New Gold Rush- Crypto Currency & ITS GST Implication

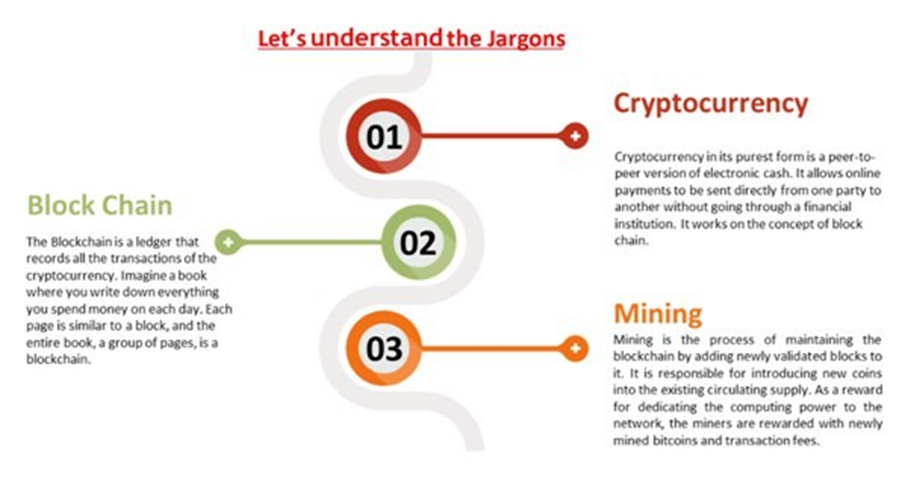

If you’re new to term ‘Cryptocurrency’ which is quiet voguish at present, here’s an infographic.

Crypto Currency Trading- Banned in India??

Good news!! it is absolutely not banned in India. Curious? Read on.

RBI Circular- Banning Crypto Trading

The Reserve Bank of India had banned cryptocurrency trading in India vide Circular no. RBI/2017- 18/154DBR.No.BP.BC.104 /08.13.102/2017-18. It directed that all entities regulated by it shall not deal in Virtual Currencies (‘VC’) or provide services for facilitating any person or entity in dealing with or setting those.

Quote

- In view of the associated risks, it has been decided that, with immediate effect, entities regulated by the Reserve Bank shall not deal in VCs or provide services for facilitating any person or entity in dealing with or settling VCs. Such services include maintaining accounts, registering, trading, settling, clearing, giving loans against virtual tokens, accepting them as collateral, opening accounts of exchanges dealing with them and transfer / receipt of money in accounts relating to purchase/ sale of VCs.

- Regulated entities which already provide such services shall exit the relationship within three months from the date of this circular

Unquote

SC to the rescue

The Supreme Court overruled the RBI’s decision to ban banks from supporting crypto transactions on the ground of proportionality. A three-judge Supreme Court bench said that the RBI needs to show at least some resemblance of any damage suffered by banks.

Quote

6.173. It is undoubtly true that RBI has very wide powers not only in view of the statutory scheme of the 3 enactments indicated earlier, but also in view of the special place and role that it has in the economy of the country. These powers can be exercised both in the form of preventive as well as curative measures. But the availability of power is different from the manner and extent to which it can be exercised. While we have recognized elsewhere in this order, the power of RBI to take a pre-emptive action, we are testing in this part of the order the proportionality of such measure, for the determination of which RBI needs to show at least some semblance of any damage suffered by its regulated entities. But there is none.

Unquote

RBI- Admits not banning Crypto

Further, the RBI says that it had not banned cryptocurrencies such as Bitcoin in India, but only ringfenced regulated entities like banks from risks associated with trading of such virtual instruments.

Subtle but very important distinction. Quote

When the consistent stand of RBI is that they have not banned VCs and when the Government of India is unable to take a call despite several committees coming up with several proposals including two draft bills, both of which advocated exactly opposite positions, it is not possible for us to hold that the impugned measure is proportionate.

Unquote

Concluding, as on date Trading of crypto is legal and permissible

Heads Up- The Economic Times has reported that the RBI is planning to file a review petition in the Supreme Court.

Happy News!!

RBI has issued clarification on May 31, 2021 that the above circular is no longer valid from the date of the Supreme court judgment, and therefore cannot be cited or quoted from. This is the major statement of RBI after the SC verdict. This will give relief to crypto exchanges who were struggling to get a bank account due to lack of clarity from the RBI.

