Impact of GST on e-Commerce Industry – A Complete Guide

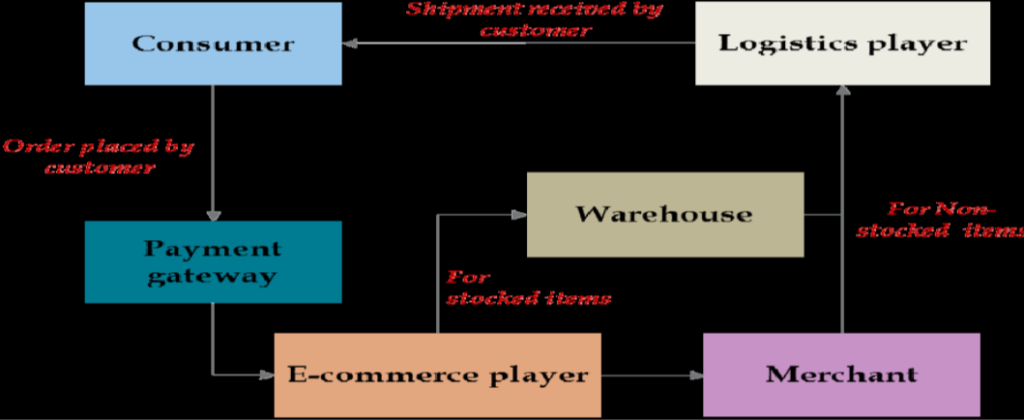

E-commerce has become a highly lucrative form of business. But there are several red flags when it comes to e-commerce platforms fitting into the traditional format of business given the hybrid model of their operations. There is a lack of clarity whether the platform is a seller or a service provider. There are questions as to who is responsible for the collection of taxes. In this article, we will discuss the impact of GST on the e-commerce industry.

E-Commerce Industry

E-commerce i.e Electronic commerce which simply means supply of goods and services through electronic mode over the internet moreover, in legal term Electronic Commerce has been defined in Sec. 2(44) of the CGST Act, 2017 to mean the supply of goods or services or both, including digital products over digital or electronic network.

E-commerce Operator (ECO) i.e. Electronic commerce operator is a person providing any information or any other services incidental to or in connection with such supply of goods and services through electronic platform would be considered as an Operator moreover, in legal term Electronic Commerce Operator has been defined in Sec. 2(45) of the CGST Act, 2017 to mean any person who owns, operates or manages digital or electronic facility or platform for electronic commerce.

Every E-commerce transaction involves below 3 parties:

- Seller

- Buyer

- ECO i.e. E-commerce Operator

FAQ Who is considered As E-Commerce Operator?

- As per the above definition someone who is providing a platform for others to sell goods or services is taken into account an e-commerce operator. Main examples of such operators selling goods are Amazon, Flipkart, Snapdeal and operators selling services are Uber, Ola, Swiggy, Urban Clap.

- A person selling goods or services through his personal website isn’t an e-commerce operator and so below provisions don’t apply to them. Such a suppliers is required to charge GST and file returns.

Types of Business Models in the E-Commerce Industry

GST on e-Commerce Industry – There are two main kinds of models in the e-commerce industry.

- The Inventory Model

- The Aggregator Model

Let us take a look at both of these models in depth.

Inventory Model

In this model E-Commerce Operator (ECO) purchases / manufacture the goods and sells them on the E-Commerce platform. He provides his services on the E-Commerce platform.

In this model, the ECO will either purchase from supplier or manufacture on its own. In Case of Purchase, the supplier will sell the goods or services first to the E-Commerce operator and the E-Commerce operator will further sell the goods/services to the Customer.

Invoicing will be done as follows in these cases:

- Invoice No.1: Supplier to E-Commerce Operator:

Invoice will be raised by the supplier to the E-Commerce operator with their GSTN numbers. The seller in the invoice will be the Supplier and the customer in the invoice will be the E-Commerce operator.

- Invoice No.2: E-Commerce operator to Customer:

Invoice will be raised by the E-Commerce operator to the Customer for sales. The seller in the invoice will be the E-Commerce operator and the customer in the invoice will be the Ultimate consumer purchasing the goods or services.

In Case of own manufacturing, ECO will directly raise Invoice no.2 from the above example.

Aggregator Model

This is the model adopted by most top e-commerce entities like Flipkart, Swiggy, Amazon, Urban clap, and most of the others. In this E-Commerce operator will just provide a platform where suppliers can register themselves and advertise their products to the customers. In this case, ECOs will charge a fee/commission from the supplier for its services.

