many factors which influence materiality level. Some major ones are listed below:

a) Requirement of Law → In many countries law defines materiality level. In India Revised Schedule VI sets materiality level at 1% of the revenue from operations or 100,000 Rs whichever is higher. This is the materiality level we use in accounting for disclosing material transactions separately. We can consider this when we want to set materiality level in audit.

b) Size & nature of the business – Larger the size of the company higher the materiality level and vice-versa.

c) In many cases we come across misstatements which are insignificant in value → but they are quality misstatement. For example: Accounting Standards are not followed or Revised Schedule VI is not followed etc. → Such misstatement though small in size becomes material and needs to be considered by auditor. This holds particularly true in case of India because Compliance with Accounting Standards and Revised Schedule VI is compulsory and if it is not complied with auditor must report the same.

d) Complexity of transactions – increases the materiality level

e) In case of statutory dues even one rupee will be material (irrespective of size of the company) – For example law requires certain dues to be collected (like indirect taxes) and deposited in banks on behalf of the Government. In such cases even small amounts become material. Make sure that the dues are properly collected and deposited by the auditor.

f) There are some misstatements which are not material individually, but they are material when aggregated. Therefore, auditor should consider materiality both individually and in aggregate (total). For Example: a misstatement of say Rs 100,000 may not be material for a big company individually. But if the same misstatement is repeated say 50 times the amount comes to Rs 5,000,000 which may be material. Therefore. auditor should consider materiality both individually and in aggregate.

g) Inherent and controls risk – Inherent risk refers to the risk that there may be some misstatements in financial statements. Whereas control risks refer to the risk of misstatements even when the internal controls are implemented by the management. It means that due to these risks there is a possibility of misstatements. Auditor should consider such risks when he wants to set materiality level in audit.

Methods used to set materiality level – How Materiality level is set in Audit as per SA-320?

Benchmarking means applying a percentage to a chosen benchmark for determining materiality level when a audit of financial statements is conducted by auditor. Where benchmark can be placed? – Areas where benchmarks can be placed are: Gross Profits/ Net Profits, Net assets, Total equity, total expenditure etc. We must select one area from the examples mentioned here.

Areas selected to set a benchmark

a) The areas where the shareholders focus is placed can be taken as a base for setting benchmarks. In majority of the cases shareholders focus is placed on profitability of the company. So, you can choose profit as your benchmark.

b) The area chosen should be relatively less volatile – if there is significant change in profits every year auditor should not choose profits as benchmark. In such cases he can choose assets as benchmark.

Once a benchmark is chosen by auditor a percentage is applied to it to arrive at materiality level. You can apply a percentage in the range of 3-5% in case you choose Gross or Net profit as your benchmark for calculating materiality level. Similarly, you can apply 1% when you choose total assets/ revenue or expenditure as your benchmark for calculating materiality level. A higher percentage is applied to Gross and Net profits because they are smaller in terms of money as compared to total assets/ revenue and expenditure. You can watch the video for exact calculation of materiality level using benchmarks.

Performance materiality SA 320

Before discussing performance materiality, we will discuss the meaning of uncorrected and undetected misstatements. Unless we understand these two concepts it will be difficult to understand performance materiality.

Uncorrected Misstatements – means misstatements that are detected by auditor, but the misstatements are not corrected by management.

You will rarely come across this scenario when practicing audit because management usually rectifies the misstatements during the course of audit.

Undetected Misstatements – it means an estimate of misstatement which may be undetected. Now this is the main reason why we set Performance materiality – there is a possibility that some misstatements will not be detected even when audit is conducted properly by the auditor.

Meaning of Performance Materiality – Performance Materiality is a level of materiality which is set by auditor at less than materiality level. Say your materiality level is Rs. 100 you will set performance materiality at less than Rs. 100. Why? This is done to reduce the possibility that the aggregate of uncorrected and undetected misstatements exceeds materiality level set for the Financial statements as a whole. It acts as a cushion for auditor. Performance materiality set by the auditor reduces the audit risk.

What is the Purpose behind setting Performance Materiality?

