Amazing Amazon

(This is based on a special report published by Reuters on Amazon’s strategies to allegedly dodge Indian regulators)[1]

Reuters report’s background

Reuters gained access to multiple sensitive documents of the company dated from 2012 to 2019. This included drafts of meeting notes, PowerPoint slides, business reports and emails. The prominent amongst the documents was the early 2019 (before general elections in India) meeting notes of a top Amazon executive with the Indian ambassador at Washington DC, USA. This report was published on 17th February, 2021.

Amazon’s Indian journey[2]

- June 2013: Amazon goes live with its India marketplace.

- February 2016: Amazon launches its two-hour grocery delivery service, Amazon Now, in India. This was later rebranded as Prime Now in May 2018 and Amazon Fresh in August 2019.

- July 2016: Amazon launches its Prime membership programme in India.

- December 2016: Amazon launches Pay Balance, its payments service in India. Amazon Prime Video makes its India debut.

- March 2018: Amazon Prime Music is launched in India.

- April 2021: Amazon claims that it has created over a million jobs since start of Indian operations.

Cloud tail & Appario

Globally about 58% of Amazon sales of physical goods are from third-party merchants; the rest 42% are direct sales by Amazon to consumers, the company has disclosed.

The ability to sell straight to people has big benefits. It means Amazon can deal directly with manufacturers,

giving it greater control over the product range, availability, pricing, etc.In India, regulations didn’t allow direct sales to customers by a foreign e-commerce platform/ marketplace. There need to be a seller separate from the marketplace. It is this barrier, Amazon was trying to overcome in India.

To deal with the restrictions on direct sales, Amazon found an indirect way of reaching consumers and boosting sales quickly. It entered into a joint venture with an entity formed by one of India’s most famous IT geniuses, N.R. Narayana Murthy, founder of software services giant Infosys Ltd. The venture was used to create a seller named Cloudtail, which began offering goods on Amazon.in. It was set up in August 2014.About two months after Cloudtail’s launch in August 2014, Jeff Bezos, founder of Amazon met Honourable PM Modi in New Delhi. A draft document containing talking points was prepared for the 3rd October 2014 meeting. It had no mention of Cloudtail or its plans (obviously). In fact the key objective of the meeting, according to the document, was to discuss barriers to foreign investment in the e-commerce sector.

For FY 2015-16, Cloudtail’s revenue was approximately INR 4,600 crores. In March 2016, its share of sales on Amazon.in was around 47%. It is was in this month that the Indian government allowed 100% foreign direct investment in online retail of goods and services under themarketplace model but prohibited marketplaces from having one dominant seller. The new rules banned marketplaces from affecting product prices, thereby effectively outlawingdeep discounts and cappedshare of total sales from one vendor to the marketplace at 25%.[3]

Following the rule change, Amazon lowered the fees it charged some big sellers on its platform to enable them to offer more competitive prices. “We adjusted our business model by activating a fee incentive program (Platinum Seller Program or PSP) to provide discounted fees to a subset of large managed sellers (Platinum Sellers) to help them match prices of e-commerce rivals”, said a global regulatory update document, as mentioned in the Reuters report.In addressing the 25%-of-sales cap on a single seller, Amazon also proposed having a second special merchant, in addition to Cloudtail.

In 2017, a new special merchant named Appario was created. This time, Amazon entered into another joint venture, with an entity backed by the family of Ashok Patni, another pioneer in the Indian IT outsourcing sector. One internal Amazon document stated that the two special merchants get “subsidized fees” and access to Amazon global retail tools. These tools are used for things like inventory and invoice management.

By 2018, these two accounted for around 35% of total sales on Amazon.in.

Lobbying?

In December 2018, the Indian government announced new restrictions that prohibited vendors in which marketplaces such as Amazon have an equity interest from selling products on these marketplaces.The aim, government officials told Reuters at the time, was (again) to deter deep discounting by big online retailers. Remember again, general elections were due in mid-2019. The regulatory change was widely seen as a move by HonourablePM Modi to pacify small traders, a critical part of his party’s electoral base.

It was this change to the foreign investment rules that the top Amazon executive Jay Carney wanted to discuss in the early 2019 meeting with the Indian ambassador to the USA at the time, Harsh VardhanShringla, at Washington DC (as mentioned earlier in this article).

Before the meeting, Amazon employees prepared a draft note for Carney.

The note, reviewed by Reuters, advised Carney what to say and what not to say. Carney was advised to highlight the fact that Amazon had committed more than $5.5 billion in investment in India and how it provided an online platform for 4 lakh plus Indian sellers (Early 2021 seller count is of around 7 lakh). But he was cautioned not to divulge that some thirty three Amazon sellers (Platinum sellers other than Cloudtail and Appario) accounted for about a third of the value of all goods sold on the company’s website. That information, the note advised, was “Sensitive/not for disclosure.”

