Let’s Nurture Algo Trading Is Way Forward

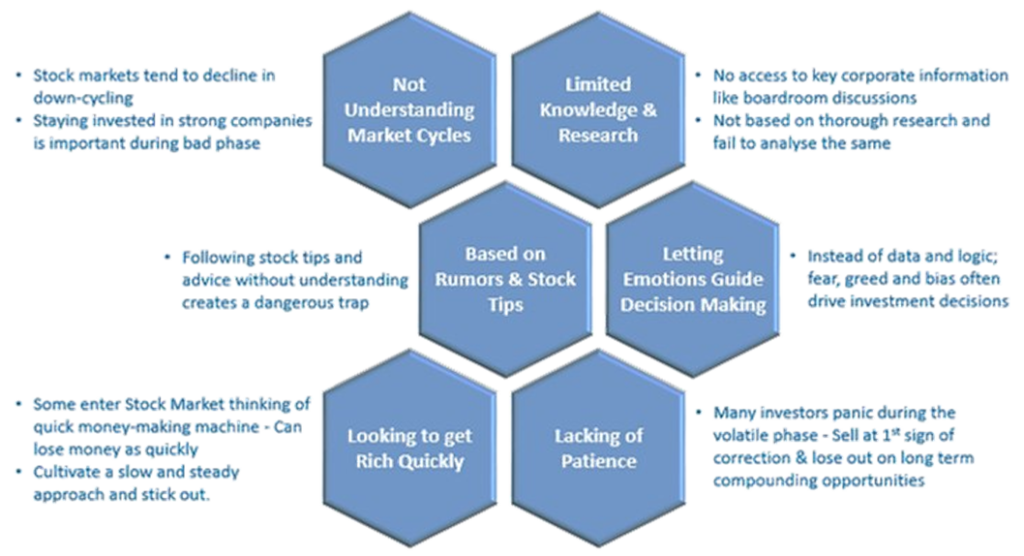

Why do Retail Investor Loose in Stock Markets?

Among all investment classes, equities have given the best returns over the century. Despite that, the failure rate here is abnormally high. A deep analysis suggests that personal flaws of human nature are more at work here.

Equity remains the most sought after class of investment. It attracts veterans and novices alike. The best part about equity investment is that it can be started with a very small amount. The returns are also quite high compared to other investment instruments.

For these reasons, a gush of new retail investors enters the market every year. Most of these investors enter the market under the illusion of making easy and quick money. This perception breaks early and most of them end up losing their hard-earned money. Saddled with the losses, many of them leave the market vowing to never return.

So, why do a staggering number of retail investors end up losing their money in the stock market? Let’s examine a few factors here:

Key takeaways:

Succeeding in the stock market requires a host of combinations. It requires a dedicated and disciplined approach over a longer period of time. A retail investor must cultivate enough knowledge and good habits to back their decisions. Also, it is important to stay calm.

What is Algo Trading?

Algorithmic trading (also called automated trading, black-box trading, or algo-trading) uses a computer program that follows a defined set of instructions (an algorithm) to place a trade. The trade, in theory, can generate profits at a speed and frequency that is impossible for a human trader.

The defined sets of instructions are based on timing, price, quantity, or any mathematical model. Apart from profit opportunities for the trader, algo-trading renders markets more liquid and trading more systematic by ruling out the impact of human emotions on trading activities.

Using simple instructions, a computer program will automatically monitor the stock price (and selected indicators) and place the entry and exit orders when the defined conditions are met. The trader no longer needs to monitor live prices and graphs or put in the orders manually. The algorithmic trading system does this automatically by correctly identifying the trading opportunity.

Global Scale of Algo Trading:

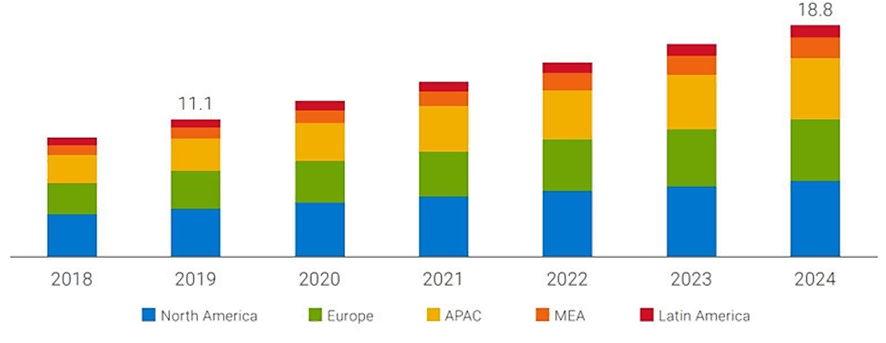

The global algorithmic trading market is expected to grow from $11.1 billion in 2019 to $18.8 billion by 2024 [1]. The growth is likely to be driven by rising demand for quick, reliable, and effective order execution. Lowered transactional costs, heightened government regulations, and increased demand for market surveillance are also few of the major catalysts for the growth of the Algo Trading Market.