- Invoice No.1 – From Supplier to Customer:

The invoice will be raised by the supplier to the customers directly. (This happens on Amazon and Flipkart) The seller on the invoice will be the supplier along with his GSTN number and the buyer on the invoice will be the Customer.

- Invoice No.2 – From ECO to Suppliers:

ECO will raise an invoice to its suppliers for collecting the fees and commission. The seller in the invoice will be the e-Commerce operator and the customer in the invoice will be the Supplier supplying the goods or services.

Registrations

After understanding primary models of E-Commerce Industry, now let us understand registration requirements of said sector;

Section 24: Compulsory registration in certain cases (Relevant Part)

“Notwithstanding anything contained in sub-section (1) of section 22, the following categories of persons shall be required to be registered under this Act,-

(iv) Persons who are required to pay tax under sub-section (5) of section 9,

(ix) Persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator who is required to collect tax at source under section 52,

(x) Every electronic commerce operator,

(xi) Every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person,”

Section 9(5): Levy and Collection:

“The Government may, on the recommendation of the Council, by notification, specify categories of services the tax on intra-State supplies of which shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the person liable for paying the tax in relation to the supply of such services:

Provided that where an electronic commerce operator does not have a physical presence in the taxable territory, any person representing such electronic commerce operator for any purpose in the taxable territory shall be liable to pay tax:

Provided further that where an electronic commerce operator does not have a physical presence in the taxable territory and also he does not have a representative in the said territory, such electronic commerce operator shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax. ”

In view of the above provision in the Act, the Central Government had issued the Notification No. 17/2017- Central Tax (Rate) wherein following services were notified:

- services by way of transportation of passengers by a radio-taxi, motorcab, maxicab, motor cycle, omnibus or any other motor vehicle;

- services by way of providing accommodation in hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes, except where the person supplying such service through electronic commerce operator is liable for registration under sub-section (1) of section 22 of the said Central Goods and Services Tax Act.

- Services by way of house-keeping, such as plumbing, carpentering etc, except where the person supplying such service through electronic commerce operator is liable for registration under sub-section (1) of section 22 of the said Central Goods and Services Tax Act.

- Supply of restaurant service other than the services supplied by restaurant, eating joints etc. located at specified premises

From the above it can be noted that, in case of Persons getting covered u/s 9(5) E-Commerce Aggregator are required to take up registration regardless of the threshold limit. However, the supplier making supplies through such aggregator would be allowed to take up advantage of threshold limit of GST registration. In all other cases Sec 24 mandates the supplier to compulsory acquire registration for supplies made through E-commerce operator.

| Particulars | Examples Of E-Commerce operator | Registration requirement for seller | Person liable for GST collection |

| Supply of Goods | Amazon, Flipkart , Snapdeal | Yes, Seller Is Required to register | Seller |

| House Keeping Services, With Turnover Below Threshold Limit | Urban Clap | No, seller is Not Required to register | Operator |

| House Keeping Services, With Turnover Above Threshold Limit | Urban Clap | Yes, Seller Is Required to register | Service Provider |

| Other Service Including Food Aggregators, With Turnover Below Threshold Limit | Swiggy , Zomato | No, seller is Not Required to register | Operator |

| Other Service Including Food Aggregators, With Turnover Above Threshold Limit | Swiggy , Zomato | Yes, Seller Is Required to register | Service Provider |

FAQ1 Are e-commerce operators mandatorily required to take up GST registration?

Yes, GST registration is mandatory for all e-commerce operators, irrespective of their turnover. Thus, before making any supplies as an ecommerce operator or within 30 days of making such supplies, the supplier shall apply for GST registration.

FAQ2 Should the sellers be required to take up GST registration, even in case of using e-commerce platforms?

Yes, suppliers supplying their product (other than those specified u/s 9(5)) using e-commerce platforms, are required to obtain GST registration irrespective of their sales turnover.

FAQ3 Can e-commerce suppliers store their goods during a common warehouse?

Yes, suppliers on an ecommerce platform can store their goods at a typical warehouse. However, before storing goods, the supplier is required to add the said warehouse of thee-commerce operator as a place of business on the GST portal.

FAQ4 Who is susceptible to Collect And Pay GST – E-Commerce Operator Or E-Commerce Sellers?

