Overview of Incentives under FTP and Customs Laws

Every Country intends to grow their economy and footprint in foreign trade and India is not an exception. Considering the broad vision of Indian Government, new foreign trade policy is introduced to expand foreign trade exponentially through focused areas such as digital economy, towns of export excellence, district export hubs, etc. While World is edging towards Global recession, India is moving towards its goal to achieve Atmanirbhar Bharat, Vocal for Local and Make in India. The author intends to shed light on various incentive avenues available to exporters.

Overview of Duty Exemption and Remission Schemes

Advance Authorization Scheme (AA)

If an exporter is importing goods which are ultimately used in goods exported then this is one of the most popular schemes of India since 1976. It is a duty exemption scheme wherein the exporters have to incorporate such inputs physically in export goods subject to a minimum value addition of 15% generally. Exemption is available not only from Basic Customs Duty, Additional Duty, Safeguard Duty, Anti-dumping Duty but also from IGST and Compensation Cess[1] generally. Authorisation is issued for physical exports as well as for deemed exports. AA is subject to actual user condition. AA is not available for specific export or import of goods such as bio-technology related goods, fruits, vitamins etc. Domestic Sourcing of inputs is also allowed under AA through prescribed procedure.

There is a room for wastage and the benefit is extended to packing material, fuel, oil, catalyst consumed in production process[2]. One of the interesting conditions of AA is imports of raw materials shall be done on the basis of SION i.e. Standard Input Output Norms. SION are fixed by Norms Committee on DGFT on the basis of technical and other data received by DGFT for various categories of products. If SION doesn’t exist then AA is issued on self-certification basis. AA has a validity period of 12 months from the date of issue of authorisation and export obligation has to be fulfilled in 18 months from the date of issue of authorisation. AA are non-transferable.

In case any additional input is to be used, the same can be imported under self ratification scheme[3]. Further, advance authorisation is also available for annual requirement for goods notified in SION except a few. Sector Specific schemes or conditions are provided for spices, apparel and clothing accessories, gems and jewellery.

Duty Free Import Authorization (DFIA)

DFIA is issued for duty free import of inputs with minimum value addition requirement of 20%[4]. DFIA is exempted only from payment of Basic Customs Duty. DFIA is issued on post export basis for products for which SION is notified. DFIA is tranferrable. DFIA are issued with validity period of 12 months from the date of issue. Exports shall be completed in 12 months from the date of filing online application. DFIA is not available for gems and jewellery sector. From the date of export or 6 months from the date of realisation of export proceeds, whichever is later, application shall be made for issuance of transferrable DFIA.

Advance Authorization Scheme vs. Duty Free Import Authorization Scheme

| Advance Authorization Scheme (AA) | Duty Free Import Authorization Scheme (DFIA) |

| Authorisation with actual user condition | Post import authorisation |

| Minimum Value addition – 15% generally | Minimum Value addition – 20% generally |

| Eligible for both SION/Non-SION goods | Only for SION products |

| Imports are exempted from payment of BCD, Additional Customs Duty, Anti-dumping, countervailing and safeguard duty, GST and Compensation Cess | DFIA is exempted only from payment of Basic Customs Duty (BCD) |

| Non-transferrable authorisation | Freely transferrable authorisation |

Though DFIA is freely transferrable, AA is much more popular considering vast benefit of saving not only BCD but various other additional Customs Duties, Safeguard Duties etc. at the stage of import itself.

Export Promotion Capital Goods Scheme (EPCG):

One of the important schemes of FTP is EPCG Scheme where major cash outflow i.e. Customs Duties on Capital Goods can be saved[5]. For manufacturer exporters, this popular benefit continues to be part of new FTP 2023. It may be noted that this Scheme is not only available to exporters of goods but also to specific exporters of services. EPCG allows import of capital goods for pre-production, production and post-production. There is no post export EPCG Scheme in New FTP 2023. Exemption is available from basic customs duty and additional customs duty. In case of physical exports, exemption is extended to IGST and Compensation Cess.

Validity period of EPCG authorisation is of 24 months from the date of issue of such authorisation. With a view to promote make-in-India concept, capital goods can also be sourced indigenously and domestic manufacturer of capital goods would then be eligible for deemed export benefit.

Under the new FTP 2023, import of capital goods under EPCG Scheme is subject to fulfilment of specific export obligation of 6 times the duties and taxes saved which shall be fulfilled in 6 years from the date of issue of authorisation. While calculating duties and taxes saved, IGST and Compensation Cess shall be excluded if the importer has paid such taxes and cesses in cash and Input Tax Credit thereof is not claimed. In other words, if ITC of IGST or Compensation Cess is claimed, the same is also considered to be duties and taxes saved for calculation of export obligation. Imported capital goods are subject to actual user condition until export obligation is fulfilled. In case capital goods are procured indigenously, specific export obligation to be fulfilled shall be 75%. Specific export obligation to be fulfilled as under for block of years:

| Period from the date of issue of authorisation | Proportion of total export obligation to be fulfilled |

| 1st to 4th year | Atleast 50% |

| 5th and 6th year | Balance 50% |

In view of possible gradual growth, balance 50% export obligation can be fulfilled in last 2 years from the date of authorisation.

