PROFESSIONAL OPPORTUNITIES IN E-COMMERCE SECTOR

Growth of E-commerce in India:

The introduction of ‘INTERNET’ and the economic reforms such as Liberalisation and Globalisation introduced in 1991 marked the beginning of the first wave of E-commerce in India. The digital and economic reforms in India attracted Multi-National Corporations (MNC’s) and gave rise to significant growth in Information technology and E-commerce.

The term E-commerce is widening its reach and base in terms of variety of products and services day by day. E-commerce has reached to an extent where one can order from a pin to air plane tickets online, also one can find a spouse or a CA to file their returns or lawyers to give legal advice or to consult a doctor for medical condition online with the help of internet. The wide reach of the Internet in the country has made it possible for a seller / service providers to reach to the most remote locations of the country just sitting in front of his computer system.

Note: The above image is taken from article at Indian Express, showing a Bangalore Rickshaw driver showing QR code for Payment on his smart wrist watch for payment of autorikshaw booked on @nammayatri app developed by the Auto rickshaw puller union association.

This is just an example to understand the far reaching impact of the E-commerce in our day to day activities.

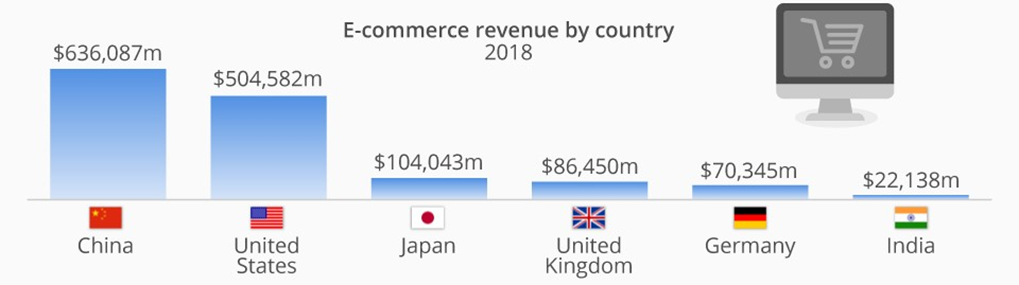

Note: Image is sourced from Statista DMO.

The above pictorial statistical data shows that E-commerce in India was still spreading its wings in early 2018. Even though India had 2nd highest population in world, the E-commerce market in India was still 6th in the World till 2018. This suggests the possibility of growth that is yet to be achieved.

After the initial boost to the E-commerce activities due to the widespread Internet, the global pandemic of COVID-19 acted as ‘AAPDA MAI AVSAR’ (as quoted by our honourable Prime Minister). Entire country was in Lockdown and all the major sales of essential items were done through E-commerce, which acted as an enabler to widen the customer base for the E-commerce business and in turn increasing more transactions and consequentially higher Revenue.

Professional Opportunities in E-commerce:

1: Opportunities in Records Keeping

E-commerce uses various models of operations such as Inventory Model, Fulfilment Model, and Marketplace Model etc so as to ease the logistics and other services / supply to the end consumer. Such different models / mix of multi models used in E-commerce activities results in details record keeping with a perspective of presentation user-friendly for the stakeholders and compliant with the legal requirements.

It results in an opportunity for the professionals who has in-depth understanding of the operations of E-commerce to help the E-commerce Companies in setting up the infrastructure for record keeping and provide support for MIS and Regulatory requirements.

Not only the E-commerce companies the stakeholders such as sellers selling through E-commerce companies / Service providers listing their services on E-commerce companies etc also have to go through the process of record keeping of the transactions done through E-commerce companies. This act as an opportunity for the professionals to provide record keeping and allied services to the stakeholders.

2: Opportunities in Compliances

Compliances in Direct Tax:

With the increase in transactions of E-commerce companies / through E-commerce companies, government in order to nab the unscrupulous section of the assesse had introduced compliance of TDS Provisions. This provision requires the E-commerce companies to deduct TDS on the sales transaction effected through E-commerce operator’s website. Further TDS payments are to be made to the treasury on a timely manner and information of such compliance to file in appropriate return form to CBDT. Professionals can assist in complying with this provision to the E-commerce operators.

Further the Deductee’s also requires to check the TDS deducted and reconcile the same with the supplies made through E-commerce operators. Professional can help the Deductee’s by assisting in reconciling the TDS amounts deducted and filing of Income tax returns for claiming the credit of TDS so deducted.

Also TDS is to be deducted by the sellers supplying through Ecommerce companies (if TDS provisions are applicable to them) for various services such as referral fee or logistics fees etc charged by the E-commerce company. Professionals can assist in compliance of such TDS provisions.

Also additionally lower TDS deduction application can be done where the deduction of TDS is resulting in additional block of working capital for the E-commerce companies (as their tax liability is lesser due to heavy expenses such as marketing etc which is very common in the initial years of set up and customer traffic acquisition). Professional can provide services to E-commerce Company to apply and obtain lower deduction certificates from CBDT.