Selling Goods – The e-commerce seller is responsible for the collection of GST and pay to the govt.

Selling services apart from mentioned in Section 9(5) – The e-commerce seller is liable for collection of GST and pay to the govt.

Selling services mentioned in Section 9(5) – The e-commerce operator is susceptible to collect and pay GST to the govt.

PLACE OF SUPPLY

GST is a destination based tax, i.e., the goods/services will be taxed at the place where they are consumed/used and not at the origin. So, the state where they are consumed will have the right to collect GST.

This makes the concept of the place of supply crucial under GST as all the provisions of GST revolves around it.

The Place of supply of goods under GST defines whether the transaction will be counted as intra-state or inter-state, and accordingly levy of SGST, CGST & IGST will be determined. Wrong determination of place of supply will result in tax collection by the wrong state. For example, inter-state supply is wrongly treated as intra-state supply and CGST & SGST filled instead of IGST. The only option is to pay IGST separately and claim a refund of CGST & SGST.

In very simple words, where you are selling from does not matter. Where your goods are going is relevant.

This would apply to all e-commerce platforms, sellers such as those who sell on Amazon.

Let us go through the provisions of the place of supply for goods:

Example 1: Intra-state sales

Mr. Raj of Mumbai, Maharashtra orders a mobile from Amazon. The seller Happy Mobiles is registered in Nagpur, Maharashtra.

The place of supply is Mumbai in Maharashtra. The location of the supplier is in Mumbai. Since the place of supply is in the same state as that of the location of the supplier, CGST & SGST will be charged.

Example 2: Inter-State sales

Mr Raj of Mumbai, Maharashtra orders a mobile from Amazon. The seller Mobile Junction is registered in Bangalore, Karnataka.

The place of supply here is in Mumbai, Maharashtra. Since the location of the supplier( i.e. Bangalore) is in a different State when compared with the place of supply (i.e. Mumbai) IGST will be charged.

Example 3: Send to a third party

Mr Raj of Mumbai, Maharashtra orders a mobile from Amazon to be delivered to his mother in Lucknow (UP) as a gift. M/s All Mobiles (online seller registered in Gujarat) processes the order and sends the mobile accordingly and Mr Raj is billed by Amazon.

It will be assumed that the buyer Mr Raj in Maharashtra has received the mobile even though it was actually delivered to his mother.

The place of supply here is in Mumbai, Maharashtra. Since the location of the supplier( i.e. Gujrat) is in a different State when compared with the place of supply (i.e. Mumbai) IGST will be charged.

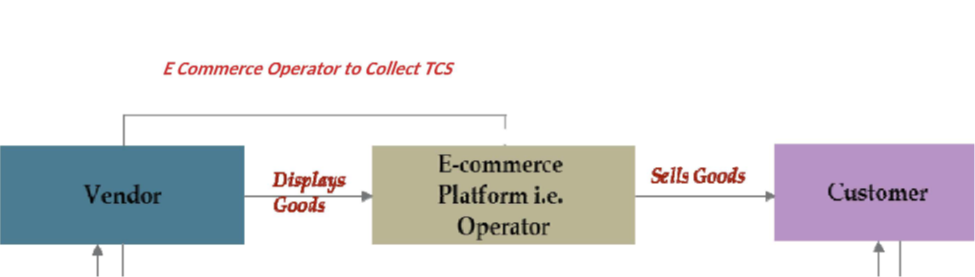

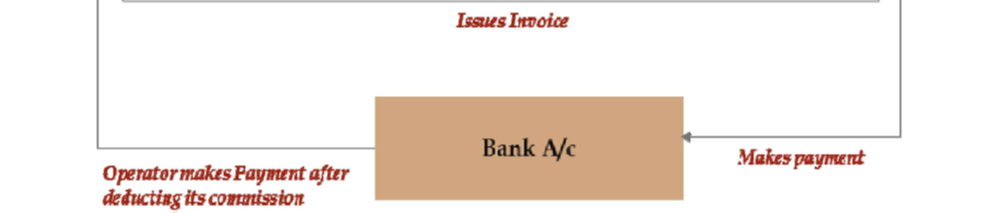

TAX COLLECTED AT SOURCE ON E – COMMERCE OPERATOR

Section 52: Collection of tax at source

“(1) Notwithstanding anything to the contrary contained in the Act, every electronic commerce operator (hereinafter referred to in this section as the “operator”), not being an agent, shall collect an amount calculated at such rate not exceeding one percent, as may be notified by the Government on the recommendations of the council, of the net value of taxable supplies made through it where the consideration with respect to such supplies is to be collected by the operator.