Auditor determines performance materiality for purpose of assessing the risks of material misstatement and determining the nature, timing and extent of further audit procedures. Auditor will perform additional procedures when the performance materiality is approached. It helps auditor to determine whether the financial statements are materially misstated.

Key findings of QRB

The basis of considering the benchmarks for determining the materiality was not documented along with the revised performance materiality and the nature, timing, and extent of the further audit procedures in case where the revised materiality was lower than that initially determined by the auditor.

• There were no documents on record determining the materiality for the report and for assessing the risk of material misstatement.

• Audit firm had not determined materiality for the report as a whole and performance materiality as per the standard on auditing SA 320-Materiality in Planning and performing an Audit; but determined the materiality based on past experience and risk and control assessments.

• No evaluation had been done to determine materiality level for particular class of transactions, account balances, or disclosures.

SA 330 – The Auditor’s Responses to Assessed Risks

- This Standard is effective for audits of financial statements for periods beginning on or after April 1, 2008.

- It deals with the auditor’s responsibility to design and implement responses to the risks of material misstatement identified and assessed by the auditor in accordance with SA 315.

Test of Controls

Controls must be tested to confirm its operating effectiveness and sufficient appropriate audit evidence to be obtained when:

- There is an expectation that the controls are operating effectively.

- Substantive procedures alone cannot provide sufficient appropriate audit evidence at the assertion level.

More persuasive audit evidence, the greater the auditor relies on the control effectiveness.

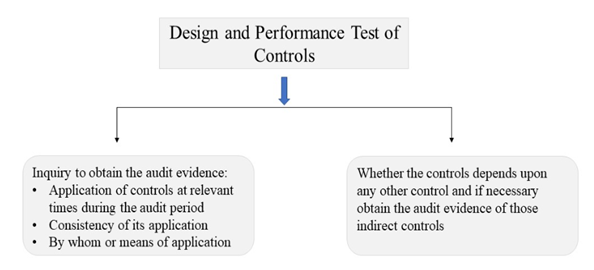

Nature and Extent of Test of Controls

Controls over Significant Risks

Any significant risk in auditor’s opinion should be tested in the current period. During this process, evaluate whether there are any misstatements detected by substantive procedure indicates the control are not operated effectively. If there are deviations, the auditor should understand its potential consequences through specific inquiries and determine:

- Test of controls performed to provide an appropriate basis for reliance.

- If an additional test is necessary

- If the potential risk of misstatement is to be addressed using substantive procedures

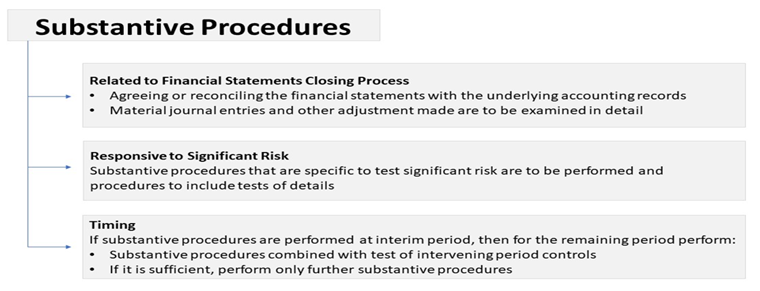

Irrespective of assessed risk of material misstatement, substantive procedures for each material class of transaction, account balance and disclosure are to be performed:

If misstatement that the auditor did not expect arises at an interim date, then the nature, timing, and extent of substantive procedures for the remaining period must be modified.