It didn’t seem like Carney’s meeting had any positive impact. The new limits forced Amazon to restructure itsrelationships with Cloudtail and Appario, the two special merchants in which it held indirect stakes.In the early hours of 1st February, 2019, thousands of products being sold by Cloudtail and Appario vanished from Amazon’s website in compliance with the deadline for the new rules. But days later, the products were back as Amazon reduced its equity stake in the parent companies of the two sellers. This manoeuvre, the company believed, made it compliant with the new rules, according to an internal document from 2019.

At that time, the four lakh Indian sellers (as per Carney’s draft note) accounted for around 32% of sales, thirty three sellers accounted for 33% of sales and two sellers accounted for 35% of sales. In other words, small and medium enterprises which form the 99.99% of sellers on Amazon.in sold products only worth 32% of total sales by value on the e-commerce platform.

Continuing challenges

In June 2019, Commerce Minister PiyushGoyal dressed down e-commerce executives, including Amazon’s India country head Amit Agarwal, telling them in a meeting that they must comply with the new rules. Goyal was blunt, said one executive who was present there.“ We will not let e-commerce impact small shopkeepers… I know there have been many issues of non-compliance,” the executive said, summarizing Goyal’s remarks. “So think about it, set it right. If you don’t, we will make things public, it will be put in the public domain and you will be embarrassed.”

Then came the news of the antitrust probe into Amazon and Flipkart in January 2020, the same month Bezos was making another trip to India for ‘Smbhav’ (Hindi word for ‘possible’) summit, held for the first time. Traders staged small street protests, holding up placards with a red “X” emblazoned on a picture of the Amazon CEO’s face and the words, “Jeff Bezos Go Back!” Commerce Minister Goyal diminished the company’s announcement of a further $1 billion of investment in India. “It’s not as if they are doing a great favour to India,” he said.

There was another salvo in August 2020, a group of more than 2,000 online sellers filed an antitrust case against Amazon and Cloudtail, alleging Amazon favours some retailers whose online discounts drive other vendors out of business. Amazon and Cloudtail have both said they comply with all laws; the Competition Commission of India decided to order an investigation into the matter.Separately, Amazon is under investigation by India’s Enforcement Directorate, the federal financial crime-fighting agency, which has been investigating the company for possible violation of foreign investment rules.

Damage control

Amazon held a Smbhav summit back in 2020 and the second edition was held in April 2021, after the news of the alleged dodging of Indian regulations. The second wave of the ravaging pandemic caused the summit to be held virtually. Government ministers like NitinGadkari (Road transport & MSME), Prakash Javadekar (I&B, PSU), MahendraNath Pandey (Skill Development) and Jitendra Singh (PM office) were present as speakers. [4]

Amazon also came out with other initiatives like ‘Saathi’, a peer mentorship programme that will help sellers to exchange knowledge and share best practices.

Why does it matter?

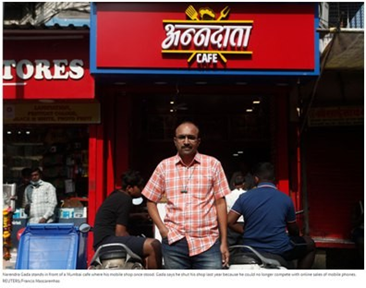

Reuters interviewed NarendraGada, erstwhile owner of a mobile shop in Colaba. In 2013, he said, his business was doing well. It enabled the 44-year-old to support his family of three, selling around

20 phones a day at his store. His monthly sales, he said, were aroundINR 1 crore. Everything changed in 2015 with the expansion of online sales of smartphones, he said. He couldn’t compete with the exclusive launch of smartphone models online or the discounts being offered, he said.

By 2016, his sales had dropped by around 40%. Customers would come to his shop to try smartphones, ask for the WiFi password and then go online to buy the model they’d just sampled, he said. In 2018, Gada began selling at lower margins and on credit to keep sales alive. Late last year, he shut the shop he’d started in 1998. The final straw was the pandemic-induced lockdown, but he said it was the advent of online sales that killed his business.

This must have rendered his employees jobless and loss of a good client for his tax consultant.

Amazon on the other hand, claimed in its Small-Midsize Business (SMB) Impact report 2020 that 4,152 Indian sellers (only) surpassed INR 1 crore sales annually.[5] (Number of usinesses in any prominent locality of Mumbai would be more than that 4,152)

Point to ponder:

Even our clients can find themselves in a situation like Narendra Gada. Can they face Amazon directly or they’d need extensive government support? Knowing how ‘amazing’ Amazon is, can we make our clients ‘amazing’? What will it take?

Think over it. Think different!

References:

- https://www.reuters.com/investigates/special-report/amazon-india-operation/

- https://economictimes.indiatimes.com/tech/technology/timeline-amazons-india-journey-under- jeff-bezos/articleshow/80670696.cms?from=mdr

- https://www.livemint.com/Companies/1EdpKoAY7GoZLh57pXuwkO/Amazon-India-top-seller- Cloudtails-revenue-rises-fourfold-t.html

- https://www.smbhav.com/summit/

- https://www.businesstoday.in/current/corporate/amazon-adds-15-lakh-indian-sellers-in-2020- 4152-cross-rs-1-crore-in-sales/story/425518.html