Algorithmic Trading Market, by Region (USD Billion)

Source : MarketsandMarkets Analysis

- More than 60% of trades for ticket sizes over $10 million were executed in March 2020 via an algorithm, stated a JPMorgan survey[1].

- 50% of stock trading volume in the US is driven by computer-backed high-frequency trading[1].

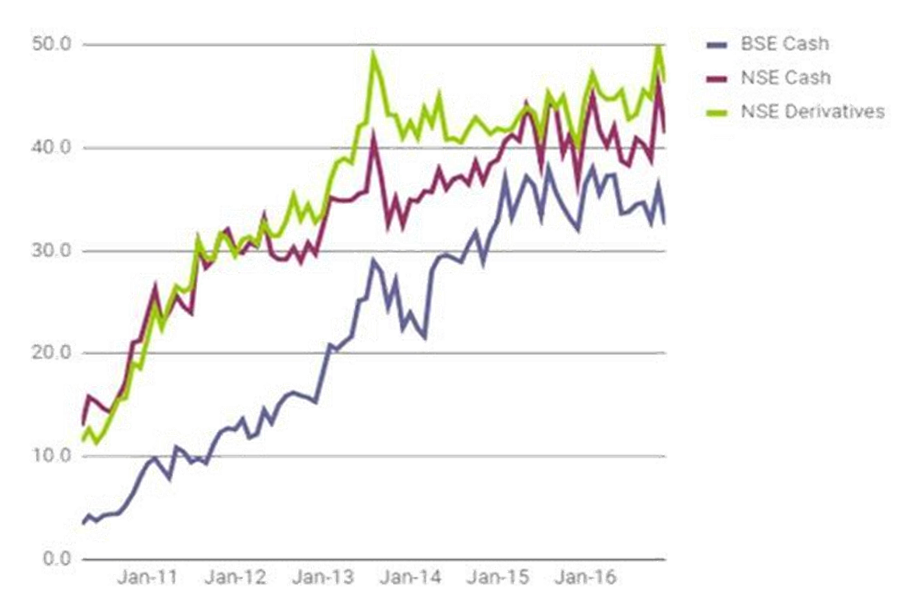

According to a National Institute of Financial Management (NIFM) report, the share of algorithmic trading in exchange turnover was stabilised at around 47% (till February 2017) in India across the cash and derivatives segment on the NSE. In March 2018, this rose to 48% in equity derivatives and around 45 % in cash market [2].Thus the algorithmic trading in India across the cash and derivatives market as a percentage of total turnover has increased up to around 50% in 8 years from merely 9.26% (average) in 2010[2]. Further, the majority of the trading activity of algo players is only in liquid scrips/contracts and in developed markets such as the US, it stands at approximately 70-80% and the high frequency trading accounts for as much as 70% of the US equity market turnover.

Source: Article named “Algorithmic trading share in total turnover grows to 50% in 8 years” in Financial Express by Bharadwaj Sharma dated May 8, 2018

“The daily turnover of equity market is around Rs 25,000 crores to Rs 30,000 crores, and in the F&O market, it is around Rs 3.5 lakh crores to Rs 4 lakh crores on a daily basis. Investors mainly use algos for options trading,” said Chandan Taparia, derivatives and technical analyst at Motilal Oswal Securities. However, as far as awareness of the retail investor is concerned, it is less in India. “This is mainly because it requires specialised skills in addition to tools. Apart from quantitative analysis, one needs to know coding to implement the strategy,” added Anil Ghelani, senior VP, DSP Blackrock.

[Transcript from Article named “Algorithmic trading share in total turnover grows to 50% in 8 years” in Financial Express by Bharadwaj Sharma dated May 8, 2018]

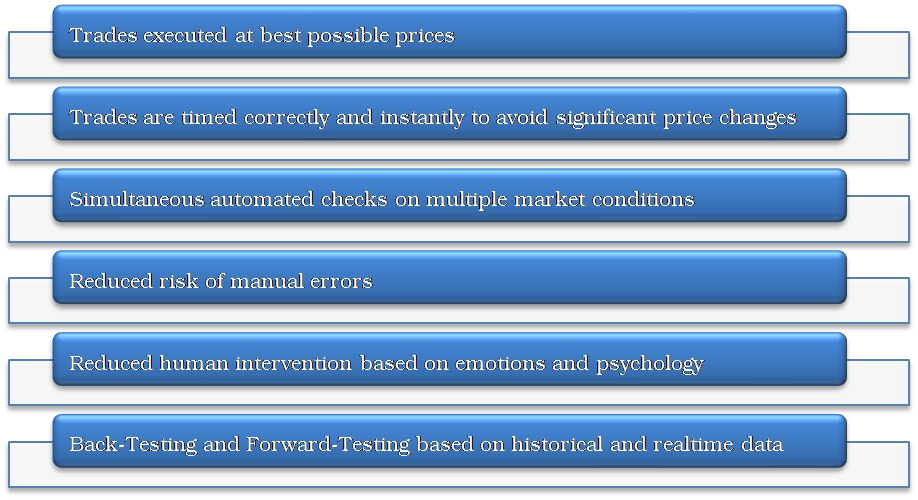

Benefits of Algorithmic Trading

Algo-trading provides the following benefits:

