BROAD CONTENTS OF TRANSFER PRICING STUDY REPORT

Background:

Transfer Pricing Documentation around the world is prepared to justify the arm’s length price(‘ALP’) with respect to an international transaction(s)entered into by the taxpayer with its Associated Enterprise(s) and India is no exception to it.

As per Indian Transfer Pricing Regulations, every person who has entered into an international transactions and/or specified domestic transactions (‘SDTs’) are required to maintain contemporaneous and robust transfer pricing documentation (referred to as “the TP Documentation”) in order to justify and support the ALP.

Section 92D(1)(i) of the Income-tax Act, 1961 (‘Act’) requires that every person who has undertaken international transaction and SDTs shall keep and maintain such information and documents as specified by Rule 10D of the Income-tax Rules, 1962 (‘Rules’). Rule 10D(1) lays down different types of documents and information to be maintained by the taxpayers in respect of its international transactions and SDTs whereas Rule 10D(3) specifies the documents to be maintained in support of the same.

As it can be seen from the above Rule, the documentation requirement is broadly divided into two parts. First part of the Rules lists down mandatory documents /information that a taxpayer must maintain with respect to the international transaction/SDT whereas the second part of the Rules require supporting documentation to be maintained that substantiates the documents/information documented under the first part. The list of mandatory and supporting documents prescribed are given below:

| Mandatory Documents [Rule 10(1)] | Supporting Documents [Rule 10(3)] | ||

| Entity Related | Price Related | Transaction Related | |

| Ownership StructureProfile of GroupProfile of Indian Entity and its IndustryProfile of associated enterprises | Transaction Nature and TermsFAR AnalysisEconomic AnalysisComparable AnalysisBudgets, Forecasts, Estimates | AgreementsInvoicesPricing Related Correspondence (Letters, Emails etc.)Transfer Pricing Adjustments | Official Publications Reports, Studies from Government Report of Market Research Studies, Technical Publications Price Publications Published Accounts and Financial Statements Agreements & Contracts related to international transaction/SDTs Letter and Other Correspondences Any other Documents |

Relaxation from mandatory maintenance of documentation offered in respect of international transaction not exceeding INR one crore.

In nutshell, Rule 10D provides for 13 line items of mandatory documentation and additional 7 line items of supporting documentation.

The aforesaid documentation for each year should be prepared and documented by 31st October (i.e. the date one month prior to the due date of furnishing Return of Income which is 30th November) and should be retained for the period of 8 years from the end of the assessment year to which the said documentation relates.

Although the Act do not specify any particular format in which Transfer Pricing Documentation is to be prepared and maintained, however over the years, since the implementation of the Transfer Pricing Regulations in India, tax officers have favored an organized and systematic approach to maintenance of TP Documentation which is called as Transfer Pricing (‘TP’) Study Report.

The TP Study Report starts with the most basic and generic information, building a context for the specific international transactions/ SDTs of the taxpayer during the year under review and then delving into the more specific aspects such as functional analysis, which will in turn help in the economic analysis section to compute the ALP concluding finally with the comparability analysis between the ALPs so determined with the transfer prices of the taxpayer.

With the aforesaid brief background, we will now understand how a typical TP Study Report looks like or contains and its flow of presentation.

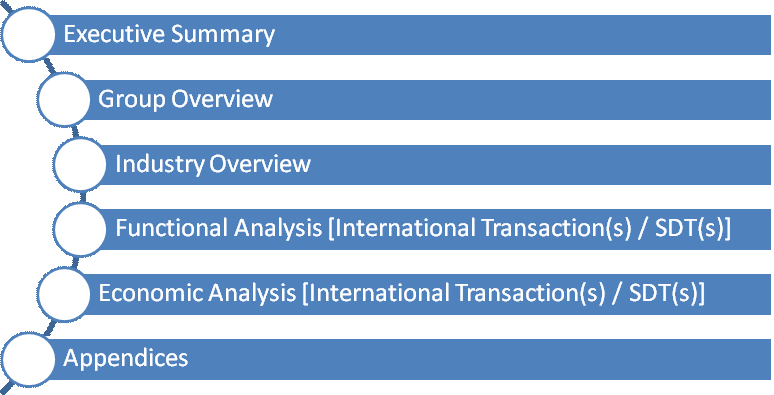

Contents of the Transfer Pricing Study Report:

The table of contents of the TP Study Report is as under:

Now let’s dwell into the contents for each of the aforesaid section of the TP Study Report in detail:

1. Executive Summary

This section should start with the introductory para on the objective of this TP Study Report stating that the international transaction(s)/ SDT(s) entered into by the taxpayer with its AE(s) which adhere to the arm’s length principle, embodied in the Indian Transfer Pricing Regulations contained in Sections 92D of the Act read with Rule 10D of the Rules. One can mention about various Principles/Guidelines considered/ followed while drafting the TP Study Report.

