Business restructuring under IBC: optimizing incentives while navigating unwarranted conundrums

- Overview of IBC:

“Failure is simply the opportunity to begin again, this time more intelligently.” – Henry Ford

Failing is fine, but denying a chance to revive the business is certainly not. Time and again many businesses have almost failed and bounced back to roaring success when given a second chance. There are ample notable examples such as Apple, General Motors, Marvel Entertainment, etc.

The government recognized the importance of creating a growth-oriented environment and implementing a time-bound legal framework for businesses experiencing financial difficulties. This led to the legislation of the Insolvency and Bankruptcy Code, 2016 (IBC) a unified law dealing with stressed businesses.

The IBC is a comprehensive legislation that provides for insolvency resolution of corporate debtors, general partnership firms, and even individuals. A corporate debtor is a corporate person that has defaulted on paying its debts.

The provisions of the IBC are being brought into effect in phases. Apart from personal guarantors to corporate debtors, the provisions of IBC for insolvency resolution and bankruptcy of general partnership firms and individuals are not in effect yet. This article primarily focuses on the insolvency resolution of a company as a corporate debtor (IBC Company).

The IBC lays down a two-step process for IBC Companies facing insolvency: (i) Corporate Insolvency Resolution Process (CIRP) and (ii) liquidation. The IBC first attempts to resolve the insolvency in a time-bound manner. However, if the attempt fails, the IBC Company will be liquidated.

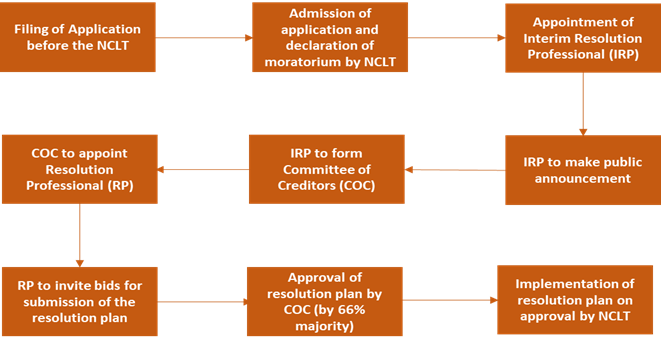

The IBC regime provides that if an IBC Company defaults on paying a debt of more than INR 1 crore, an application may be made to the National Company Law Tribunal (NCLT) by a creditor of the IBC Company or by the IBC Company itself to initiate a CIRP. The key stages of successful CIRP under IBC are briefly outlined below:

It is important for businesses to understand the various incentives available, and challenges faced while reviving the companies under IBC. This article attempts to highlight key income-tax benefits that can be availed and at the same time, certain income-tax issues that need to be considered during restructuring of IBC company.

- Tax Incentives for companies going through IBC proceedings:

- Moratorium on tax proceedings:

The objective of the moratorium under IBC is to protect the IBC Company against any legal proceedings for debt recovery, security interest enforcement, or transfer of its assets. The moratorium halts such coercive actions against the IBC Company during the moratorium period.

The Supreme Court in the case of Sundaresh Bhatt[1] ruled that once a moratorium is imposed, the tax authorities have limited jurisdiction to assess/determine the quantum of tax and other levies and no recovery proceeding can be initiated against the IBC Company. The Supreme Court has observed that the assessment is only for determining the amount of tax which is a function of the tax authorities. Therefore, tax authorities may undertake assessment proceedings limited to determining the amount of tax but cannot proceed to recover any demand.

- Relaxation for carry forward and set off of losses:

Under section 79 of the Income-tax Act, 1961 (IT Act), carrying forward and set-off of losses is not allowed if there is a change in the shareholding of the company by more than 51%. However, a specific relaxation is provided under the IT Act for a company seeking insolvency resolution. The IBC Companies are entitled to set off losses even if there is a change in shareholding beyond the prescribed limit if the resolution plan is approved by the NCLT. However, this relaxation is subject to providing the jurisdictional Principal Commissioner or Commissioner a reasonable opportunity to be heard.

- Relaxation under the provisions of Minimum Alternate Tax (MAT):

While calculating Book Profit for MAT, section 115JB of the IT Act allows deduction of lower of brought forward business losses or unabsorbed depreciation. In a case if either brought forward business losses or unabsorbed depreciation is nil, no deduction is allowed. However, relief has been provided to companies whose application is admitted under IBC, as they are eligible to set off the aggregate of business losses brought forward and unabsorbed depreciation.

- Modified notice of demand:

The NCLT in its order may reduce the outstanding tax and other related dues in respect of which a notice of demand has been issued by the tax authority to an IBC company. In such case, as per the provisions of section 156A of the IT Act, the tax authorities are required to reduce the demand payable in conformity with the NCLT order and after that, serve a modified notice of demand specifying the reduced sum payable.

