Financial Lessons From Covid Times

Let us begin this discussion recounting a story from childhood. This story is popularly known as the Ant and the Grasshopper. The story begins with summer days, where everything is green and there is plenty of food available. The ant is busy collecting food and storing it away for Winter, while the grasshopper is singing and dancing all day. In some versions of the story, the ant even urges the grasshopper to save something for the winter days, the grasshopper refuses stating that he will do it later. As winter starts to set in, the food sources become scarce. The grasshopper finds it difficult to find enough food to survive the day, much less store away something for the future. He begins starving and has to eventually beg the ant for food. The moral of the story is that people who work hard and plan ahead are better off than those who don’t

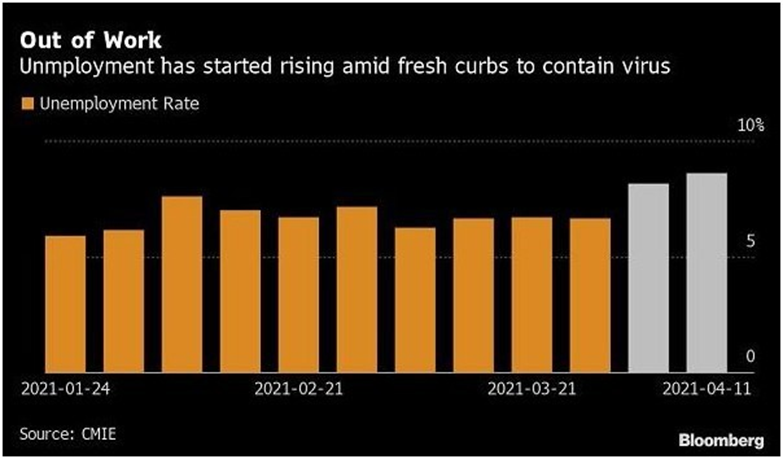

This exact situation is also applicable in our lives today. The last year has forced us to face many difficulties due to COVID-19 pandemic. Several employees faced pay cuts, several other lost jobs completely, in an economy where it was becoming increasingly difficult to find work. Even the professionals and businessmen weren’t spared. They also faced issues in extracting payments for the previous goods/services delivered, while facing hardships in making any fresh sales due to mobility restrictions and lockdown. If this wasn’t enough, prices of several essential commodities rose, as people flogged to buy and store these. Falling income and rising prices ate away at the common man’s pocket from both sides.

Image Source : Business Standard

The situation didn’t stop here. Preventive healthcare items like masks and sanitizers saw their prices going through the roof. Getting admitted means a huge outlay of lakhs of rupees with no guarantee of recovery. While the doctors and scientists are working on the vaccine and cure for the disease, there is another pressing matter that demands our immediate attention. In such an adverse situation, where physical and mental well-being is already at stake, it is our duty to ensure that financial well-being is taken care of. A larger part of our population faced hardships on account of lack of a rainy-day fund

Image by Steve Buissinne from Pixabay

In simple terms, a rainy-day fund (emergency fund) is a sum of money set aside to help us sail through tough times. Adverse situations may crop up anytime without prior notice, and we need to be prepared to address them as they arise.

The above lines by poet Raheem Das, say that it is previous efforts which yield results later. One can’t hope to extinguish the fire, if one starts digging the well after the fire has already started. The well needs to be in place much before the fire starts and should be ready to use. Only then, can one expect to use its water to extinguish the fire.

Now that we have discussed the importance of emergency funds, the next question arises – how much money should one hold in their emergency fund? Well, there is no one size fits all approach. An ideal fund comprises three to six months’ worth of expenses. However, if an individual’s source of income is not stable (e.g., in case of professionals and businessmen), one may look at a higher amount, up to one year. Hence, for deciding the amount to be kept, there are two factors – average monthly expenses (based on analysis and estimate) and number of months (based on stability, risk appetite, alternative source of income, etc.)

Once we know the amount, the next logical question is – where do Ikeep this money? Should it be kept in cash form or at the bank? The primary purpose of this money is to act as a backup plan, hence it’s not very important for this money to grow at high rates. Focus is on availability at the time of need. A bucketing approach may help in deciding our allocations. An amount equal to initial one to two months expenses can be kept in cash form at home, for immediate access. Money for next two to three months expenses can be kept in a bank savings account (for minimal growth and increased safety). The balance amount can be distributed between very short-term mutual funds and short-term fixed deposits. These are merely guidelines, to be adjusted and personalised as per one’s needs.

In addition to emergency funds, one should also look at getting adequate insurance cover on two counts – health and life. Health insurance comes to rescue in medical/accident cases, while life cover takes care of the dependents after the insured is no more. Only once the trio is complete, we can have a protective shield against potentially dangerous situations that may arise.

To conclude this discussion with a quote from Benjamin Franklin, “If you fail to plan, you are planning to fail”. These and other words of wisdom have continued to guide us through generations about the importance of planning. We all have read about it in some or the other format, and yet failed to really apply it in our life. It’s high time that we take steps to implement these and also help our clients with the basic concepts