Export obligation under the scheme shall be, over and above, the average level of exports achieved by authorisation holder in the preceding 3 licensing years for same or similar products within the overall Export obligation period except few categories of goods. The Average Export Obligation (AEO) shall be fulfilled every financial year until export obligation is completed on overall basis. Exports over and above AEO shall only be considered for fulfillment of Export Obligation under EPCG authorisation. Therefore, there is direct measurement of duty saved on import of capital goods viz-a-viz incremental exports done. For few sectors such as handicrafts, agriculture, etc., AEO is not required to be fulfilled.

Duty Drawback Scheme (DBK) Scheme

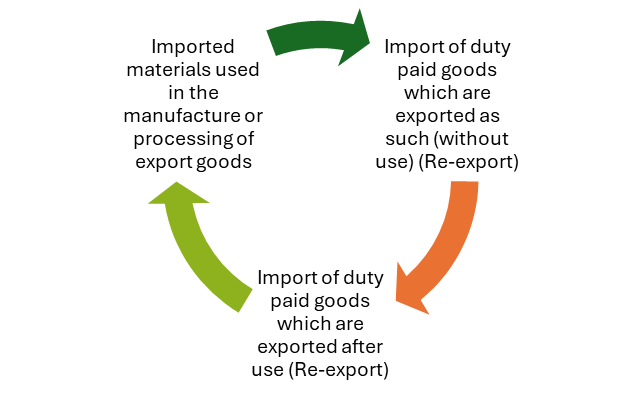

‘Drawback’ scheme is a scheme to claim benefit of Customs Duties and Central Excise, borne by either imported goods re-exported or by the inputs and input services used in manufacture of exported goods. Following types of duty drawbacks are available:

Duty drawback in cases of re-export[6]:

In case of re-export of goods, duty drawback is available for all customs duties paid alongwith IGST and Compensation Cess provided goods are re-exported within 2 years from the date of payment of duty or extended time period, as is allowed by CBIC.

For unused goods, 98% of import duty is available as duty drawback.

For used goods, depending upon the period of use, duty drawback rates are notified from 95% to 60% except motor car or goods imported for personal and private use. If the goods are re-exported after 18 months, no duty drawback is available.

In case of re-export of used wearing apparels, tea-chests, exposed cinematograph films passed by the Board of Film Censors in India and Unexposed photographic films, paper and plates, and X-ray films, duty drawback is not available.

Duty drawback in cases of manufacture of goods[7]:

In case of manufacture of goods, duty drawback is available to Customs Duty other than IGST and GST Compensation Cess. Rate of drawback in this case is as a percentage of the free on board value or the rate per unit quantity of the export goods.

- Drawback is allowed as per All Industry Rate (AIR) notified by Drawback Directorate

- Exporter may also apply for Brand Rate if AIR is not determined

- Exporter may also apply for Special Brand Rate if duty drawback as per AIR is less than 80% of import duty

Duty drawback is not available if there is negative value addition or if the value addition in % terms is not achieved as notified by Central Government.

Remission of Duties and Taxes on Exported Products (RoDTEP Scheme)

In view of long drawn dispute at WTO, India has introduced this Scheme only from 1 January 2021 replacing one of the most popular Foreign Trade Scheme i.e. MEIS (Merchandise Exports from India Scheme). RoDTEP Scheme provides remission of taxes, duties, and levies at the Central, State, and Local levels, which are not refunded through any other existing mechanisms such as VAT, mandi tax, taxes on fuel, etc. Rebate is allowed as per notified percentage of FOB (free on board) value of exports. This scheme is based on the globally accepted principle that “exports should be of goods and services and not of duties and taxes”. In this case, rebate is issued as a transferable electronic scrip which can be used to pay Basic Customs Duty.

Productwise schedule is provided wherein rebate is available in the range of 0.3% to 4.3% on FOB value of exports[8]. Though the benefit is peanuts when compared with earlier MEIS Scheme, RoDTEP benefit is available to numerous sectors and is extended to both manufacturer exporters and merchant exporters. One of the pertinent conditions is that the goods should be of Indian Origin to claim the benefit of RoDTEP.