Explanation.- For the purposes of this sub-section, the expression “net value of taxable supplies” shall mean the aggregate value of taxable supplies of goods or services or both, other than services notified under sub-section (5) of section 9, made during any month by all registered persons through the operator reduced by the aggregate value of taxable supplies returned to the suppliers during the said month.”

Tax Collected at Source (TCS) provides for mechanism, wherein the e-commerce operator is required to collect a specified percentage of payment to e-commerce supplier, when the supplier make supply of specified goods or service using its portal. The said amount of TCS collected must be remitted to government within 10th of next month, from the month in which the invoice is generated.

The supplier who has supplied the goods or services or both through the operator shall claim credit of such TCS, in his electronic cash ledger.

FAQ1 What is the rate of GST TCS?

TCS shall apply at the speed of 1% on the overall net value of the products or services supplied through the e-commerce operator.

For example, where the value of the products sold to a customer amounts to Rs.1lakh, the e-commerce operator is required to collect and deposit Rs.1000 from the payment to be made to the supplier, as Tax Collected at Source.

FAQ2 What is the due date for remitting GST TCS?

The e-commerce operator shall remit the GST TCS to the govt., within 10 days after the end of the relevant month.

FAQ3 How to claim the credit of TCS deducted by e-commerce operators?

The supplier is eligible to claim the credit of TCS deducted by the e-commerce operators. The said amount of TCS collected can be used by the supplier to set off their GST liability while filing GSTR 3B.

FAQ4 Will online travel agents be responsible for TCS?

Yes, online travel agents supplying services using an ecommerce platform would be susceptible to TCS.

GST Returns Filing

- E-commerce suppliers/aggregators are required to file Form GSTR-1 and GSTR 3B monthly and GSTR-9 is to be filed annually.

- E commerce operators are required to file their GST return in form GSTR 8 in monthly basis.

- Form GSTR 8 is one of the most important form which need to be taken utmost care for an E-commerce operator.

- Form GSTR 8 is a statement that must be filed by E-commerce operators every month. It must contain the details of supplies made to customers through the taxpayer’s E-commerce portal by both registered taxable persons and unregistered persons, customer’s basic information, the amount of tax collected at source(TCS) (to be counted at 1%) , tax payable, and tax paid.

Impact of GST on e-Commerce Industry

- Increased Compliance Burden:

One of the significant impacts of GST on the e-commerce industry is the increased compliance burden. E-commerce companies are required to comply with various GST registration regulations, including registering for GST, filing GST return, and collecting and remitting GST on behalf of sellers. The increased compliance burden has led to increased costs for e-commerce companies, particularly smaller players.

- Uniform Tax Structure:

The introduction of GST has led to a uniform tax structure across the country, which has benefitted e-commerce companies. Earlier, different states had different tax rates, which made it difficult for e-commerce companies to calculate and collect taxes. The uniform tax structure has made it easier for e-commerce companies to operate across the country and has reduced the complexity of tax calculations.

- Impact on Tier II and Tier III Suppliers:

The introduction of GST has had a significant impact on small and medium-sized enterprises primarily suppliers from Tier II and Tier III cities which are were earlier making supplies through e-commerce platforms. Such Suppliers selling through e-commerce platforms are required to register for GST and comply with GST regulations. The compliance burden and increased costs have made it challenging for such small and medium –sized enterprises to operate in the e-commerce industry, leading to a decline in the number of small and medium –sized enterprises selling through e-commerce platforms.

- Impact on Prices:

The impact of GST on prices in the e-commerce industry has been mixed. While the introduction of GST has led to a reduction in the prices of some goods, the prices of other goods have increased due to the increased compliance burden and costs for e-commerce companies. The impact on prices varies depending on the product and the e-commerce company.

Concluding Remarks:

In conclusion, although it’s not easy to conclude such a vast topic but in my opinion GST is one of the biggest fiscal reforms that our country has witnessed. It is a unified taxation system in a federal country like India.

Though the compliance under GST has increased for the E-commerce industry, still it improves the market for the local suppliers as they can sell in any state with same tax rates, this will promote more sellers to go online and provide best services to the customers.

In simple terms it can be understood that the State will be able to make revenue from this sector, but some practical implications are there, but overall implementation of GST on e-commerce is appreciable.