Second para shall comprise about the brief overview of the taxpayer as a whole and the business it operates into.

And lastly the taxpayer will have to summarize all the international transaction(s)/SDT(s) entered into with its AE(s) as per the below format (please note there is no such standard format of summarizing)

| Sr. No. | Nature of International Transaction(s) / SDT(s) | Most Appropriate Method | Tested Party Data | Comparable Companies Data | |

| Book Value of Transaction (Amount in INR) | Pricing or Margin Data | Arm’s Length Price (incl. Median with Range or Mean) | |||

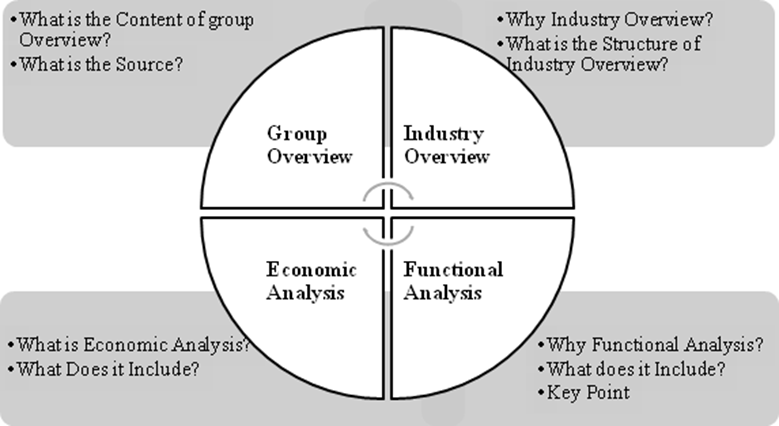

After the executive summary, four main pillars of the TP Study Report have to be drafted and documented. While drafting the four main pillars, one will have the following basic questions with respect to each of the four sections of the TP Study Report which are as under:

Let us now discuss each of the aforesaid four main pillars of the TP Study Report in detail:

1. Group Overview

The purpose of this section is to provide a brief overview, ownership structure and the broad description of the business activities. Group overview broadly should be divided into three parts:

- MNC Group Profile;

- Indian Taxpayer Profile; and

- Each of the transacting AE(s) Profile MNC Group Profile

The TP Study Report should contain an overview of the business of the MNC Group as a whole, different line of business in which the Group is engaged, its presence in the countries all over the world, key products and/or services of the MNC Group.

Such information can be obtained from the MNC Group’s website, Taxpayer’s website, Consolidated Financial Statement of the Group and other publicly available authentic data.

Indian Taxpayer Profile

After giving brief overview of the Group as a whole, now the taxpayer will have to document its shareholding structure with the Group and its subsidiary Companies along with the Country of Incorporation in the form of a diagrammatic presentation which would provide a better visual of the Group Structure and would be easy to understand.

This section should include historical background of the taxpayer’s operations, date of incorporation, its presence in India and outside India, no of employees, list of brands owned by the taxpayer and any significant events like acquisition, merger, demerger, etc.

Then, the TP Study Report should mention the brief description of the business activities carried out by the taxpayer and the key products and services offered by the Company to its AE(s) and/or third parties.

Such information can be obtained from the Taxpayer’s/Group website, Standalone/Consolidated Financial Statement of the Group and any other publicly available authentic data.

Each of the transaction AE(s) Profile

Lastly, a brief business description of each of the AE(s) with whom the transaction has been entered into by the taxpayer during the Financial Year which will help in understanding the business activities of the AE(s) and a complete perspective of the activities of all the AE(s).