Algo-trading is used in many forms of trading and investment activities as enumerated below:

| Category | Participants | Algo Trading used for |

| Mid to Long-term investors or buy-side firms | Pension funds, Mutual Funds, Insurance companies | To purchase stocks in large quantities when not wanting to influence stock prices with discrete, large-volume investments |

| Short-term traders &Sell-side participants | Market Makers (such as brokerage houses), Speculators&Arbitrageurs | To automate trade executionTo create sufficient liquidity |

| Systematic traders | Trend followers, Hedge Funds, or Pairs Traders* | To have efficient trade setup based on programmed trading rules |

* Pair Trading is a market-neutral trading strategy that matches a long position with a short position in a pair of highly correlated instruments such as two stocks, exchange-traded funds (ETFs) or currencies

Algorithmic trading provides a more systematic approach to active trading than methods based on trader intuition or instinct.

Algorithmic Trading Strategies

Any strategy for algorithmic trading requires an identified opportunity that is profitable in terms of improved earnings or cost reduction. The following are common trading strategies used in algo-trading:

- Trend-following Strategies

- Arbitrage Opportunities – time based, price based, volatility based, etc.

- Mathematical Model-based Strategies – delta-neutral trading strategy, ratio based trading strategy

- Trading Range (Mean Reversion)

- Scalping based on Volume-weighted Average Price (VWAP) & Time Weighted Average Price (TWAP)

Technical Requirements for Algorithmic Trading

Implementing the algorithm using a computer program is the final component of algorithmic trading, accompanied by back testing (trying out the algorithm on historical periods of past stock-market performance to see if using it would have been profitable). The challenge is to transform the identified strategy into an integrated computerized process that has access to a trading account for placing orders. The following are the requirements for algorithmic trading:

- Computer-programming knowledge to program the required trading strategy, hired programmers, or pre-made trading software.

- Network connectivity and access to trading platforms to place orders.

- Access to market data feeds that will be monitored by the algorithm for opportunities to place orders.

- The ability and infrastructure to back-test the system once it is built before it goes live on real markets.

- Available historical data for back-testing depending on the complexity of rules implemented in the algorithm.

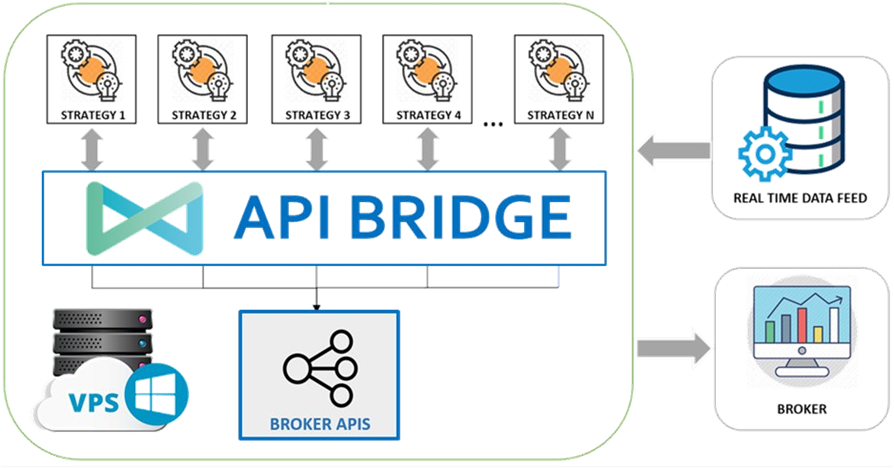

The below chart tries to summarize different components to be figured out for execution of any algorithmic trading setup.

Flips of Algo Trading:

Though algo execution looks easy, the practice of algorithmic trading is not that simple to maintain and execute. Remember, if one investor can place an algo-generated trade, so can other market participants. Consequently, prices fluctuate in milliseconds and even microseconds. In a scenario, if a buy trade is executed but the sell trade does not because the sell prices change by the time the order hits the market; trader will be left with an open position making the arbitrage strategy worthless.

There are additional risks and challenges such as system failure risks, network connectivity errors, time-lags between trade orders and execution and, most important of all, imperfect algorithms. The more complex an algorithm, the more stringent back-testing is needed before it is put into action.

Points to Ponder:

In India, we are far behind in terms of algorithmic trading compared globally. Hence, the mis-pricing or certain phenomena in instruments like time decay in options would still prevail, inspite of growing and maturing markets. Further, algorithmic trading has recently being opened by some tech companies to retail traders. We believe that in the near future human-machine interaction could go to the next level. Through Deep Learning, AI, algorithms will self-correct and adapt to dynamic markets. Algos will be everywhere, in HFT, mid-to-low frequency, arbitrage, scalping, hedging, market making and anything you can define to a machine.

References:

1. https://analyzingalpha.com/algorithmic-trading-statistics

https://www.financialexpress.com/market/algorithmic-trading-share-in-total-turnover-grows- to-50-in-8-years/1159020/