If the Organisation has a typical structure focusing on exports, major benefits are available through following routes:

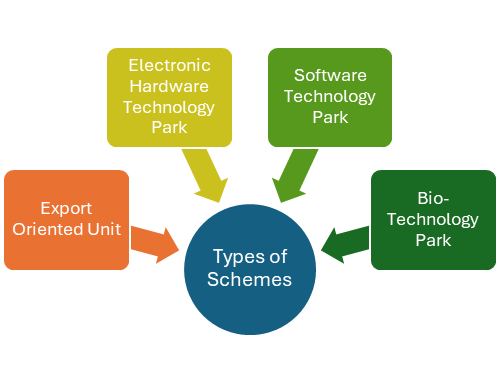

Export Oriented Units (EOU) Scheme

There are various types of Schemes provided hereunder:

Units undertaking to export their entire production may be set up under this scheme for import without payment of duties. This Scheme is available for Units engaged in manufacture of goods including repair, re-making, reconditioning, re-engineering, rendering of services, development of software, agriculture, biotechnology, horticulture etc. One may note that trading units cannot get status of EOU. Projects with minimum investment of Rs. 1 Crore in plant and machinery shall be considered for establishment as EOU except units engaged in IT services, agriculture, handicraft etc. 100% FDI investment is permitted through automatics route similar to SEZ Units.

Exemption is available from Basic Customs Duty as well as Additional Customs Duty[9]. Further, inputs and capital goods imported are subject to actual user condition which have to be used for export production. Export proceeds shall be realised in 9 months from the date of export.

One of the pertinent conditions for EOUs is achievement of positive Net Foreign Exchange (NFE). Calculation of NFE is done cumulatively for the block of 5 years starting from commencement of production with extension upto 1 year as is approved by Board of Approvals. NFE is calculated as under:

Positive NFE = A-B > 0

A = FOB value of export by EOU/EHTP/STP/BTP Unit

B = CIF (Cost Insurance Freight) value of all imported inputs and capital goods + value of payments made in foreign currency such as commission, royalty etc. + High sea purchases even if in INR

Though this Scheme is fit for Units with 100% exports, the Unit can very well sell goods in Domestic Tariff Area. Therefore, if manufactured goods are removed to DTA, alongside GST liability on removal of goods to DTA, basic customs duty, GST and other customs duties would also have to be paid on imported goods used in manufacture of such goods.

It is extremely important to note that this is an old school scheme which requires heavy investment with strict compliances and therefore, the Organisation needs to be diligent for entry in and exit from this Scheme.

Special Economic Zone (SEZ)

SEZ is a specifically allocated duty-free enclave and shall be deemed to be foreign territory for the purposes of trade operations, duties and tariffs[10]. Customs authorities do not carry out routine examination of export or import cargo, however, SEZ being a separate geographical area does include various procedures for taking goods into or out from SEZ. This is one of the popular Scheme amongst service exporters. In the manufacturing sector, barring a few segments, 100% FDI is allowed. SEZ also needs to achieve positive NFE.

Goods and services coming to SEZ units from domestic tariff area (DTA) are treated as exports from India and goods and services rendered from SEZ to DTA are treated as import into India. Import of goods and services for SEZ units and developers are duty free when meant for their authorized operations. Further, goods imported for setting up SEZ Units are also granted exemption from payment of Duties and Taxes. All supplies by DTA to SEZ are treated as exports and are considered as zero rated supplies under GST Law.

Free Trade Warehousing Zones

These are special Category of SEZs with a focus on warehousing and trading in free currencies with the object of making India a global trading hub like Dubai and Singapore. FTWZ units are allowed to hold inventory on behalf of foreign suppliers or domestic buyers. If an Organisation doesn’t intend to carry out any processing but is engaged in trading i.e. import and export or import and DTA sale of goods with packing, re-packing, re-sale, assembly of CKD(Complete Knockdown)/SKD (Semi-Knockdown) goods etc., FTWZ could be a game changer to save working capital. It is interesting to note that Organisation need not have its own warehouse i.e. imported goods can avail warehousing services of any FTWZ Unit. .FTWZ is one of the Scheme in India which allows deferment of customs duty without incurring interest or penalty.

Manufacturing and other operations in Warehouse under bond (MOOWR)

This is one of the recent Schemes which allows importer manufacturer to defer payment of Customs Duties until removal thereof for home consumption. All Customs Duties are deferred on import of inputs and capital goods since it is a customs bonded warehouse registered under Section 65 of Customs Act 1962 wherein the owner of the warehoused goods can carry on any manufacturing process or other operations in the warehouse with prior permission of Principal Commissioner of Customs or Commissioner of Customs in the Units registered under Manufacturing and Other Operations in Warehouse (no. 2) Regulation 2019, popularly known as MOOWR scheme.

From a date to be notified yet[11], deferment of such Customs Duties is restricted to duties other than IGST and Compensation Cess and therefore, from a notified date goods can be deposited in such warehouse only after payment of IGST and Compensation Cess. IGST and Compensation Cess paid on impots shall be available as input tax credit (ITC) subject to conditions as mentioned in Customs Laws and GST Laws.