- Tax challenges that remain to be solved

- Write-back of liabilities:

- Typically, under IBC proceedings, there are substantial haircuts to the outstanding dues of the creditors as the companies are under financial stress. Accordingly, outstanding liabilities along with accrued interest waived by the creditors are written back in accordance with the approved resolution plan.

- Under section 41(1), where an allowance or deduction has been made in the assessment for any year in respect of loss, expenditure, or trading liability incurred by the assessee and subsequently during any previous year the person has obtained some benefit by way of remission or cessation of such trading liability, then such benefit will be deemed as profit and gains of business or profession. Accordingly, section 41(1) seeks to tax only trading liabilities along with accrued interest written back, which are claimed as deductions in earlier years.

- Under section 28(iv), any benefits or perquisite in cash or kind, whether convertible into money or not, arising from business or profession is subject to tax. The scope of the definition has been recently expanded under the Finance Act, 2023 to include cash benefits to nullify the decision of the Supreme Court in the case of Mahindra and Mahindra Ltd.[2]

For the liabilities written back, which were not earlier claimed as deduction, companies were relying on the above-mentioned Supreme Court’s decision in the case of Mahindra and Mahindra Ltd. (supra) to argue that such waivers resulting in benefits in cash should not be taxable under the extant provisions. Under the expanded scope of section 28(iv), waiver of a loan is a benefit in the shape of money and will be considered cash benefits. However, it would further need to be evaluated if such benefits “arise from” the business or profession and could be taxed under section 28(iv). Certain judicial precedents[3] have held that where the assessee was not in the business of obtaining loans, the remission of such loans by the creditors cannot be said to be a benefit arising from such business.

- Under section 56(2)(x)(a), where any person receives any sum of money, without consideration, the whole of the aggregate value of such sum will be deemed as the income from other source. Pursuant to the Supreme Court decision in the case of Mahindra and Mahindra Ltd. (supra), waiver of loan may be considered as a cash receipt. However, it would be imperative to evaluate if a waiver of a loan is only a constructive receipt and not an actual receipt and therefore, not subject to tax under section 56(2)(x). Further, relying on the judicial precedent[4] it may also be possible to argue that the amount received by the assessee as waiver or remission of the loan amount cannot be said to be without consideration.

- Accordingly, tax treatment under section 28(iv) and section 56(2)(x) is still subject to a lot of interpretational issues, and clarification in this regard from the government especially for the IBC Companies, will bring much needed certainty.

- Key tax implications on waiver of loan can be summarised as follows:

| Provisions of the IT Act | Write back of trading liability | Write back of the capital loan |

| Section 41(1) – Remission/ cessation of trading liability | Deduction claimed in any FY – Taxable No deduction claimed in any FY – Not taxable | Not taxable |

| Section 28(iv) – Benefit or perquisite from business and profession | Taxable according to the amendment brought by Finance Act, 2023 to include cash benefits?Possible to argue that no benefit arises from business or profession? | |

| Section 56(2)(x) – Receipt of any sum of money without consideration | Taxable as cash receipt considering the Supreme Court decision in the case of Mahindra and Mahindra Ltd.?Only a constructive receipt and not an actual receipt?Arguably, waiver of liability under a loan settlement not without consideration? | |

- Deduction of tax under section 194R on benefit or perquisite:

The provisions of section 194R require deduction of tax at source on benefits or perquisite arising from business or the exercise of the profession. CBDT circulars[5] provide that waiver or settlement of a loan would constitute a benefit. Though waiver of loan by certain specified lenders which inter alia includes banks, specified non-banking financial institutions, etc., are not required to withhold tax under section 194R of the IT Act. However, no specific relaxation has been provided for IBC Companies leading to additional tax compliances and cash flow issues.

- MAT on waiver of loan:

Waiver or write-back of liabilities along with accrued interest may also be subject to tax under the MAT provisions. There should be relaxation in the MAT provisions for reducing waiver of loans and interest from the income of IBC Companies.

Nevertheless, if the IBC Company has sufficient book losses and unabsorbed depreciation available, it can be set off against any income resulting from the write-back of liabilities. Alternatively, MAT liability could also be mitigated by opting for a new concessional tax regime under section 115BAA of the IT Act.

- No relaxation on amalgamation:

The successful bidder may generally acquire the IBC Company through a special purpose vehicle (SPV) or a merger. These are the quite preferred routes for the acquisition of IBC Company. However, in case of acquisition through a merger, section 72A of the IT Act allows carry forward of tax losses only to industrial undertaking on the satisfaction of certain conditions such as continuing to hold fixed assets and continuing the business, etc. These conditions are quite stringent for IBC Companies trying to recover from the brink of insolvency. Thus, some relaxation should be provided.