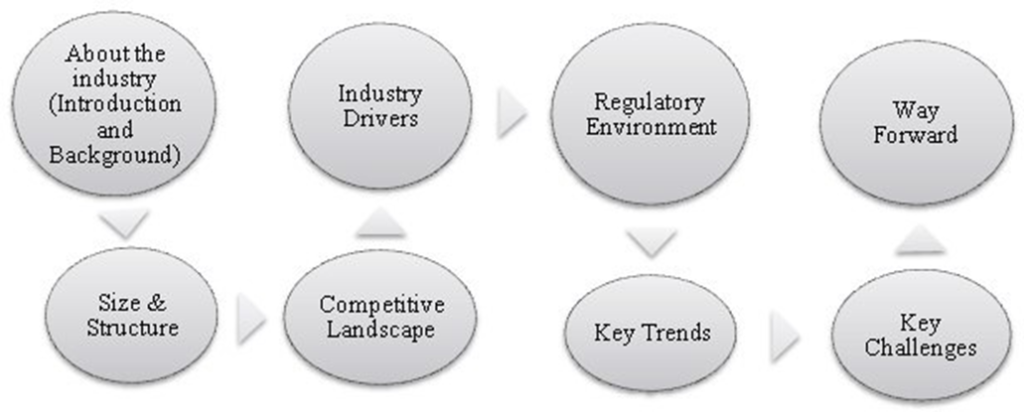

2. Industry Overview

The purpose of this section is to provide the following results:

- an overall justification of the taxpayer’s financial performance vis-à-vis the industry or verticals in which it operates;

- assist in understanding the taxpayer’s relative positioning in the Industry or verticals vis-à-vis other players;

- helps in screening factors when undertaking comparability analysis The structure of the Industry Overview in the TP Study Report should be as under:

The aforesaid industry overview can be sourced from internal sources such as Financial Statements, Director’s Report and other similar documents and external sources such as Reports prepared by external agencies like Reuters, Bloomberg, CRISIL, etc. One can mention the source of information as a foot note for the reliability and authenticity of the information mentioned in the TP Study Report.

1. Functional Analysis

Overview of the International Transaction 1

Brief description of the international transaction entered into by the taxpayer with its Associated Enterprise(s). In addition, details from the agreement to be produce here such as broad range of services to be performed, type of goods purchased or sold, pricing, allocation of costs methodology, if any, payment/receipt terms and any other important terms and conditions of the agreement.

The functional analysis facilitates the characterization of the transaction between the AE(s) after taking into account their functions performed, assets employed and risk assumed (‘FAR analysis’) and helps in establishing a degree of comparability with similar transactions in uncontrolled transactions. One has to give detailed analysis of functions performed, assets employed and risk assumed by the taxpayer and its AE(s) with respect to the said international transaction/ SDTs.

- Functions Performed

The identification of relevant functions and processes will support in understanding the specific roles and responsibilities associated with the transactions. Further, this analysis can aid in identifying specialized and critical business assets and activities that are fundamental to the business.

- Assets Employed

Any business requires tangible and/or intangible assets without which it cannot carry out its business activities. An understanding of the assets employed by the taxpayer and its AE(s) provides an insight into the resources deployed by them and their contribution to the economic activities. Hence, it is relevant and useful in identifying the assets employed while conducting functional analysis.

- Risk Assumed

Functional analysis is incomplete unless the material risks assumed by each of the transactional party have been considered since the assumption or allocation of risks would influence the pricing of transactions between the AE(s).

FAR analysis is the heart of the TP Study Report as it lays down the foundation for establishing the transfer pricing methodology and for determination of the ALP.

Typically, the type of international transactions/ SDTs entered into with the AE(s) fall under either of the broad category i.e. manufacturing model or distribution model or service model. Manufacturing model comprises of Toll or Contract or Licensed or Entrepreneur Manufacturer whereas Distribution model comprises of Low Risk or Normal Risk or Entrepreneur Risk Distributor and Service Model comprises of Captive or Limited Risk or Entrepreneur Risk Service Provider. Basis these models, commonly used functions, assets and risks are as under:

| Functions Performed | Assets Employed | Risks Assumed |

| Procurement of Raw Materials | Tangible Assets | Market Risk |

| Research and Development | – Plant & Machinery | Inventory Risk |

| Manufacturing Process | – Office Equipments | Credit Risk |

| Budgeting | – Factory Building, etc. | Service Liability Risk/ Product Defect Risk/Product Failure Risk |

| Marketing Services | Intangible Assets | Manpower Risk |

| Negotiation of Prices | – Brands | Foreign Exchange Risk |

| Inventory management | – Patents | Capacity Utilisation Risk |

| Providing after Sales Services | – Trademarks | |

| Warranty Services | – Softwares, etc. |

The aforesaid detailed FAR analysis data is collated by conducting interviews with the respective team of the taxpayer and its AE(s) involved in the international transaction/ SDTs and from the agreements/ contracts entered into by the taxpayer with its AE(s) for such transaction.