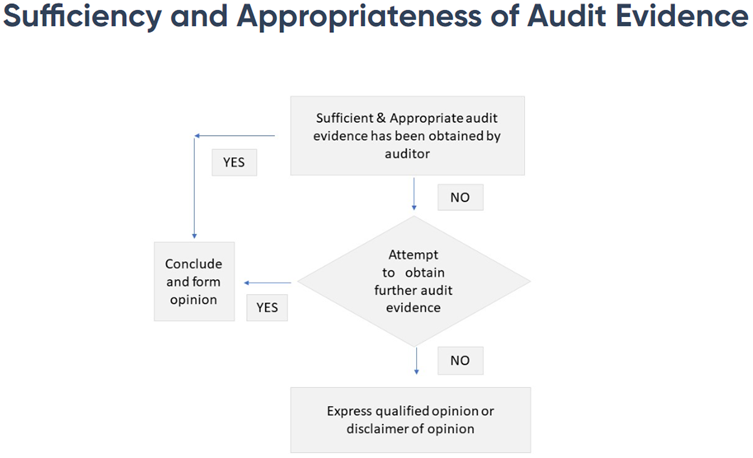

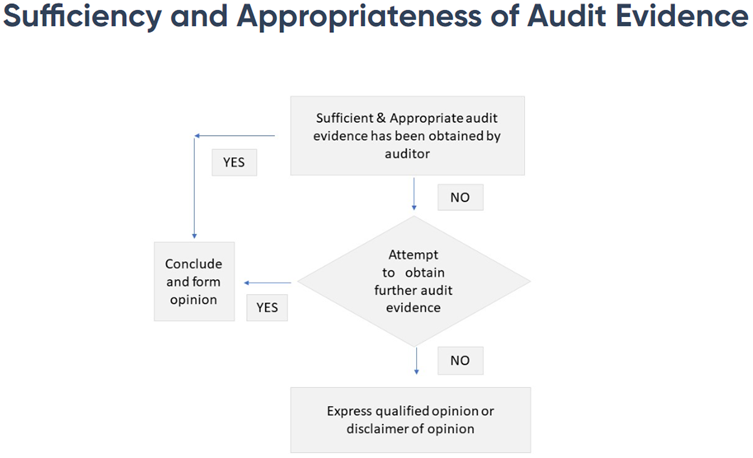

Before the conclusion of the audit, the auditor should determine whether the audit procedures performed, and audit evidence obtained is appropriate for the assessment of the risk of material misstatement at the assertion level. An auditor should consider all relevant evidence regardless of whether it appears to corroborate or to contradict the assertions.

Key findings of QRB

- Not considering material RPT transactions as high-risk item.

- Failure to document audit procedure performed for treating certain litigation and claims as non-contingent.

- Failure to plan for overall audit / procedures.

- Work papers wherein substantive testing was performed were not cross referenced to the groupings/ trial balance with reference numbers in all cases.

- The aspects of the external factors affecting the entity, the laws and regulations and their monitoring by the Entity are to be covered.

- Audit plan and programmes were not comprehensive to cover all aspects and the audit strategy did not contain applicable reporting framework and other legal regulatory requirement.

SA 450, Evaluation of Misstatements Identified During Audit

- This Standard is effective for audits of financial statements for periods beginning on or after April 1, 2010.

- It deals with the auditor’s responsibility to evaluate the effect of identified misstatements on the audit and of uncorrected misstatements, if any, on the financial statements.

- It covers various considerations for auditor regarding evaluation of misstatements identified during the audit.

Auditor’s Communication & Correction of Misstatements

- Communicate on a timely basis to the appropriate level of management (unless prohibited by law or regulation)

- Request management to correct those misstatements.

- If management refuses to correct misstatements, the auditor should understand the reason for the same.

- Based on the understanding auditor should evaluate whether the financial statements as a whole are from material misstatements.

Effect of Uncorrected Misstatements

Before evaluating the effect of uncorrected misstatements, the auditor should reassess materiality per SA 320 to confirm whether it remains appropriate to the entity’s financial results by taking into account:

- Size and Nature of the misstatements both in relation to particular classes of transactions account balance or disclosures etc and circumstance of their occurrence.

- Effect of uncorrected misstatements related to prior periods on the relevant classes of transactions, account balance or disclosure, and the financial statements as a whole.

Communication by the Auditor to those charged with governance.

- Uncorrected misstatements and the effect they may have on the auditor’s report unless prohibited by law or regulation.

- Identified material uncorrected misstatements individually.

- Request uncorrected misstatements are corrected.

Written Representation

If in an auditor’s opinion, the effect of uncorrected misstatements is immaterial (individually or in aggregate) to the financial statements, a written representation should be obtained from the management with the summary of such items.

Documentation

- Materiality limit – determining the trivial amount.

- All misstatements accumulated during the audit and if those are corrected.

- Whether uncorrected misstatements are material, individually or in aggregate and its conclusion.