Once the goods are manufactured, Customs Duties on imported goods shall be paid if finished goods are removed to domestic markets. In case finished goods are exported, there is no need to pay any Customs Duties thereon.

Hitherto, this Scheme was quiet attractive in view of working capital benefit, no requirement of export commitment and lesser compliances as compared to EOUs and SEZs. However, this Scheme faced small turbulence with recent amendment which removed deferment of IGST and Compensation Cess.

Preferential Trade Agreements(PTAs) / Free Trade Agreements (FTAs)

If the Orgainsation doesn’t export but is engaged in import from particular Country/Countries especially Asian Countries, one of the major benefits could be availed through Preferential Trade Agreements and/or Free Trade Agreements. Few examples of PTAs / FTAs are:

- India-Sri Lanka Free Trade Agreement (FTA);

- Agreement with South Asian Free Trade Area (SAFTA);

- Agreement with Association of Southeast Asian Nations (ASEAN);

- India-South Korea Comprehensive Economic Partnership Agreement (CEPA);

- India-Japan CEPA etc.

For regular imports, this benefit directly affects the topline of business and can help to beat competition with other manufacturers either using indigenous duty paid goods or using imported goods from other Countries without the benefit of PTAs/FTAs. Saving in Customs Duty may reach to 100% i.e. complete exemption from Customs Duty. Key essential to avail this important benefit is procuring Certificate of Origin. To restrict misuse of this benefit, now, importer is required to carry out due diligence to ensure that goods meet the criteria of rules of origin[12].

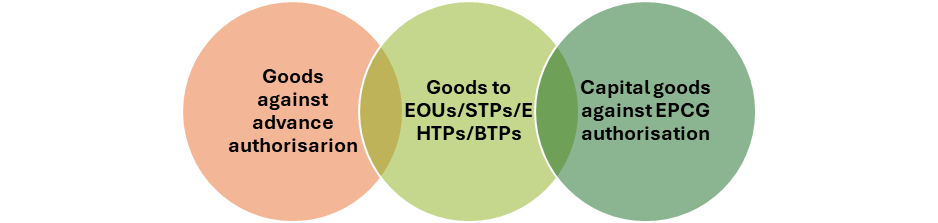

Deemed Exports

Even if the Organisation is not directly engaged in exports but in penultimate exports, benefit of deemed export can be explored. Therefore, if Indian manufacturer supplies:

then deemed export benefit is available under FTP as well as GST Law. Further, supply by main or sub-contractor to specific projects such as projects financed by multilateral or bilateral agencies, projects under international competitive bidding (ICB) etc. also enjoy benefit of deemed export under FTP. Under FTP, benefit of advance authorization, Duty Drawback and/or Terminal Excise Duty is available[13] whereas under GST Law, refund can be claimed by either supplier or recipient of deemed exports[14].

Though the Schemes are lucrative, importers and exporters shall be cautious for compliances to be done under FTP, HBP and various other provisions of Customs Laws since heavy penal consequences may arise for failure to adhere to stringent provisions of relevant Laws. Penal consequences under Foreign Trade Policy read with Foreign Trade (Development & Regulation) Act, 1992 could be as high as 5 times the value of goods or services[15].

The author has tried to provide a broad overview above of important incentives available to genuine and serious exporters to save import duties and taxes. Further, there are various other incentives such as Status Holder recognition, Gold Card Scheme, market access initiative scheme, etc. which can be availed by such exporters under FTP. Though there are no sky-high incentives discussed above in new Foreign Trade Policy 2023 but steps are taken to promote exports, ease of doing business and reduce transaction costs.

[1] Notification No. 18/2015-Cus. Dated 01.04.2015

[2] Chapter 4 of Foreign Trade Policy 2023 (FTP 2023)

[3] Para 4.06 of FTP 2023

[4] Para 4.24 of FTP 2023

[5] Chapter 5 of FTP 2023 read with Notification No. 16/2015-Customs dated 01.04.2015

[6] Section 74 of Customs Act 1962

[7] Section 75 of Customs Act 1962

[8] Appendix 4R of Handbook of Procedures 2023 (HBP 2023)

[9] Notification No. 52/2003-Cus. Dated 31.03.2003

[10] Special Economic Zones Act, 2005

[11] Amendment made through Finance Act 2023, effective date of which is yet to be notified

[12] Custom (Administration of Rules of origin under Trade agreements) Rules, 2020

[13] Chapter 7 of FTP 2023

[14] Section 147 of CGST Act 2017 read with NOTIFICATION No. 48/2017–Central Tax dated 18.10.2017

[15] Section 11 (2) of Foreign Trade (Development and Regulation) Act, 1992