Characterisation

Based on the facts presented above in the analysis of functions performed, assets employed and risk assumed, one can determine the economic characterization of the taxpayer and its AE(s) with respect to the aforesaid transaction. The economic characterization helps to determine which of the methods might be appropriate and also what type of comparable would be require for benchmarking the said transaction.

1. Economic Analysis

The economic analysis section includes selection of the tested party, selection of the most appropriate method (‘MAM’), application of the MAM, selecting the appropriate profit level indicator (‘PLI’) conducting a search for uncontrolled companies based on the application of the MAM, and then finally determining the ALP. Now, let’s discuss the content to be included for each of the section.

Selection of the Tested Party

Tested party means a party to an international transaction/SDT with reference to which the said transaction is tested basis the functional analysis of the said transaction. Please note the term ‘tested party’ is not defined in the Act and therefore there are no Rules prescribed laying down the selection of the tested party.

However, as a golden rule, the tested party is the one to which a transfer pricing method can be applied in the most reliable manner and for which the most reliable comparables can be found i.e. it will most often be the one that has the less complex functional analysis.

In the TP Study Report, one has to first give the background i.e. what is the tested party, why it is required and how it is selected and then in the ensuing para select and provide the name of the tested party with proper reasoning of its selection.

Selection of the Most Appropriate Method

As per Section 92C of the Act, the calculation of the ALP has to be carried out by using the MAM. The MAM should be selected from the following methods:

The Regulations do not provide for any hierarchy of methods instead, the MAM should be the method which is best suited to the facts and circumstances of each particular international transaction/ SDTs and which provides the most reliable measure of ALP. In determining the most reliable method following factors to be considered:

- Availability of data;

- Coverage and reliability of data;

- Degree of comparability between controlled and uncontrolled transactions; and

- Extent to which accurate and reliable adjustments can be made to account for differences, if any.

This section of the TP Study Report should first start with the introductory para on selection of MAM, then give brief on each of the method along with the reasoning for its selection or rejection.

Pursuant to the above analysis of each of the method, now one needs to apply the MAM concluded to determine the ALP of the international transaction/SDT.

Choice of the PLI, if applicable

The application of the few methods requires selection of an appropriate PLI. The PLI measure the relationship between profits and either revenue earned or cost incurred or assets employed. The choice of the PLI depends upon the actual nature of the international transaction/SDT, the reliability of the available data, etc.

This section too first start with what is the PLI and how it is to be derived at and then the ensuing para should contain an appropriate PLI selected as the acceptable PLI for setting the arm’s length operating margin for the said international transaction/ SDT.

Search for Uncontrolled Comparable Companies

This section should start with the brief para on the database selected for carrying out the search of uncontrolled comparable companies. Then, one can summarise the type of Comparable Companies searched for in the database and arrived at along with the final comparable list with the adjusted average PLI for each of the Comparable Company. The details of entire search process carried out in the database to arrive at the final list for Comparable Uncontrolled Companies along with the PLI computation for each of the year can be given as part of the Appendix, however an appropriate reference should be given here.

Determination of Arm’s Length Price

In the initial para, the taxpayer can provide the margin/price details of its international transaction/ SDT with its AE(s) into consideration with the reference to a detailed working forming part of the Appendices.

Based on the aforesaid analysis, the taxpayer will have to conclude that the ALP (i.e. median along with range or mean) of the Comparable Uncontrolled Companies vis-à-vis the taxpayer’s margin would meet the arm’s length standard as required under the Indian TP Regulations.

The aforesaid process of functional and economic analysis has to be carried out for each of the international transaction/SDT having altogether different nature and which cannot be inter-linked or aggregated with a particular transaction.