- Deemed tax provisions on transfer of shares:

Section 50CA and section 56(2)(x) impose tax on the transfer of unquoted shares of a company at a price less than the fair market value (FMV) in the hands of the transferor and transferee, respectively. The tax FMV is computed as per the prescribed methodology, which inter alia uses the book value of assets of the companies. In the case of IBC Companies with distressed assets and huge liabilities, the shares may be acquired at a price far below the FMV of shares calculated under the income tax law. This would lead to a tax implication both for the transferor and the transferee making entire resolution proceedings untenable.

The government should exempt the applicability of the above-deemed tax provisions for IBC Companies by exercising its power under the provisions of the IT Act.

- Deductibility of costs incurred for CIRP:

The allowability of costs incurred during the insolvency process, such as fees for the resolution professional, cost of restructuring, etc., remains uncertain under the provisions of the IT Act. Expenses that are directly incurred for business activities are generally deductible from taxable income. However, the deductibility of costs related to CIRP may be questionable as these costs are not particularly incurred for running the business.

The IT Act provides specific provisions for allowing the deduction of amalgamation and demerger-related costs over five years. Considering the challenges that IBC Companies will inevitably experience, it will be imperative to introduce provisions allowing the deduction of CIRP-related costs.

- Priority of tax dues:

Under the IBC, the secured creditors are given priority over the operational creditors for payment of their outstanding dues. In this regard, there is a major controversy as to whether tax dues are to be dealt with as operational dues or to be treated as the first charge as secured creditors.

The Supreme Court in the case of Ghanshyam Mishra & Sons (P.) Ltd.[6] held that government dues would qualify as ‘operational debt’ and if not part of the approved resolution plan, would stand extinguished. However, the Supreme Court in the recent decision of Rainbow Papers Ltd.[7] treated the government as a secured creditor and held that if the payment of statutory dues in a proportional manner is ignored in a resolution plan, it is bound to be rejected. Therefore, the decision of the Supreme Court in the case of Rainbow Papers has disturbed the settled position emanating from the earlier decision of the Supreme Court in the case of Ghanshyam Mishra. The Madras High Court in a subsequent decision in the case of Aginiti Industrial Parks Pvt. Ltd.[8] has distinguished the Rainbow paper ruling by holding it to be fact-specific and relevant for dues arising under the Gujarat Value Added Tax Act, 2003.

Considering the conflicting rulings and huge controversy around the payment of outstanding statutory dues, a clarification from lawmakers will be much appreciated to dispel uncertainties surrounding the given issue.

- Applicability of General Anti-Avoidance Rules (GAAR):

There is no specific exemption from the applicability of GAAR on the restructuring of companies under IBC. Under the CIRP, approval is provided by NCLT to the resolution plans that are backed by a commercial objective of reviving the IBC Company from insolvency. Therefore, GAAR provisions should not apply to a restructuring approved by the NCLT under the provisions of IBC, as the main purpose of the same is to revive the business, and not to obtain any tax benefits.

The Income Tax Department vide a Circular[9] clarified that provisions of GAAR will not be invoked where the Court has explicitly and adequately considered the tax implication while sanctioning an arrangement. However, while approving a resolution plan, the NCLT generally does not analyse in detail the tax implications arising from the restructuring undertaken to acquire the IBC Company, and therefore, recourse to Circular may not be possible. Accordingly, a specific exemption from the applicability of GAAR provisions should be introduced for restructuring under IBC to safeguard acquirers from unwarranted tax consequences.

- Conclusion:

While significant strides have been taken to revolutionize the law on insolvency and bankruptcy, it is imperative to bring corresponding reforms under the income tax law to ensure the success of business restructuring under IBC. With synchronized changes in the tax framework, the full potential and effectiveness of the IBC in revitalizing businesses and the economy can be achieved.

[1] Sundaresh Bhatt, Liquidator of ABG Shipyard v. Central Board of Indirect Taxes and Customs [Civil Appeal No. 7667 OF 2021, Supreme Court]

[2] CIT v. Mahindra and Mahindra Limited [2018] 404 ITR 1 (SC)

[3] CIT v. Chetan Chemicals (P.) Ltd. [2004] 267 ITR 770 (Gujarat); CIT v. Gujarat State Fertilizers & Chemicals Ltd. [2013] 358 ITR 323 (Gujarat)

[4] Jai Pal Gaba v. Income-tax Officer [2019] 178 ITD 357 (Chandigarh – Tribunal)

[5] CBDT Circular No. 12 of 2022 dated 16th June 2022 and CBDT Circular No. 18 of 2022 dated 13th September 2022

[6] Ghanashyam Mishra & Sons (P.) Ltd. v Edelweiss Asset Reconstruction Co. Ltd. [2021] 166 SCL 237 (SC)

[7] State Tax Officer v Rainbow Papers Ltd. [2022] 172 SCL 250 (SC)

[8] Aginiti Industrial Parks (P.) Ltd. v. Superintendent of CGST and Central Excise [2024] 159 taxmann.com 297 (Madras)

[9] Question 8 of the Circular No. 7 of 2017 issued by the Central Board of Direct Taxes (CBDT)