RBI, however has asked banks to continue carrying due diligence processes prescribed under existing regulations.

Is Crypto- Liable to GST in India?

As the name suggest, GST is a tax applicable when there is supply of goods or services. Unless, crypto is classified as goods/services GST on the same would not be applicable.

The term ‘Goods’ as per Section 2(52) of the CGST Act means every kind of movable property other than money and securities but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply.

The term ‘Service’ as per Section 2(102) of the Act means anything other than goods, money and securities but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged.

We will first need to understand whether crypto can be akin as money or securities

Crypto- Can be classified as Money??

Money has been defined under Section 2(75) of the CGST Act, the Indian legal tender or any foreign currency, cheque, promissory note, bill of exchange, letter of credit, draft, pay order, traveller cheque, money order, postal or electronic remittance or any other instrument recognised by the Reserve Bank of India when used as a consideration to settle an obligation or exchange with Indian legal tender of another denomination but shall not include any currency that is held for its numismatic value.

Inference : RBI has not granted any regulatory approval to crypto currency till date. Accordingly, it may not be treated as money and should fall under definition of Goods or Services.

Crypto- Can be classified as Securities?

The CGST Act has under Section 2(101) states that securities shall have the same meaning as assigned to it in section 2(h) of the Securities Contracts (Regulation) Act, 1956 which states-

“securities” include—

- shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporate;

(ia) derivative;

(ib) units or any other instrument issued by any collective investment scheme to the investors in such schemes;

(ic)security receipt as defined in clause (zg) of section 2 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002;

(id) units or any other such instrument issued to the investors under any mutual fund scheme

- Government securities;

- such other instruments as may be declared by the Central Government to be securities; and

- rights or interest in securities

As per the general understanding of Crypto it does not fall under any of the above categories. Accordingly, it cannot be classified as Securities also. Thus, the said transaction is leviable to GST.

Question arises whether it is goods or services

In the writ filed before SC, the petitioners have frequently claimed that crypto currency is a tradable commodities which you can’t touch, hold or caress- Virtual commodities. It may be appropriate to classify that it is an intangible asset.

Prima facie, we can interpret that if anything, cryptocurrencies are cognate to goods then they are to services.Although, till date there is no clarity on GST oncryptocurrency by Government whether same is classifiable as goods or services.

Cryptocurrency and GST- Pandora’s box

Some of the key grey areas which are yet to be looked upon:

- What will be the place of supply?

- Who is require to take GST registration?

- Determination of Value of the transaction

- Rate of tax

- Tax implications on cross-border supplies

Proposal by CEIB

Recently, the Central Economic Intelligence Bureau (CEIB) proposed the Ministry of Finance recommending a levy of 18 percent GST on bitcoin transactions.

The CEIB has suggested that bitcoin might be categorized as an ‘intangible assets’ class, and GST could be imposed on all transactions.

Key points of the proposal of CEIB are:

- Treatment of Cryptocurrency `mining’ as a supply of service since it generates cryptocurrency and involves rewards and transaction fees.

- Taxing of `wallets’ storing keys. Wallet service providers should be registered under GST.

- Registration of Cryptocurrency exchanges under GST and levy of tax on their earnings.

- Trading in cryptocurrency to be taxed @18 percent.

- Buying and selling of cryptocurrencies to be considered as a supply of goods.

- Other related facilitating transactions, including supply, transfer, storage, accounting to be treated as services.

- Determination of value of cryptocurrency.

- Where both buyer and seller are in India, transactions to be treated as a supply of software and taxable at the buyer’s location.

- For transfer and sale, the place of supply to be the location of the registered person. However, where the sale is to a non-registered person, the supplier’s location is considered a place of supply.

- Integrated GST payable on transactions outside the taxable territory and considered as import or export of goods.

Given the regulatory vacuum on the cryptocurrency itself, it is also a subject which Parliament may legislate upon in the near future. As per words on street for cryptocurrency, the Government of India earlier had plans to ban digital currencies. Accordingly, the question of levy may not arise, although it may favour adigital currency backed by the Reserve Bank of India, which may be treated as currency recognised by RBI and would be eligible under the definition of money which is excluded from the goods and services, thus not liable to tax under GST law.

Until next time…