1. Appendices

In my view, all the TP Study Report should have a separate section as Appendices which may include the following items:

- Indian Transfer Pricing Regulations as per the Act;

- Databases and their limitations (only if search carried out through external databases);

- Steps of Search Process for Comparable Uncontrolled Companies (if applicable);

- Brief Business Description of final set of Comparable Companies (if applicable);

- PLI computation for each of the final set of Comparable Uncontrolled Companies (if applicable);

- PLI computation of the taxpayer’s margin;

- Scope and Limitations;

- Abbreviations;

- Finally, summarise the Rue 10D details in a tabular format giving reference number to the TP Study Report for each of the clauses of Rule 10D.

Please note the aforesaid details are not mandatorily to be included as part of Appendices and can be included in the main Report itself but if presented in the above manner will help the taxpayer in better presentation.

Penalty Provisions:

The penalty provisions in connection with the failure to prepare and maintain TP documentation are contained in Section 271 of the Act and the same are summarised in the below table:

| Type of Penalty | Section | Penalty Quantified | |

| 1 | Failure to maintain prescribed documentation,Failure to report transactions, orMaintenance or furnishing of incorrect | 271AA(1) | 2% of transaction value |

| 2 | Failure to furnish information/ documents during assessment | 271G | 2% of transaction value |

Conclusion:

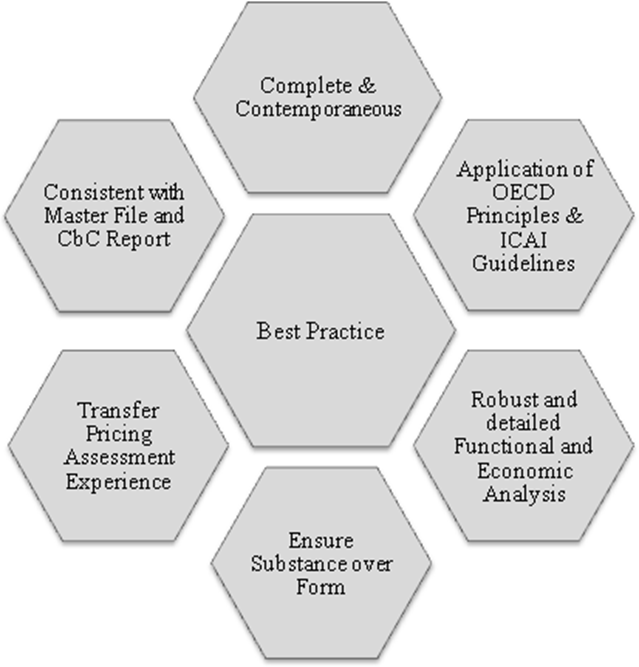

The TP Study Report must be prepared or collated regularly at the time of occurrence of the transactions and continuously, rather than waiting for the notice from the tax authorities to present the same, as the information is more accessible at the time of occurrence of transactions and thereby helps in maintaining contemporaneous and reliable records and to safeguard the taxpayer from the aforesaid penalty provisions.

Based on the information and details contained in TP Study Report, it may be reasonably concluded that the analysis in TP Study Report meets the specified requirements and contains all of the relevant documents required to be maintained under the standards of the Indian Transfer Pricing Regulations.

In a nutshell, the taxpayer has to maintain an adequate, appropriate and contemporaneous documentation with respect to the international transaction(s)/ SDT(s) before the filing of the Accountant’s Report (i.e. Form 3CEB).

Pointers for preparation of the TP Study Report:

- Discussion with only tax or finance team of the Client will not help, instead one will have to carry out the functional interview with respective Heads of the Department to understand the business which in turn will help to draft the FAR Analysis for international transaction/ SDT entered into by the taxpayer. This should be carried out in the year in which the transaction was entered for the first time and later at least once in every three year or when there is a substantial change;

- Be creative in the drafting of the TP Study Report – such as include executive summary to the Report, present value chain analysis of the business of the taxpayer with its AE(s), diagrammatic presentation wherever possible, etc.;

- Mention the source of information wherever required as a foot note for the reliability and authenticity of the information/details mentioned in the TP Study Report;

- Ensure that the FAR aligns with the actual conduct of the business of the taxpayer with its AE(s);

- Update the TP Study Report based on recently concluded transfer pricing assessment proceedings, if required;

- Ensure that the TP Study Report is in alignment with what has been included in the Master File of the taxpayer or the Group and also in alignment with the Country-by-Country Report (if any) of the Group;

- Avoid cherry picking of the Comparables; and

- Lastly ensure that the details mentioned in the TP Study Report are contemporaneous in nature.