Compliances in GST:

After the introduction of GST, the charging point of tax was shifted from Manufacture / Sale to Supply. Since there are many intermediaries involved in a single E-commerce transaction, it becomes critical to determine which limb of the transaction will be considered as supply and taxes will be applicable on which supplies. (For e.g., When an seller supplies the goods to E-commerce Operator, Customer placing an order on E-commerce Platform, E-commerce Operator invoicing to the customer on behalf of seller, E-commerce Company charging certain fees for their services to the seller, E-commerce operator handing over the goods to the Logistics partner and so on so forth).

Further GST law when introduced though presented as ‘ONE NATION ONE TAX’ but in compliance it is ‘ONE NATION 36 TAXES’ (since there are 28 states and 8 union territories). The GST Act considers branches of same E-commerce Company in different states as distinct person and the Taxation of each supply from oneself in one branch in one state to branch in another state is considered as taxable.

Professionals can assist the taxpayers who are E-commerce Operators or supplying through E-commerce Operators in structuring the systems such that all the legal compliances of GST are properly been taken care off. Professional can also help in structuring and designing the framework so as to make the transactions tax effective.

Similar to Direct tax, the Indirect tax department also felt a need to obtain details of the transactions done through E-commerce Companies so that tax is not evaded by any unscrupulous section of society, they also introduced provisions of Tax Collected at Source (TCS) in Goods and Service Tax Act, 2017. Professional can assist in complying with the requirements of the provisions of TCS under Goods and Service Tax Act, 2017.

Compliances in FEMA Regulations:

E-commerce industry is restricted not only to B2B supplies but also effects B2C or in the common terms known as D2C ‘Direct to Consumer’ segment of Trade. Further with introduction of the MNC giants such as Amazon, Alibaba etc, the compliance provisions of Foreign Direct Investment allowed in this segment by Foreign entities and compliances related to the same also becomes applicable.

Professionals can provide their legal opinion on the applicability of these provisions and also assists the E-commerce operators to comply with the requirements of FEMA and RBI rules related to E-commerce transactions.

Compliances in other Legal Statues:

E-commerce transactions as discussed in the introduction section has crossed all the possible barriers and has reached to a point where anything can be procured online, such as Groceries, Food Products, Electronics, Medicines etc.

With these wide range of products, various legal requirements applicable to these industries becomes applicable to the transactions done through E-commerce Operators. Few of such legal requirements are as follows:

- FSSAI Licence (Food Safety and Standards Authority of India)

- Legal Metrology Act

- Drug Licence (applicable for Medicines)

- Trademark and Copyright Laws etc.

Professionals can assist the E-commerce operators and sellers selling through E-commerce operators in complying with legal requirements of such other statutes.

3: Opportunities in Data Analytics

In today’s information age, data is everywhere and ever-increasing. We are leaving digital footprints when we use the internet right from desktops, laptops, mobiles to wristbands.

Data analysis is the process of extracting actionable information from raw data. Data analysis can be described as a cycle of activities and procedures that transform raw data into information, knowledge and understanding.

Data analysis in e-commerce can help you to identify what makes up your potential customers, their buying behaviour, how much a particular factor influences their decision to buy, which websites they visit before making a purchase, how often they visit your website etc. As Chartered Accountants we are trained to observe, analyse, generate actionable information and predict trends.

Professionals can assist E-commerce Operators and sellers selling though E-commerce operators to analyise the data and take actions based on the actionable information so received from data analytics.

4: Opportunities in Technology Implementation

The evolving technology is fuelling factor behind the rise in the commercial transaction through E-commerce. Gone are the days when Chartered Accountants (CA) were only required to know about finance and accounting. With the advancement of technology, the world has transformed into a digital landscape and the profession of Chartered Accountancy is no exception. The role of a Chartered Accountant has evolved with technology and new-age professionals need to acquire digital skills.

E-commerce business are adapting all set of new technologies such as Artificial Intelligence, Machine learning etc. These digital initiatives or technology though are developed by professionals in the field of Engineering but to draw a proper framework for the technology to be effective in terms of finance, accounting and compliance, professionals such as CA’s are required.

Professional can assist E-commerce industry in designing the frameworks for Technology Implementation.

5: Opportunities in Global E-commerce

Global e-commerce is the process of selling products or services online across geopolitical borders to customers in foreign countries. Compared to local e-commerce, in which a retailer only sells within its country of origin, global e-commerce allows merchants to expand to reach new customers globally. This is in line to the vision of our honourable prime minister ‘LOCAL to GLOBAL” with an aim to take local products to Global markets.

With transforming the local business to such a global ecommerce business to grow and attain more customers, will bring in various challenges of compliances, record keeping etc for the international transactions. These can open opportunities globally like compliances of taxes and other laws of foreign countries.

Professionals can assist the E-commerce sector in managing the compliances and other activities and help them to transform their local business to Global Ecommerce business.

Problems can become opportunities when the right people come together – quoted by Robert Redford,

Every wall is a door – quoted by Ralph Waldo Emerson.

The E-commerce industry globally is growing at an exponential pace and will continue to grow even more exponentially. The growth of E-commerce Industry means more Transactions and with increasing transactions there will be more challenges. As quoted by the scholars above that each challenge is an opportunity. Therefore there are vide areas of challenges that can be considered as an opportunity by the professionals to develop a new areas of practice.

Disclaimer: The views expressed in the article are author’s personal view.